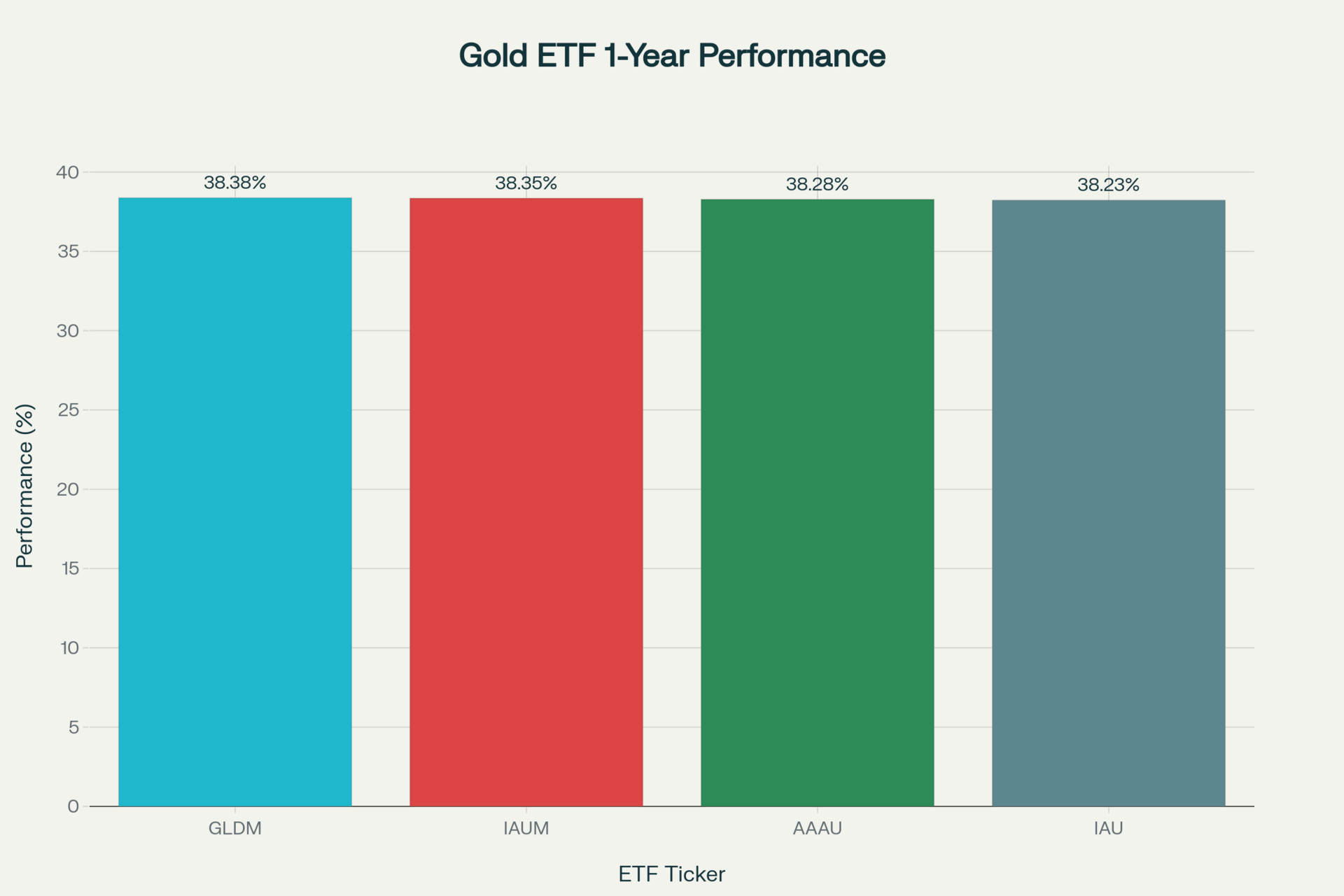

Gold has surged to unprecedented heights in 2025, with prices reaching record levels above $3,400 per ounce and delivering over 25% returns year-to-date. This extraordinary performance has been driven by a convergence of macroeconomic forces including persistent geopolitical tensions, aggressive central bank accumulation, Federal Reserve policy uncertainty, and a fundamental shift toward precious metals as a hedge against dollar weakness. The top-performing gold ETFs have capitalized on this rally, with GLDM leading the pack at 38.38% returns, closely followed by IAUM at 38.35%, while offering investors the lowest-cost exposure to physical gold through expense ratios as low as 0.09%. As major investment banks forecast gold reaching $4,000 by 2026, understanding the nuances between these ETF options has become critical for both tactical allocation and long-term portfolio hedging strategies.

Comparison of top-performing Gold ETFs in 2025: Performance vs. Cost Analysis

Gold's 2025 Status: The Macroeconomic Picture

Current Price Dynamics and Market Performance

As of August 4, 2025, gold is trading at approximately $3,360 per ounce, representing a remarkable 26% gain year-to-date from its starting price of around $2,620. This performance has been nothing short of extraordinary, with gold setting over 40 new closing highs this year alone. The precious metal's rally has been characterized by sustained momentum rather than speculative spikes, indicating deep structural demand underpinnings.

Gold Price Performance in 2025: A Record-Breaking Rally

The gold market has experienced unprecedented trading volumes, with daily trading reaching $329 billion per day in the first half of 2025, marking the highest semi-annual value on record. This exceptional liquidity has been driven by increased activity across multiple venues, including COMEX, Shanghai Futures Exchange, and global ETF markets, with North American ETF trading averaging $4.3 billion daily.

Federal Reserve Policy and Interest Rate Environment

The Federal Reserve has maintained its benchmark rate at 4.25%-4.50% for five consecutive meetings through July 2025, creating a complex dynamic for gold investors. While the Fed's pause on rate cuts has temporarily muted gold's immediate upside potential, markets are pricing in an 81% probability of a September rate cut, with expectations of up to 100 basis points of easing over the next 12 months.

Federal Reserve Chair Jerome Powell's acknowledgment that "uncertainty about the economic outlook remains elevated" has reinforced gold's safe-haven appeal. The central bank's cautious stance reflects concerns about persistent inflation, which rose to 2.7% in June 2025 from 2.4% in May, while core inflation edged higher to 2.9%. This environment of elevated inflation combined with restrictive monetary policy has created ideal conditions for gold appreciation.

Inflation Dynamics and Real Yields

Current inflation readings show consumer prices rising 2.7% year-over-year as of June 2025, with the Cleveland Fed's nowcasting models projecting inflation to remain elevated at 2.91% for August 2025. The persistence of above-target inflation, particularly amid ongoing trade tensions and tariff implementations, has eroded real yields and enhanced gold's attractiveness as an inflation hedge.

Real interest rates remain effectively negative when adjusted for actual inflation, creating a supportive environment for non-yielding assets like gold. This dynamic is particularly pronounced given the Fed's reluctance to raise rates further while inflation persists above the 2% target, effectively subsidizing gold ownership through opportunity cost considerations.

Central Bank Demand: The Structural Shift

Central banks worldwide have emerged as the dominant force driving gold's structural bull market. Global central banks purchased 410.5 tonnes of gold in the first half of 2025, with Q1 alone accounting for 244 tonnes—24% above the five-year quarterly average. This aggressive accumulation reflects a strategic shift away from dollar dependency, with gold now comprising 20% of global central bank reserves, up from 14% in 2020.

China's People's Bank has been particularly active, increasing reserves from 1,948 tonnes in 2020 to 2,640 tonnes in 2025, while Poland has set ambitious targets to hold 20% of its reserves in gold. The World Gold Council reports that 95% of central bankers surveyed believe official gold reserves will continue increasing over the next 12 months, with a record 43% indicating their own institutions plan to boost holdings.

Geopolitical Tensions and Safe-Haven Demand

The global geopolitical landscape has provided continuous support for gold prices throughout 2025. US-China trade tensions, despite periodic de-escalation attempts, have maintained elevated uncertainty levels. President Trump's implementation of reciprocal tariffs ranging from 10% to 50% on various trading partners has repeatedly triggered safe-haven flows into gold.

Middle East conflicts, particularly the intensification of Israel-Iran tensions in June 2025, pushed gold to near-record levels above $3,451 per ounce. The ongoing Ukraine-Russia conflict continues to reinforce gold's role as a geopolitical hedge, with European central banks particularly active in diversifying away from dollar assets.

Dollar Weakness and Currency Dynamics

The US Dollar Index has experienced its worst first-half performance since 1973, declining 10.8% in the first six months of 2025. This historic weakness stems from multiple factors including Trump administration trade policies, concerns over Federal Reserve independence, and mounting fiscal deficit concerns following the passage of major tax legislation.

The dollar's decline has been particularly pronounced against major currencies, with foreign investors increasingly diversifying into gold and other assets. This "de-dollarization" trend has been accelerated by concerns over US fiscal sustainability, with the Congressional Budget Office projecting that new legislation will add $3.4 trillion to the national debt over the next decade.

The Gold ETF Showdown: A Comparative Analysis

Performance Leadership: GLDM Takes the Crown

The SPDR Gold MiniShares Trust (GLDM) has emerged as the top performer among major gold ETFs, delivering 38.38% returns over the past year. This slight outperformance over its competitors reflects not just the underlying gold rally but also GLDM's superior cost structure, which allows more of gold's gains to flow through to investors.

GLDM's performance advantage, while marginal in percentage terms, becomes significant over extended periods due to the compounding effect of lower fees. The fund has demonstrated consistent tracking of gold prices while maintaining $16.078 billion in assets under management, providing excellent liquidity for investors.

The Low-Cost Champion: IAUM's Expense Advantage

iShares Gold Trust Micro (IAUM) offers the lowest expense ratio at just 0.09%, making it the most cost-effective option for long-term gold exposure. With 40.94% returns over the past year and $1.4 billion in assets under management, IAUM provides compelling value for cost-conscious investors.

The fund's year-to-date return of 25.87% closely tracks gold's underlying performance, demonstrating effective portfolio management despite its smaller scale compared to industry giants. IAUM's low-cost structure is particularly beneficial for buy-and-hold investors who prioritize minimizing expense drag over extended periods.

Assets Under Management: Scale and Stability

SPDR Gold Shares (GLD) remains the undisputed leader in assets under management, with approximately $100 billion under management. However, among the top performers in our analysis, GLDM commands $16.078 billion, followed by IAU with $47.735 billion and smaller but growing funds like IAUM at $1.4 billion.

Larger AUM generally translates to better liquidity, tighter bid-ask spreads, and operational efficiency. However, the data shows that larger funds often carry higher expense ratios, creating a trade-off between scale benefits and cost efficiency. This dynamic is evident in IAU's higher 0.25% expense ratio compared to smaller, more focused offerings.

Liquidity and Trading Volume Analysis

Trading volume and liquidity metrics reveal significant differences across gold ETFs. GLD maintains the highest daily trading volumes, typically exceeding several billion dollars in daily turnover, while GLDM averages 3.30 million shares daily. The 30-day median bid-ask spreads are remarkably tight across all major gold ETFs, with most maintaining spreads of 0.01-0.03%.

Gold ETF trading volumes reached record levels in H1 2025, particularly from North American and Asian markets. This increased activity reflects both tactical trading around geopolitical events and strategic allocation shifts toward precious metals exposure.

Tracking Error and Operational Efficiency

Tracking error analysis reveals that larger funds generally maintain tighter tracking to underlying gold prices. Among Indian gold ETFs, funds with larger AUM demonstrate lower tracking errors, with some achieving tracking errors below 3%. However, expense ratios tend to increase with fund size, creating a complex optimization problem for investors choosing between cost and tracking precision.

The most efficient funds balance low tracking error with reasonable expense ratios, though perfect correlation is challenging given the operational complexities of holding physical gold across multiple vault locations and managing creation/redemption processes.

Expert Forecast & Future Outlook (2025-2030)

Goldman Sachs: The $4,000 Trajectory

Goldman Sachs Research maintains the most aggressive bullish stance, forecasting gold to reach $3,700 per ounce by end-2025 and $4,000 by mid-2026. Their analysis centers on continued central bank accumulation and potential recession risks that could drive additional ETF inflows. The firm's analysts, led by Lina Thomas, estimate that central bank demand alone could average 80 tonnes monthly in 2025, significantly above historical norms.

Goldman's "extreme tail scenario" envisions gold reaching $4,500 by end-2025 if geopolitical tensions escalate or recession risks materialize more rapidly than expected. This upside case assumes accelerated ETF inflows and continued dollar weakness amid mounting fiscal concerns.

J.P. Morgan Research has established even more ambitious long-term targets, projecting gold could reach $4,000 by Q2 2026 under their base case scenario. More dramatically, the bank's analysts suggest that gold could surge to $6,000 by 2029 if just 0.5% of foreign-held US assets are reallocated to the precious metal.

The bank's forecast hinges on structural demand from central banks averaging 710 tonnes quarterly and the ongoing de-dollarization trend. J.P. Morgan's analysis incorporates trade war impacts, recession probabilities, and the potential for accelerated institutional adoption of gold as a strategic asset.

World Gold Council: Measured Optimism

The World Gold Council presents a more conservative outlook, suggesting gold may gain 0-5% in the second half of 2025 under current consensus conditions. However, their analysis includes significant upside scenarios where economic deterioration could drive gold 10-15% higher from current levels.

WGC's framework incorporates multiple variables including GDP growth, inflation trajectories, and geopolitical developments. Their base case assumes cautious Fed rate cuts totaling 50 basis points by year-end, with gold benefiting from continued uncertainty and central bank demand.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Risk Factors and Downside Scenarios

Several factors could derail the bullish gold narrative. A stronger-than-expected US economy could enable more aggressive Fed policy, potentially pushing real yields positive and reducing gold's appeal. Additionally, any significant reduction in central bank demand would remove a key structural support for prices.

UBS and other institutions highlight potential headwinds including possible demand destruction at very high price levels, particularly in key consumer markets like India and China. Chinese insurance companies' recent authorization to allocate up to 1% of assets to gold could provide 255 tonnes of additional annual demand, but this assumes continued implementation.

Five-Year Outlook: The $8,900 Question

Long-term forecasts extend dramatically higher, with some analysts projecting gold could reach $8,900 by 2030 under highly inflationary scenarios. These projections from firms like Incrementum AG depend heavily on inflation trajectories and assume continued erosion of fiat currency purchasing power.

However, such extreme forecasts require sustained inflation well above current levels and continued degradation of confidence in major fiat currencies. More moderate long-term projections center around $4,000-5,000 by the late 2020s, reflecting steady but not catastrophic monetary debasement.

Actionable Insights: What Should Investors Do Now?

Choosing the Right Gold ETF for Your Profile

For cost-conscious, long-term investors, IAUM represents the optimal choice with its industry-lowest 0.09% expense ratio. The fund's smaller size doesn't compromise its ability to track gold prices effectively, and the cost savings compound significantly over time. Investors planning multi-year holdings should prioritize expense ratios above all other factors.

Active traders and institutional investors should favor GLDM or GLD for their superior liquidity and options market depth. GLDM offers an attractive middle ground with 0.10% expenses and $16 billion in assets, providing excellent liquidity while maintaining competitive costs. GLD remains the gold standard for large-scale institutional trading despite higher fees.

Risk-averse investors seeking maximum tracking precision should consider funds with larger asset bases like IAU, which maintains tight correlation to gold prices despite its higher 0.25% expense ratio. The trade-off between cost and tracking precision becomes less relevant for shorter holding periods or smaller position sizes.

Portfolio Allocation Strategies

Current market conditions support tactical allocation to gold ETFs ranging from 5-15% of total portfolio value. The negative real yield environment makes gold's zero nominal yield relatively attractive, while ongoing geopolitical uncertainties support higher allocations than historically optimal.

Dollar-cost averaging strategies work particularly well in the current environment of elevated volatility. Rather than attempting to time entries around geopolitical events, systematic accumulation allows investors to benefit from gold's structural tailwinds while managing short-term volatility.

International investors should consider currency hedging implications. While dollar weakness has supported gold prices, investors in strengthening currencies may face headwinds. European and Asian gold ETFs offer currency-hedged alternatives that can provide more predictable returns in local currency terms.

Tactical Timing Considerations

Current price levels around $3,360 per ounce present a reasonable entry point despite gold's substantial year-to-date gains. Multiple analysts suggest dips toward $3,100-3,200 would offer more attractive strategic entry opportunities, though such corrections may prove elusive given structural demand factors.

Fed policy meetings represent key catalysts for gold price movements. The September FOMC meeting, with its high probability of rate cuts, could trigger significant upward moves if dovish signals exceed expectations. Conversely, unexpectedly hawkish messaging could create temporary buying opportunities.

Geopolitical event calendar management requires careful attention to Middle East developments, US-China trade negotiations, and European political stability. While impossible to predict precisely, maintaining dry powder for geopolitical spike buying can enhance risk-adjusted returns.

Implementation and Risk Management

Position sizing should reflect individual risk tolerance and portfolio correlation. Gold's low correlation with traditional assets makes it an effective diversifier, but its volatility requires careful position management. Most advisors recommend maintaining gold positions between 5-10% of total assets under normal