Why are NVIDIA’s robots sitting like this? The answer is alarming. (from Behind the Markets)

Yeah, it’s official. SpaceX ties up with xAI, creating a combined entity valued at $1.25 trillion, positioning it as the most valuable private company in history.

The transaction values SpaceX at $1 trillion and xAI at $250 billion, establishing the foundation for what management indicates could become the largest IPO ever attempted when the company targets public markets as early as June 2026.

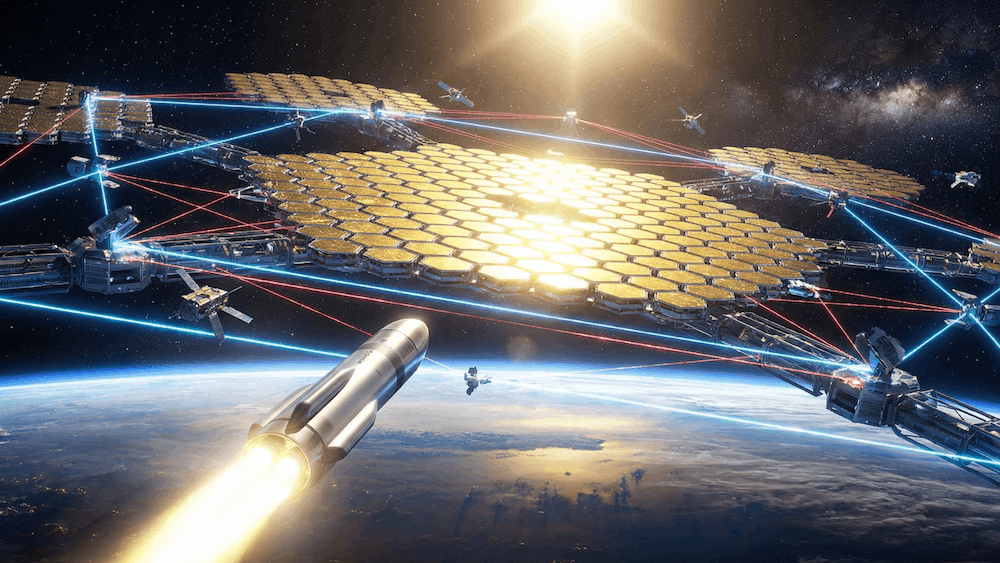

The merger fundamentally reshapes competitive dynamics within AIinfrastructure. Musk's proposal centers on a categorically different architecture: space-based AI data center powered by solar.

This represents visionary infrastructure planning in commercial space history.

SpaceX & xAI Strategy

Elon Musk (Krisztian Bocsi/Getty Images)

Musk's internal memo frames the acquisition around energy.

AI advancement requires massive data centers consuming electricity at grid-stressing rates.

Orbital data centers bypass this. Solar power in orbit delivers 5x more energy than ground installations, operates continuously without atmospheric interference, and sidesteps terrestrial permitting nightmares.

That's the story. Now examine the underlying mechanics.

Capital pressure drove timing.

xAI raised $20 billion in January 2026 at a $230 billion pre-money valuation. Yet $1 billion monthly burn means those proceeds fund approximately 20 months of operations. Management faced a hard choice: raise again at potentially unfavorable terms, or merge with a cash-generative entity.

SpaceX reported estimated $8 billion EBITDA on $15-16 billion revenue for FY2025.

Launch economics creates guaranteed revenue.

SpaceX earns revenue deploying Starlink satellites. The merger vertically integrates guaranteed demand for SpaceX's core service. If orbital data centers require millions of satellites as FCC filings suggest, SpaceX just locked in the largest long-term contract in aerospace history—with itself.

IPO optics matter more than acknowledged.

Public markets reward growth narratives backed by profitability. SpaceX alone presents a mature aerospace operation with limited expansion.

xAI alone presents itself as a cash-incinerating AI venture. Combined, they present a profitable infrastructure platform with exposure to space commercialization and AI. The $1.5 trillion IPO target prices this narrative.

Regulatory arbitrage remains underappreciated.

Space operations face FCC and FAA launch licensing. Space data centers navigate zoning boards, environmental impact statements, and community opposition.

xAI's Memphis facility triggered significant local resistance. Orbital deployment eliminates this friction entirely.

Valuation Trajectory

The $1.25 trillion combined valuation makes SpaceX the most valuable private company,

SpaceX accelerated from $36 billion (2020) to $1 trillion (2026), a 27.8x increase in six years.

Starlink operates over 9,600 active satellites in low Earth orbit, making it by far the largest operator in space, with $15-16 billion annualized revenue.

Launch cadence dominance compounds value. SpaceX executed 165 orbital launches in 2025, representing 85% of global mass to orbit.

The valuation reflects $42+ billion cumulative capital raised and the 100,000-GPU Colossus supercomputer expanding to 1 million GPUs. But primarily, it reflects investor conviction that Musk's execution track record justifies pricing in extraordinary success.

That gap matters. SpaceX generates actual profit. xAI remains pre-revenue at scale. The $250 billion valuation prices a decade of flawless execution in the most competitive technology market in existence.

How do you view the SpaceX-xAI $1.25 trillion merger valuation?

Orbital Data Centers

Musk projects a space-based AI data center will achieve "lowest cost per unit capacity" within 2-3 years.

Space-based solar power exists in demonstration form, not commercial deployment. NASA's 2024 comprehensive SBSP assessment concluded such systems might achieve cost-competitiveness with terrestrial renewables by 2040-2050.

AI data centers in space are emerging as a potential solution to the massive energy and cooling demands of terrestrial AI, with firms like Starcloud, LoneStar Data Holdings, and Sidus Space actively developing orbital infrastructure.

Key problems make this extremely hard:

1. Power loss: Beaming power from space wastes 30-50% of the energy. We need 80-90% efficiency to make money, which requires major physics breakthroughs.

2. Cooling: Space has no air, so heat can only escape through radiation. We don't know how to cool massive computers in orbit like we do on Earth.

3. Cost: Launching 1 million satellites would cost $105 billion just for launches, plus $200-500 billion to build them.

4. Timeline mismatch: Other projects aim for small demos by 2026-2028, or 2-gigawatt systems by 2050. SpaceX wants to skip ahead 20+ years and build something 1,000x bigger than what others are planning.

When will space-based AI datacenters become commercially viable?

SpaceX IPO Implications

The June 2026 IPO at $1.5 trillion valuation would rank among history's largest capital markets events. Institutional allocation will be substantial, concentrated, and consequential for portfolio performance.

Revenue concentration risk.

SpaceX derives 80% of revenue from Starlink. If subscriber growth plateaus or satellite deployment moderates, consolidated revenue growth decelerates immediately. This concentration would trigger covenant violations in most debt facilities. Yet the $1.5 trillion valuation assumes sustained growth across this concentrated base.

Execution risk.

Either physics and economics align, enabling commercial deployment, or $500+ billion capital deployment generates zero return. The 5-10 year realistic timeline means investors won't see validation for half a decade. That's extraordinary patience to demand at $1.5 trillion entry valuation.

Regulatory risks.

Pentagon adoption creates export control dimensions. FCC authorization for up to 1 million satellites—approval is not guaranteed.

Capital intensity eliminates near-term free cash flow.

Orbital infrastructure demands hundreds of billions before revenue generation.

Vision vs Valuation

This transaction combines genuine innovation with financial necessity.

The orbital data center architecture represents legitimate technological advancement. The 2-3 year commercial deployment timeline appears detached from current technology readiness. The $1.5 trillion IPO valuation prices flawless execution of the most ambitious infrastructure project ever attempted.

Musk has delivered improbable outcomes repeatedly: reusable orbital rockets, mass-market EVs, global satellite internet.

But $1.25 trillion isn't consideration, it's conviction.

The investment thesis requires belief that Musk will compress a 20-year NASA timeline into 2-3 years while scaling 1,000x larger and maintaining cost competitiveness against terrestrial alternatives.

That's not impossible. It's just never been done.

This represents visionary consolidation and the most expensive infrastructure experiment in human history.

Will you buy SpaceX-xAI shares in the June 2026 IPO?

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Trump's Fed Pick Sends Gold Crashing: What Investors Need to Know Now

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.