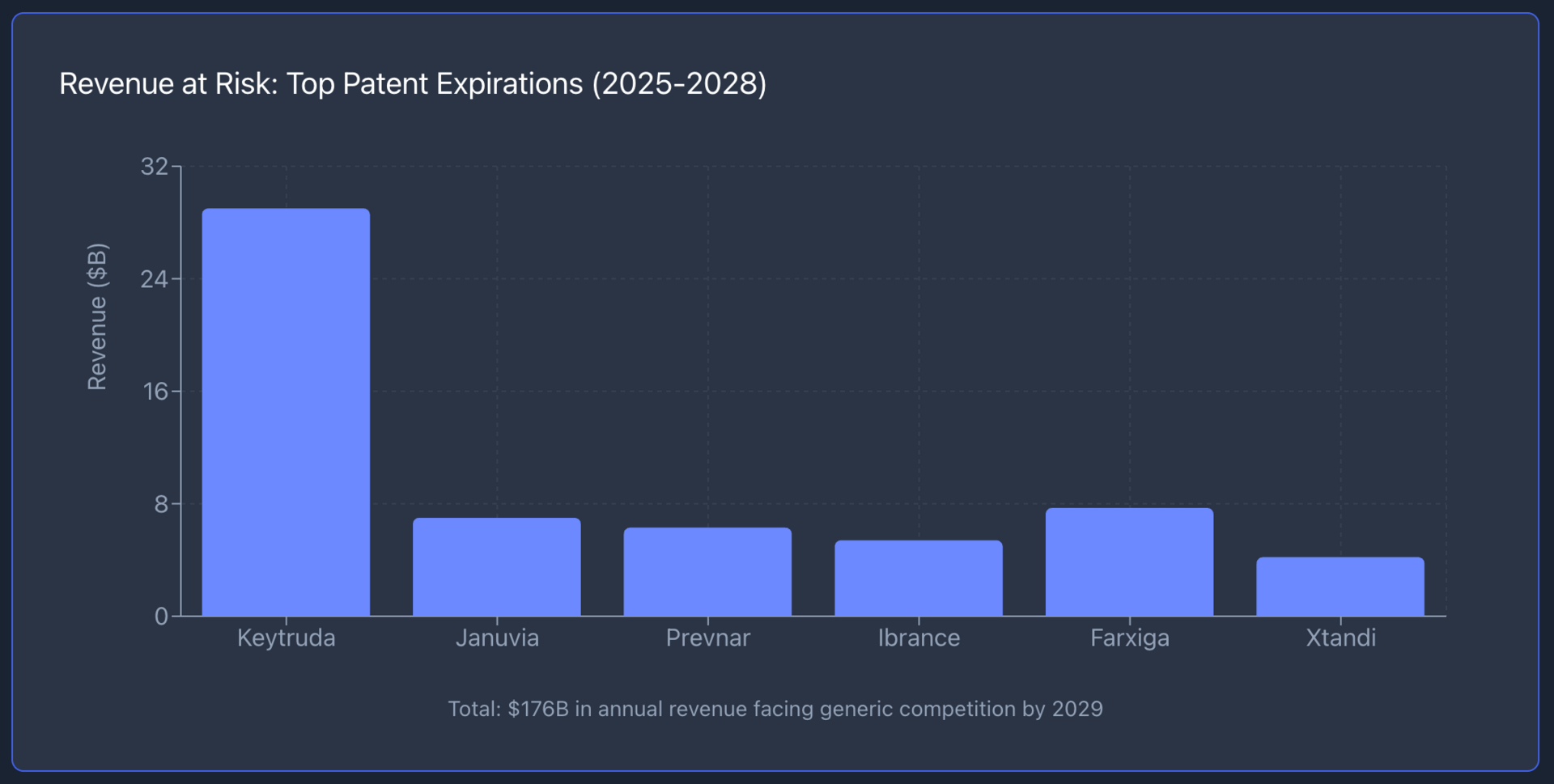

Big Pharma is sitting on a problem worth $176 billion.

That's the combined annual revenue from the top 20 drugs facing patent expiration between 2026 and 2029.

Merck's Keytruda alone, generating over $29 billion in sales, loses exclusivity in 2028.

Pfizer's Prevnar and Ibrance face the same cliff in 2026 and 2027.

When you're losing that kind of revenue, you don't cut costs. You buy growth.

Here's what we know.

Pharmaceutical giants have accumulated roughly $1 trillion in cash reserves. Interest rates dropped in September following the Federal Reserve's policy shift. The FTC's recent leadership changes signal a more permissive regulatory environment.

And January brings the J.P. Morgan Healthcare Conference—historically the most active venue for biotech deal announcements.

The math is straightforward.

Patent cliffs create pipeline gaps. Lower borrowing costs make acquisitions cheaper to finance. Small and mid-cap biotechs are trading below cash value.

That combination doesn't happen often.

The Conference Effect

The J.P. Morgan Healthcare Conference draws 8,000 executives, investors, and dealmakers to San Francisco each January. It's invitation-only.

It generates $92 million in local economic impact. But more importantly, it's where deals get announced.

January 2025 saw several significant transactions unveiled during or around the conference.

Johnson & Johnson acquired Intra-Cellular Therapies for $14.6 billion.

Eli Lilly bought Scorpion Therapeutics for $2.5 billion. GlaxoSmithKline picked up IDRx for $1.15 billion. These weren't coincidences. They were strategic timing.

Investment banks and pharma corporations use this conference as a stage. Announcing acquisitions here signals intent to the market and sets the tone for the year.

With 2025's biotech M&A activity already reaching $49 billion, surpassing all of 2024's $44 billion, the momentum heading into January 2026 looks strong.

How significant will the J.P. Morgan Healthcare Conference be for biotech deals in January?

The Structure Matters

This is where ETF selection becomes critical.

The SPDR S&P Biotech ETF $XBI uses a modified equal-weight methodology.

The iShares Biotechnology ETF $IBB uses traditional market-cap weighting.

That structural difference produces divergent results during M&A cycles.

IBB's top 10 holdings represent 58% of the portfolio. XBI's top 10 represent just 11%.

When a mid-cap biotech company receives a buyout offer at a 50% premium, that gain gets diluted across IBB's portfolio because smaller companies carry minimal weight.

In XBI, the same acquisition produces a more noticeable impact across the entire basket due to equal weighting and quarterly rebalancing.

The performance gap reflects this.

Year-to-date through November 2025, XBI returned 36.8% while IBB gained 10.82%.

XBI's median market cap sits at $2.56 billion, precisely the range where acquisition targets typically trade. These are companies with late-stage assets, clean intellectual property, and regulatory clarity.

They're also small enough for large pharmaceutical companies to acquire without triggering significant antitrust scrutiny.

The Risk Profile

XBI carries a beta of 0.95 compared to IBB's 0.74. That means higher volatility. The fund's annual volatility runs at 27.8%, and its recent RSI reading of 72 suggests overbought conditions in the near term.

The expense ratio is 0.35%, lower than IBB's 0.44%, but the turnover rate reaches 90% due to quarterly rebalancing.

But during M&A cycles, this same rebalancing mechanism distributes gains across the portfolio. A single acquisition doesn't just benefit one position.

It pulls capital into the entire basket as investors anticipate further deals.

That's the structural advantage during periods of elevated transaction activity.

The Timing Question

January represents a potential catalyst, not a guarantee.

Conference announcements can drive short-term momentum. But the underlying thesis depends on pharmaceutical companies executing their acquisition strategies. Patent cliffs create urgency.

Cash reserves provide capacity. Lower rates improve financing economics. Regulatory shifts reduce friction.

The question is whether these factors converge into sustained deal flow or produce isolated transactions.

Goldman Sachs projects global M&A could reach $3.9 trillion in 2026. Healthcare and biotech represent a growing share of that activity.

With 120 holdings and exposure tilted toward mid-cap names (43.3% of XBI's portfolio), the fund offers broad capture of potential acquisition premiums.

The setup looks favorable. Big Pharma needs pipeline assets. Biotech companies need liquidity. The conference provides a venue. But markets don't move on structure alone. Execution matters. Deal quality matters. Valuation discipline matters.

$XBI currently trades at $123.16, up 73% from its 52-week low of $66.66.

That's a significant move in under a year. Some of that reflects recovered sentiment. Some reflects actual deal activity. Some represents positioning ahead of January.

Whether that momentum continues depends on how many companies walk into the conference with signed term sheets and how many walk out with handshake agreements.

The data suggests conditions are right.

The question is whether pharmaceutical executives see the same opportunity investors do.