Introduction: The "Name and Shame" Rally

For decades, Japanese corporations were "value traps"—hoarding cash and ignoring shareholders. That era is dead.

Similar to the structural shifts we analyzed in [Defense / $ITA] and [Insurance / $KIE], Japan is undergoing a fundamental repricing. The trigger? The Tokyo Stock Exchange (TSE) dropped a hammer: if your company trades below a Price-to-Book (P/B) ratio of 1.0, you are put on a "shame list" and explicitly threatened with delisting.

The result is panic-buying... of their own shares. While US Tech ($QQQ) fights valuation concerns, Japan offers deep value with a government mandate to go higher.

Here is why Buffett is betting big, and why you need the right ETF to follow him.

The Mandate: Fix Your Price or Die

This is not a suggestion; it's a threat. The JPX (Japan Exchange Group) demanded companies "implement management conscious of cost of capital."

The Data (Dec 2025 Update):

Compliance: In 2023, few cared. Today, >70% of Prime Market companies have disclosed concrete action plans.

Impact: The average P/B ratio has surged from 1.2 to 1.5 in just two years.

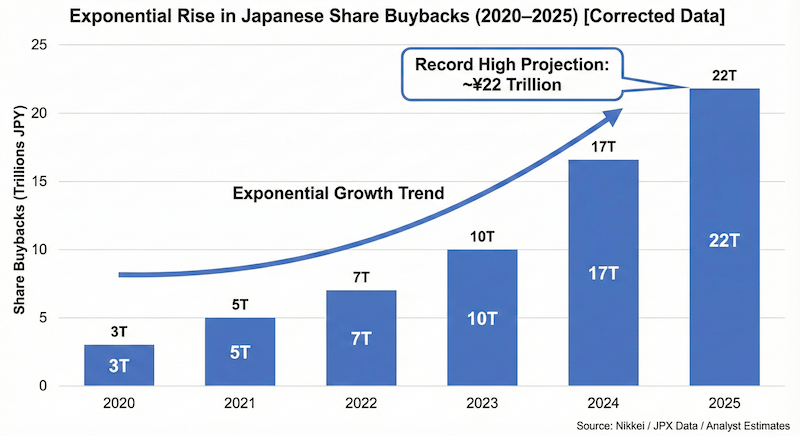

The Mechanism: To escape the "shame list," companies are executing record buybacks to artificially pump their stock prices.

The Buffett Code: The "Carry Trade" Masterclass

Warren Buffett isn't just buying Japanese stocks; he's engineering a financial arbitrage. As of late 2025, Berkshire Hathaway holds nearly 10% of the five Sogo Shosha (trading houses: Itochu, Marubeni, Mitsubishi, Mitsui, Sumitomo).

Why? It’s "Free Money." Buffett issues bonds in Yen (borrowing at nearly 0% thanks to Japan’s low rates) to buy stocks that pay 4–5% dividend yields.

Cost of capital: ~0.5–1.0%

Return on assets: ~5% + Capital Gains

The Spread: Pure profit.

He sees these firms not just as Japanese plays, but as global commodity banks trading at a massive discount to their US peers.

The Critical Mistake: EWJ vs. DXJ

This is the most important section of this post. Do not buy the wrong ETF.

The Japanese Yen is weak (USD/JPY > 150). This is great for exporters like Toyota, but it is terrible for foreign investors holding unhedged assets like $EWJ.

The 2025 Scorecard (YTD):

Nikkei 225 Index: +25% (The raw market move).

$DXJ (Hedged): ~+20% (Captures the rally).

$EWJ (Unhedged): +10% (Gains erased by weak Yen).

The Math of the Trap: If you bought $EWJ, you lost half your potential profit to the currency exchange rate. $DXJ uses derivatives to neutralize this risk, giving you the pure equity performance.

Hedging Wins: DXJ Crushes EWJ on Weak Yen

The Macro Wind: "Sanaenomics"

The political landscape supports this trade. The continued policy of aggressive fiscal spending (dubbed "Sanaenomics") ensures that the Bank of Japan remains behind the curve on interest rates.

This keeps the Yen weak (good for exporter earnings) and liquidity high (good for stock prices). Giants like Mitsui & Co. are reporting record profits specifically because the Yen is cheap.

The Risks: A Reality Check

What could break this thesis?

BoJ Pivot: If the Bank of Japan aggressively hikes rates to defend the Yen, the "carry trade" becomes expensive.

Global Recession: Japan is an export economy. If the US stops buying cars, cheap Yen won't save them.

The Bottom Line

US Tech is fighting gravity. Japan is fighting for survival. The TSE has aligned the incentives of CEOs with shareholders for the first time in history.

The Play: Forget the headline economic data. Follow the corporate reform. Buy $DXJ on dips. You get the buybacks, the dividends, and the exporter earnings, without the currency risk.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.