Supreme Court ruling on tariff powers meets geopolitical chess match over rare earth metals.

The Supreme Court hears all arguments tomorrow on presidential tariff authority.

The timing isn't random. President Trump just threatened 25% tariffs on eight European nations unless Denmark hands over Greenland's mineral wealth.

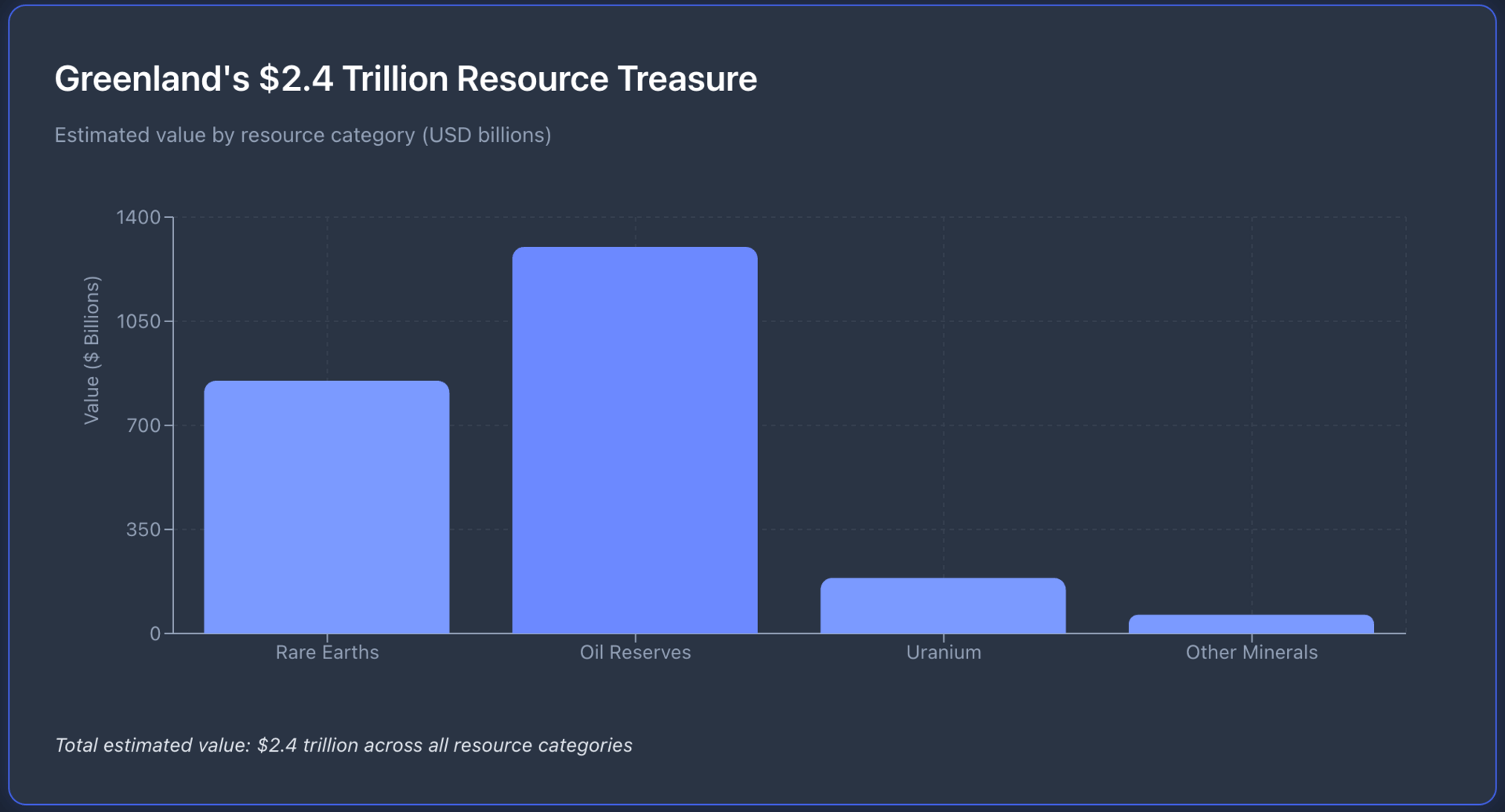

We're talking about $2.4 trillion in rare earth elements, uranium, and oil sitting under Arctic ice.

This isn't about real estate. It's about breaking China's 90% monopoly on rare earth elements that power everything from F-35 fighter jets to AI data centers.

Key factor: Greenland holds 25% of global rare earth reserves. The U.S. currently imports 80% of its rare earths from China. Every defense contractor, every tech company building AI infrastructure, every EV manufacturer needs these materials.

Tomorrow's SCOTUS hearing determines whether Trump can legally weaponize tariffs under the International Emergency Economic Powers Act (IEEPA).

But the real story is the Arctic resource pivot already underway.

What Led to This Moment

August 2019: Trump offers Denmark $600 million-plus for Greenland. Denmark calls it "absurd." Trump cancels his state visit. Markets shrug.

July 2025: Trump issues Executive Order imposing 10-41% tariffs on 69 countries. IEEPA legal challenges begin. The U.S. Court of International Trade questions presidential authority.

September 2025: SCOTUS agrees to hear the case on an accelerated schedule. Oral arguments set for November, then moved to January 20, 2026.

January 14, 2026: Trump slaps 25% tariffs on advanced AI chips, including Nvidia's H200. Silicon Valley scrambles.

January 17, 2026: Trump threatens eight EU nations with tariffs over Greenland. Denmark, Norway, Sweden, Finland, Germany, France, Netherlands, Belgium all targeted. $130 billion in annual trade at stake.

The euro dropped 0.8% overnight. Rare earth mining stocks jumped 2%.

Tomorrow's SCOTUS Arguments

The Supreme Court will examine whether presidents can impose tariffs without Congressional approval under IEEPA. Treasury Secretary Scott Bessent told Bloomberg the administration expects "constitutional validation of executive trade authority."

Scenario 1: Full Victory (35% probability) Court upholds broad IEEPA powers. Trump implements 10% tariffs February 1, escalating to 25% by June. European Union retaliates with countermeasures. Rare earth ETFs surge on supply chain urgency.

Scenario 2: Partial Ruling (45% probability) Court limits tariff authority but allows national security exceptions. Arctic resources qualify. Targeted tariffs proceed. Markets see moderate volatility.

Scenario 3: Defeat (20% probability) Court strikes down IEEPA tariff powers. Trump pursues Congressional route or alternative executive actions. Short-term relief for European equities. Long-term Arctic strategy unchanged.

The Federal Circuit already issued a stay on tariff refunds, signaling judicial reluctance to overturn executive trade powers during the case.

Why Greenland Matters More Than Most Think

Greenland isn't just ice. The Kvanefjeld deposit alone contains 228,000 tons of rare earth oxides. That's enough dysprosium to build magnets for 15 million electric vehicles or 500,000 wind turbines.

China controls 90% of global rare earth processing. When Beijing restricted exports in 2010, rare earth prices spiked 750% in six months. Molycorp's stock jumped from $14 to $79.

The U.S. has exactly one operational rare earth mine at Mountain Pass, California. Total production: 43,000 tons annually. China produces 168,000 tons.

Defense contractors need these materials. Each F-35 fighter jet requires 920 pounds of rare earth elements. Virginia-class submarines use 9,200 pounds. The Pentagon's 2023 report identified rare earths as the highest supply chain risk in defense manufacturing.

But here's the bigger play: AI data centers.

Microsoft just signed a 20-year uranium supply deal with Constellation Energy to power its AI infrastructure. Each data center needs 500-800 megawatts of reliable baseload power. Solar and wind can't deliver that consistency. Nuclear can.

Greenland has uranium deposits estimated at 228 million pounds. At current prices of $82 per pound, that's $18.7 billion in uranium alone.

Arctic oil adds another dimension. The U.S. Geological Survey estimates 17.5 billion barrels of recoverable oil in Greenland's offshore fields. At $75 per barrel, that's $1.3 trillion.

Add it up: rare earths, uranium, oil, zinc, lead, gold. Total estimated value: $2.4 trillion.

Which resource crisis worries you most?

The Geopolitical Chess Match

Denmark knows what it has. Greenland's government (which has autonomy on resource development) just approved new mining licenses. A June 2026 independence referendum polls at 60% support.

If Greenland goes independent, the U.S. loses its existing Thule Air Base agreement. China has already offered $8 billion in infrastructure investment. Russia operates 40 icebreakers in the Arctic. The U.S. has two.

Trump's tariff threat forces Europe's hand: cooperate on Arctic resource development or face trade war. Germany imports €47 billion annually from the U.S. France exports €38 billion. Neither wants 25% tariffs.

The EU Trade Commissioner called the threats "economic blackmail." But Bloomberg reports backroom negotiations on joint Arctic development already underway.

Will Denmark hand over Greenland resource rights?

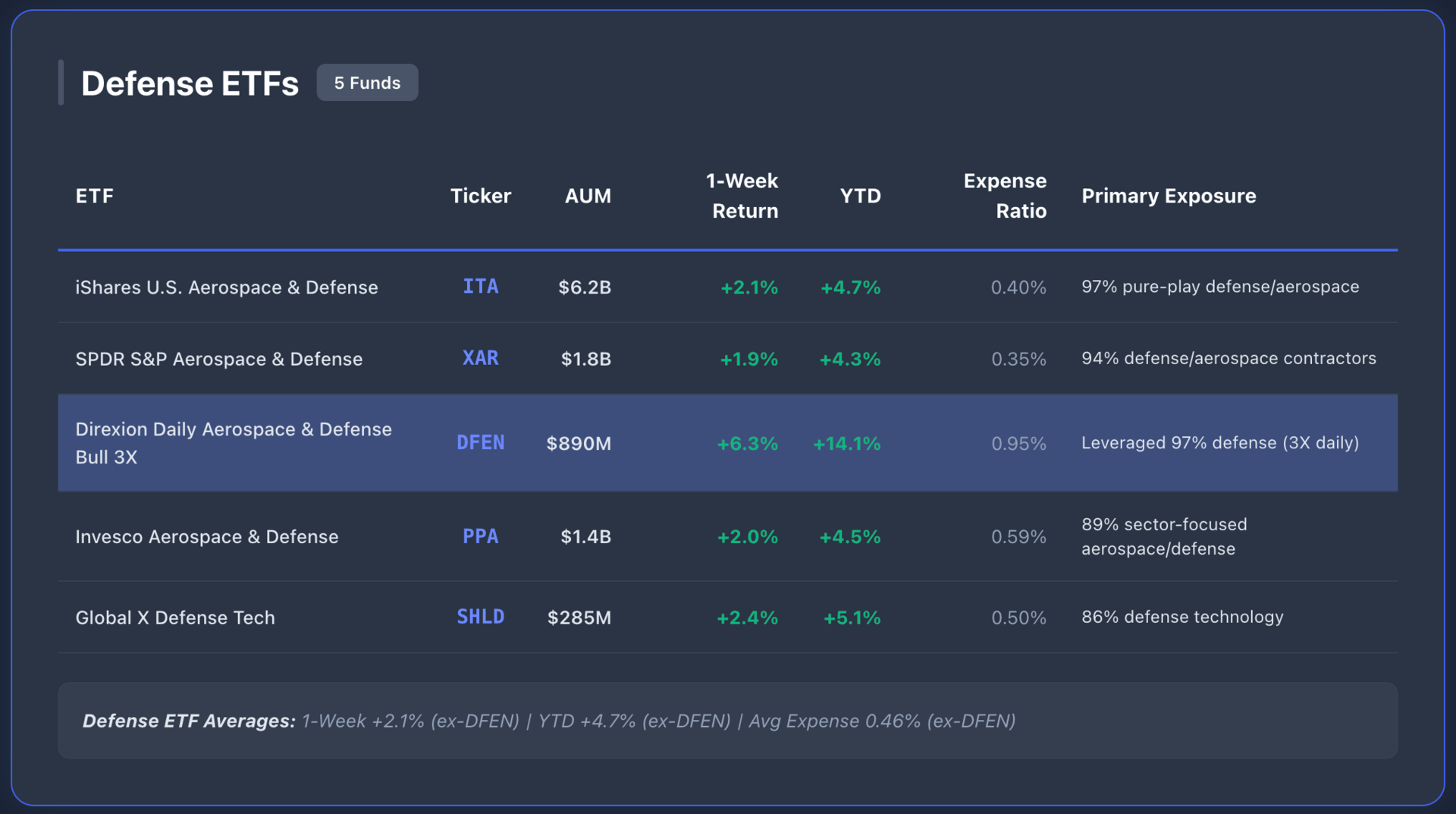

Defense ETF Exposure to Arctic Resources

Most defense ETFs don't directly own rare earth miners. But their holdings depend on rare earth supply chains.

Lockheed Martin (8.2% of ITA, 7.9% of XAR) needs rare earths for missile guidance systems. RTX Corporation (7.1% of PPA, 6.8% of ITA) uses them in radar systems. Northrop Grumman (6.4% of DFEN, 5.9% of XAR) requires them for satellite components.

Here's the current defense ETF landscape with exposure to companies dependent on rare earth supply chains:

Defense ETFs are already moving. $ITA gained 2.1% last week as Greenland headlines intensified. $DFEN's leveraged exposure delivered 6.3% in five trading days.

But the real opportunity isn't in defense ETFs directly. It's in the rare earth supply chain that defense contractors desperately need.

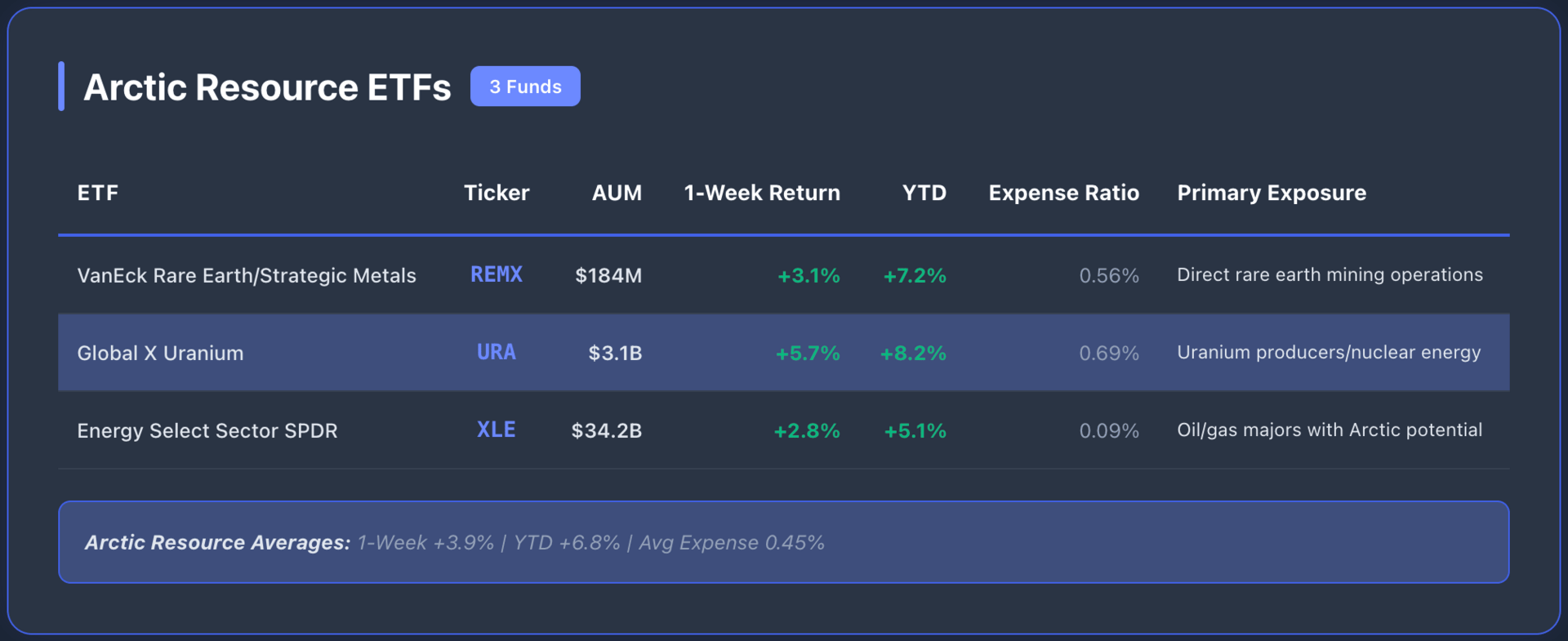

ETF Plays on Arctic Resources

1. VanEck Rare Earth/Strategic Metals ETF (REMX) - The Direct Play

$REMX holds 25 rare earth mining companies globally. Top holdings: MP Materials (16.2%, the Mountain Pass mine), Lynas Rare Earths (14.8%, Australia), Pilbara Minerals (8.3%, lithium).

The fund jumped 11% in the three months after China's 2023 export restrictions. It's up 2.7% since January 14 when Trump announced AI chip tariffs.

Here's the thesis: If SCOTUS upholds tariff authority and Greenland negotiations accelerate, rare earth prices spike. MP Materials already has Pentagon contracts to build domestic processing. Lynas operates the only large-scale rare earth separation facility outside China.

Greenland development means a multi-year construction timeline. Existing producers benefit from supply urgency. Expense ratio: 0.56%. AUM: $184 million.

2. Global X Uranium ETF (URA) - The Energy Infrastructure Angle

$URA tracks uranium miners and nuclear energy companies. Holdings include Cameco (24.1%, world's largest publicly traded uranium producer), Kazatomprom (15.6%, Kazakhstan state miner), NexGen Energy (8.9%, Canadian developer).

Uranium prices hit $82 per pound, up from $47 in 2023. Microsoft's Constellation deal, Amazon's nuclear data center plans, Google's small modular reactor investments all signal AI-driven uranium demand.

Greenland's 228 million pounds of uranium won't hit markets for years. But speculation on Arctic development drives uranium equities. URA gained 47% in 2024. It's up 8.2% year-to-date.

Nuclear provides 24/7 baseload power that AI data centers require. Renewable energy can't match that reliability. Expense ratio: 0.69%. AUM: $3.1 billion.

3. Energy Select Sector SPDR (XLE) - The Oil Hedge

$XLE holds 21 energy companies led by ExxonMobil (23.4%) and Chevron (16.8%). While not Arctic-focused, major oil companies will bid on Greenland's 17.5 billion barrels of development proceeds.

Arctic oil extraction costs $60-80 per barrel versus $35-45 for Texas shale. But strategic reserve importance matters. The U.S. imports 6.3 million barrels daily. Greenland oil reduces that dependence.

XLE provides 3.5% dividend yield and $34.2 billion AUM. It's up 5.1% in 2026 as oil prices stabilize around $75. Expense ratio: 0.09%.

Best Arctic resource play for next 6 months?

What Happens Next

January 20, 10:00 AM ET: SCOTUS oral arguments begin. Audio streams live. Legal analysts watch for Justice questioning on Congressional versus executive trade authority.

January 21-23: Trump keynotes World Economic Forum in Davos. EU leaders present. Arctic development panels scheduled. Bloomberg reports Denmark's Prime Minister will address Greenland directly.

February 1: If SCOTUS doesn't issue stay, 10% tariffs take effect on eight EU nations. European stocks face pressure. Euro tests 1.02 support level.

June 2026: Greenland independence referendum. If passed, new government negotiates resource rights. U.S., China, EU all positioning for access.

Q3 2026: SCOTUS issues final ruling. Markets price in long-term tariff authority framework.

The smart money isn't waiting for headlines. MP Materials stock volume increased 340% in the week after Trump's January 17 announcement. Institutional investors see the multi-year Arctic resource development cycle beginning.

Defense contractors can't build weapons without rare earths. Tech companies can't scale AI without uranium power. Energy independence requires Arctic oil development.

China knows this. That's why they've invested $90 billion in Arctic infrastructure since 2012. Russia knows this. That's why they have 40 icebreakers patrolling northern shipping routes.

Tomorrow's SCOTUS arguments determine the legal framework. But the geopolitical resource competition is already underway.

The Real Question You Should Ask

Is Greenland the next semiconductor crisis?

In 2021, the world learned that Taiwan Semiconductor produces 92% of advanced chips. That single-point failure sent governments scrambling. U.S. CHIPS Act: $52 billion. EU Chips Act: €43 billion. Everyone is building domestic production.

Rare earths have the same problem. One country controls processing. Defense, technology, renewable energy all depend on it. There's no quick fix. Building separation facilities takes 5-7 years. Mining development takes 8-12 years.

Greenland offers the only large-scale alternative deposit outside China that sits in friendly territory. The island is technically part of Denmark (NATO member) with U.S. military presence already established.

If tomorrow's SCOTUS ruling gives Trump tariff authority, expect accelerated Arctic development negotiations. If the Court limits that authority, expect Congressional bills on rare earth supply chain security within weeks.

Either way, the Arctic resource pivot is happening. The only question is timing.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Greenland: Trump’s Vision of the New World Order

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.