The world's biggest countries just held a major meeting in China, and it's shaking up global markets. The Shanghai Cooperation Organization (SCO), think of it as Asia's answer to NATO but focused on economics, gathered in Tianjin with a clear message: “we're building our own financial system.”

GDP Growth Analysis: SCO vs US Economic Performance

The economic scoreboard tells a compelling story:

SCO (2025 Growth Rates)

China: 5.3%

India: 6.5-7.0%

Russia: 2.8% (despite sanctions)

United States

Projected growth: 1.6%

Combined, China, India, and Russia have a $25.5 trillion economy, that's 84% the size of the entire US economy.

What This Means for Markets

The SCO isn't just talking, they're putting serious money behind their vision:

$1.4 billion in new loans committed by China over three years

$890 billion in trade volume between SCO countries in 2024

$140 billion in Chinese investments across SCO nations

These aren't small numbers. They represent the building blocks of an alternative global financial system.

ETFs Telling the Story

Smart money is already positioning for this shift:

Defense Stocks

Global X Defense Tech ETF (SHLD): +60% this year

$1 billion flowing into aerospace and defense funds

Safe Haven

Gold ETFs: +$10 billion in new money

Inflation-protected bonds: +$7 billion

Energy Markets

ProShares UltraShort Bloomberg Crude Oil ETF (SCO): +3.52% YTD

High volatility as investors hedge against supply disruptions

Trump's trade war strategy is backfiring. By hitting everyone with tariffs, including 50% on Indian goods, the US is accidentally pushing its friends toward China and Russia.

The Real Game Changer

This isn't just about tariffs. The SCO is building parallel infrastructure:

Independent payment systems (against dollar dominance)

Digital trade platforms (+34% growth in cross-border e-commerce)

Energy cooperation (72% of global renewable energy growth)

New railways and shipping routes (reducing dependence on Western logistics)

What Trump Gets Wrong

President Trump keeps claiming his tariffs brought in "trillions of dollars," but the data shows something different.

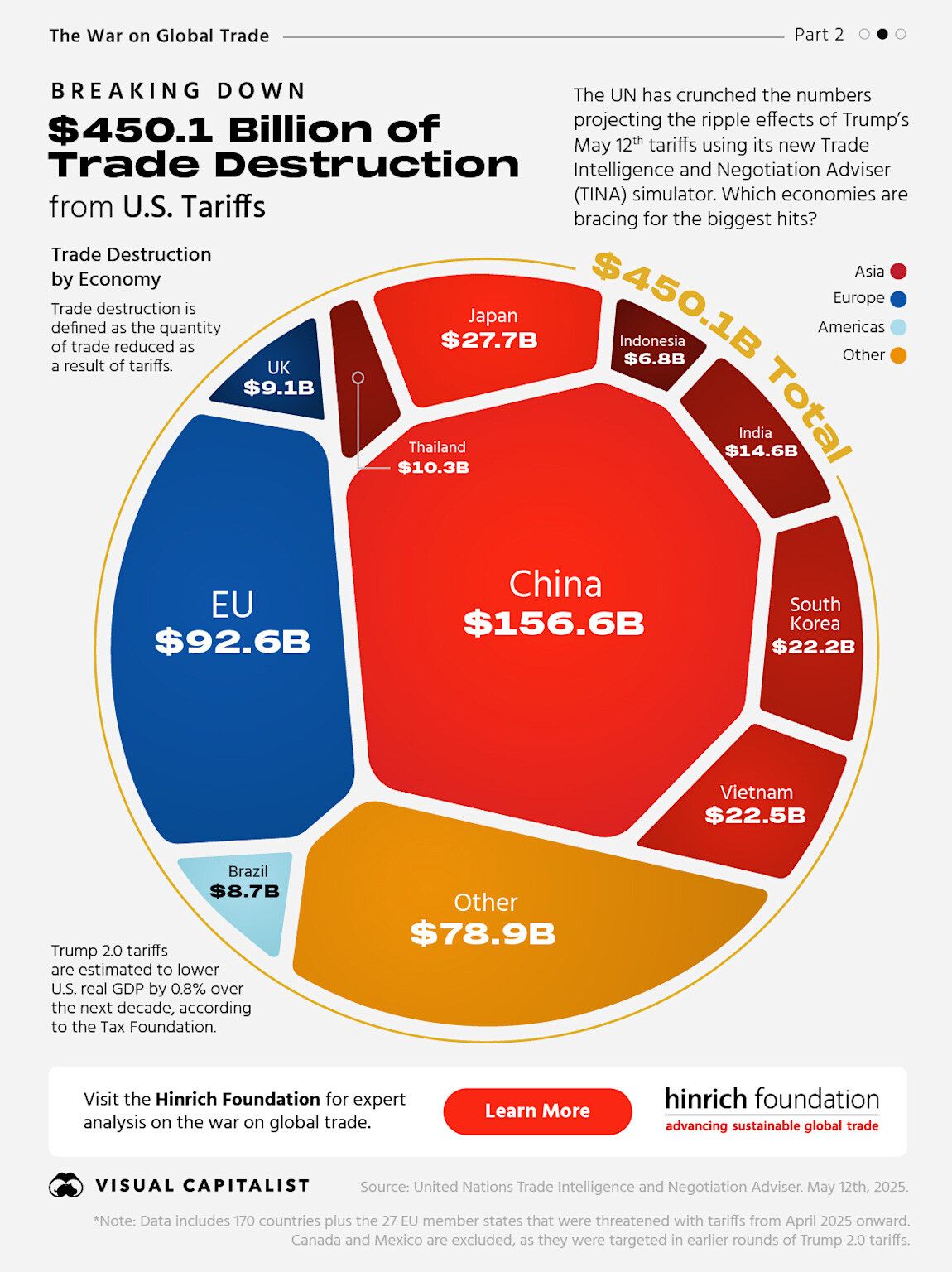

The trade war cost the US $450 billion in lost trade, while pushing competitors to work together more closely.

What This Means

We're watching the development of a two-track global economy:

US-Led System

Slower growth (1.6%)

Higher uncertainty

Defensive positioning

SCO Alternative

Faster growth (5%+ average)

New infrastructure

Rising trade volumes

Investment Implications

Short-term (2025-2026)

Expect continued volatility

Defense and commodity ETFs may outperform

Currency hedging becomes critical

Long-term (2027+)

Geographic diversification essential

US-only strategies may underperform

Emerging market exposure more important

The SCO summit wasn't just another international meeting. It marked the moment when half the world's population decided to build their own economic system.

For investors, this creates both risks and opportunities:

Risks:

Reduced US influence over global trade

Dollar's role as reserve currency under pressure

Traditional growth assumptions may not hold

Opportunities:

New markets opening up

Infrastructure investment boom in Asia

Technology transfer and innovation

What to Watch Next

Keep an eye on these key indicators:

SCO Development Bank progress: Will they actually build it?

India-China cooperation: Can they overcome border disputes?

Russian sanctions impact: How long can they maintain growth?

US policy changes: Will the U.S. moderate its approach?

The numbers suggest we're not going back to the old system. The question isn't whether this shift will happen, it's how fast, and whether investors will adapt in time.

This analysis is based on current market data and geopolitical developments. Past performance doesn't guarantee future results. Consider consulting with a financial advisor before making investment decisions.