Check your latest car insurance renewal. Did you gasp? You aren't alone. Since 2020, the cumulative cost of motor vehicle insurance in the US has surged by +55%.

Most investors look at this and see a monthly bill. Smart money sees a breakout chart. Property & Casualty (P&C) insurers have a unique "superpower": when inflation hits repair costs, they don't eat the loss—they pass it to you.

While Tech ($QQQ) is up ~21% YTD driven by AI hype, it comes with massive volatility. Insurance ($KIE) is up a steady ~6%, doing exactly what it’s supposed to do: protecting capital while compounding cash.

1. The Data: The "Sticky" Revenue Baseline

In 2024, auto insurance inflation peaked at a staggering 22% YoY. Now, in late 2025, that rate has cooled to a sustainable 3–5%.

Why this is bullish: Unlike gas prices or used cars (which are experiencing deflation), insurance premiums almost never go back down. That massive 2024 hike is now the permanent baseline for 2025's revenue. While Core Goods inflation is flatlining near 0–0.2%, insurers have successfully locked in higher margins.

2. The Secret Weapon: The "Float" at 3.5%

Why do insurers thrive even when growth slows? The answer is Warren Buffett’s favorite concept: "The Float."

How it works:

You pay your premium today.

The insurer pays your claim years later.

In the meantime, they hold billions in cash (Float).

Buffett calls this "money we hold, but don't own." It is effectively a zero-cost loan. Even after the recent Fed cut to the 3.50%–3.75% range, insurers are earning massive, risk-free income on Treasuries.

The Double Engine:

🔥 Engine 1: Cumulative price hikes of 55%.

🔥 Engine 2: Earning ~3.5% yield on idle cash.

3. The Outlook: The "Hard Market" Continues

Is this trend over? Not according to Swiss Re.

In their latest Sigma report, they confirm we are in a prolonged "Hard Market"—where demand exceeds supply.

The Scale: Total global insurance premiums have crossed ~$7–8 Trillion.

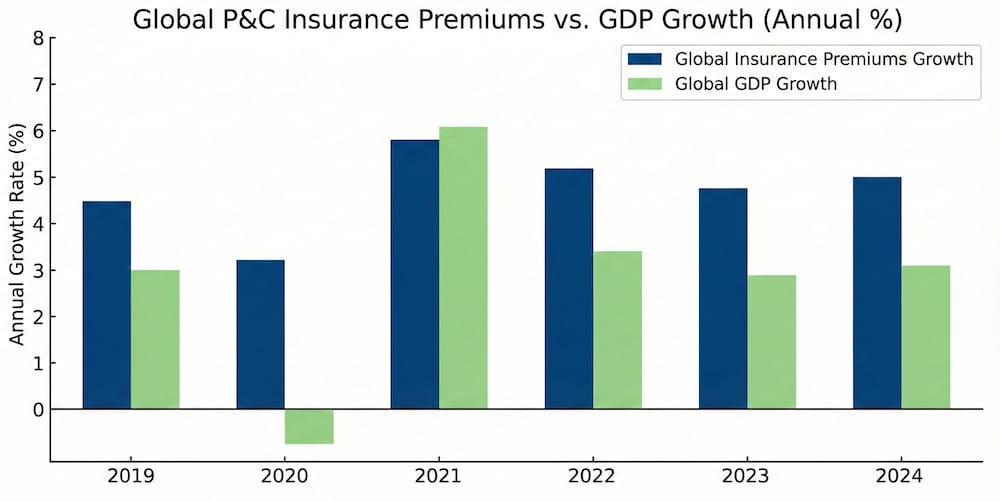

P&C Focus: The P&C segment alone is ~$2.4 Trillion, growing at ~2.5% (Real), in line with GDP.

The Driver: Climate risks are forcing a structural repricing of the entire world.

4. The Risks: A Reality Check

This is a defensive play, but it’s not risk-free. Here is the bear case:

Disruption: Insurtech competitors (like Lemonade) are aggressive, potentially eroding pricing power over time.

Rate Cuts: If the Fed cuts deeper (below 3%), the yield on "Float" will drop, squeezing investment income.

Climate Spikes: A "mega-catastrophe" year could wipe out underwriting profits regardless of high premiums.

5. The Trade: KIE vs. IAK

You don't need to pick a single winner. You can own the casino via ETFs.

Option A: SPDR S&P Insurance ETF ($KIE)

Strategy: Equal Weight.

Why buy: You get exposure to ~55 holdings. This limits concentration risk and gives you exposure to smaller, agile insurers that are often M&A targets.

Option B: iShares U.S. Insurance ETF ($IAK)

Strategy: Market Cap Weight.

Why buy: Heavily concentrated (~66% in top 10) in the giants like Progressive (PGR), Travelers (TRV), and Chubb (CB).

The Bottom Line

Tech stocks are for getting rich; Insurance stocks are for staying rich. As Warren Buffett wrote in his 2002 letter: "Float is money that doesn't belong to us, but that we get to invest for our own benefit."

$KIE isn't flashy. It's just a machine that prints cash in a high-cost world.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.