Trump Just Dropped a Bombshell (from Behind the Markets)

What a wild week! The equity markets show their most significant technical deterioration since “Liberation Day”, driven by a convergence of three critical factors: massive AI infrastructure spending, earnings volatility, and a broad-based reversal in speculative positioning.

The Thursday Close (February 5, 2026 after hours): The S&P 500 broke key support at 6,830, closing at 6,820.20 (down 1.2%), marking the index's first negative YTD return. The Nasdaq sustained a 4% weekly decline, and the Dow Jones shed nearly 600 points.

Friday Morning Update (February 6, 2026): Bulls fought back. U.S. stock indexes rebounded in morning trading, attempting to break the three-day losing streak.

Dow Jones Industrial Average: Rose over 300 points (+0.62%) to 49,212.43.

S&P 500: Gained 0.50% to 6,832.11, reclaiming the critical 6,830 level.

Nasdaq Composite: Advanced 0.35% to 22,618.76, led by a recovery in chip makers.

So, is this a dead-cat bounce or a successful defense of support? Let’s deep dive.

Amazon's Earnings Paradox

Key Points:

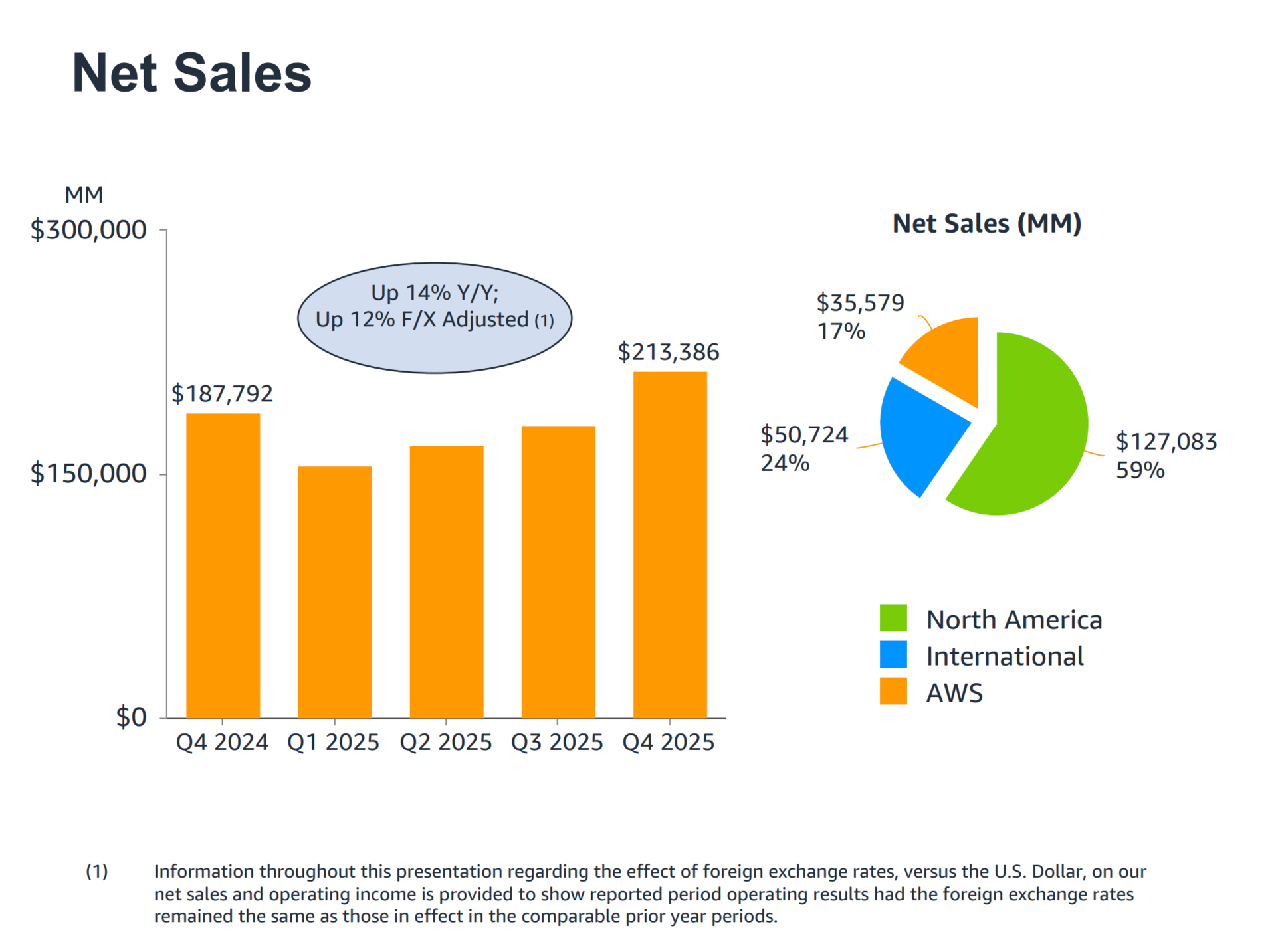

AWS revenue: $35.6 billion (Q4 2025)

AWS growth rate: +24% YoY

AWS operating margin: 35% ($12.5 billion in quarterly profit)

Annual AWS run rate: $142 billion

Announced 2026 capex: $200 billion

Amazon reported quarterly results that, by conventional metrics, exceeded expectations. AWS delivered $35.6 billion in revenue with 24% YoY growth, the business unit's strongest performance since Q3 2022. The operating margin held at 35%, generating $12.5 billion in profit for a single quarter.

Yet $AMZN declined 11.5% in after-hours trading, followed by a 9% premarket collapse on February 5, bringing the stock to $223, substantially below Wall Street's median price target near $300.

The disconnect stems from capex concerns.

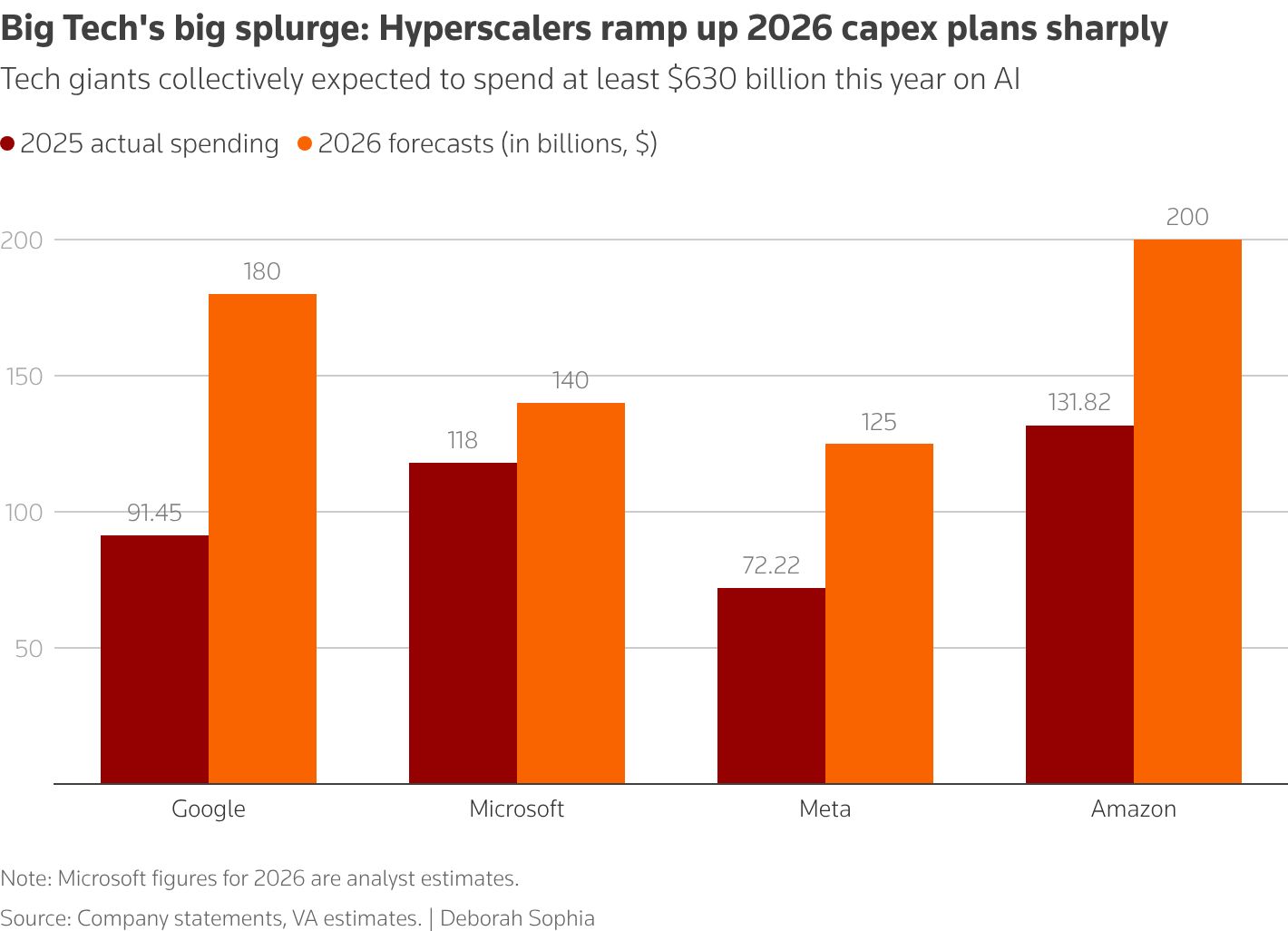

Management's guidance calling for $200 billion in capex spending for 2026 represents a +60% increase over 2025's $125 billion outlay.

Analysts had modeled $145-160 billion at the high end. The $40-55 billion variance triggered immediate margin compression fears and pushed out profitability inflection timelines by 12-18 months in most Street models.

The market's message: operational excellence no longer compensates for balance sheet uncertainty when spending commitments of this magnitude lack visibility into returns.

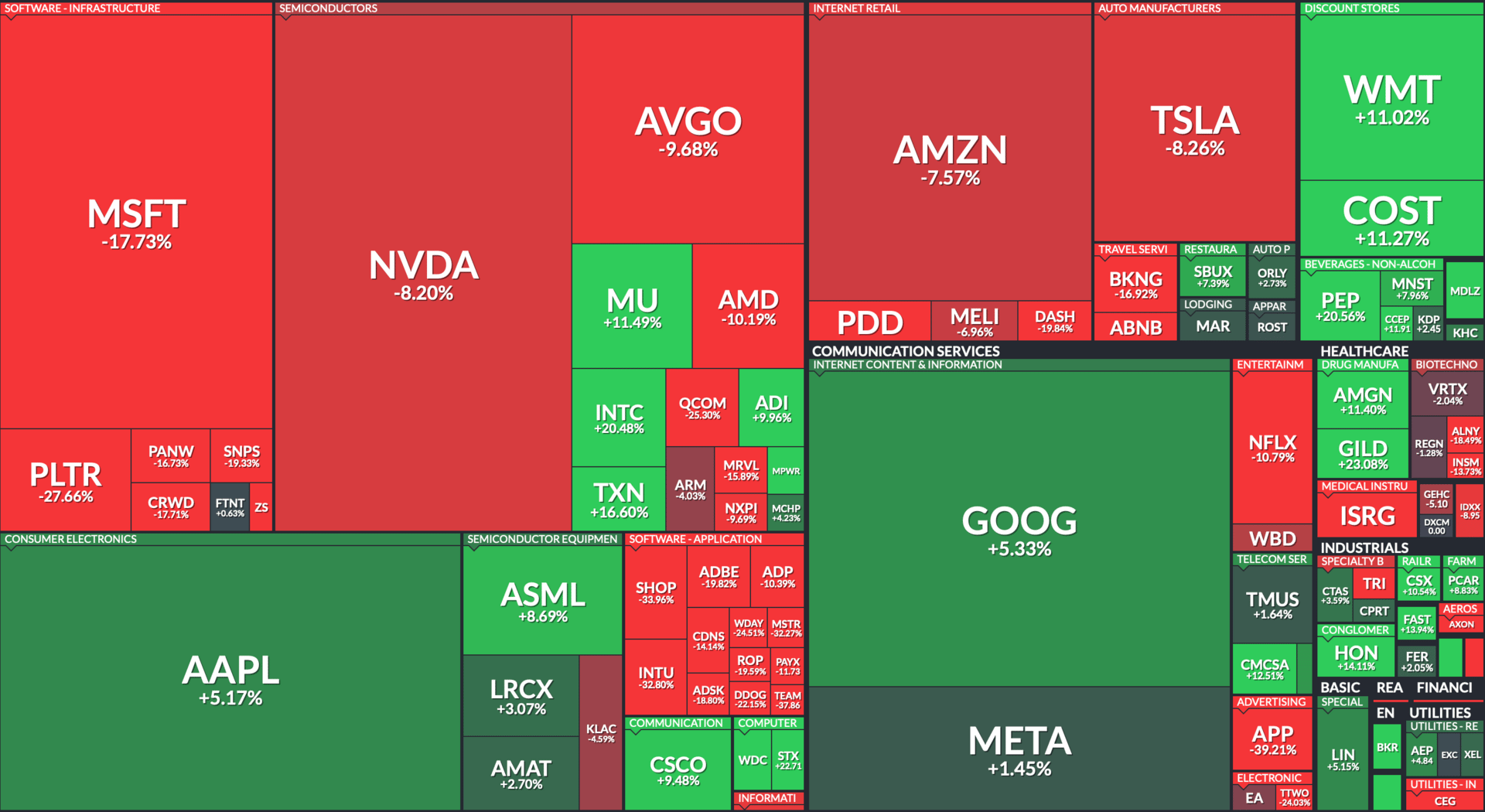

Tech Earnings: Divergence Under Pressure

Key Points:

Meta: Outperformed on ads revenue strength, equity advanced

Microsoft: Solid fundamentals, stock declined on AI spending scrutiny

Amazon: down 11.5% post-earnings

Qualcomm: dropped 8.5% following quarterly report

C3.ai: declined 8.6% session decline to $10.15 (52-week low)

Mag7's quarterly reporting cycle revealed a fundamental shift in market tolerance for growth-at-any-cost narratives.

Meta's ads machinery continues firing on all cylinders, rewarding shareholders with immediate gains.

Microsoft posted defensible numbers but faced equity headwinds as investors questioned whether Azure's 39% growth justifies the company's undisclosed but substantial AI infrastructure investments.

Amazon's -11.5% post-earnings decline serves as the clearest illustration of shifting sentiment. Strong operational results no longer suffice when paired with capital deployment that extends ROI timelines beyond investor comfort zones.

The broader tech sector absorbed collateral damage.

Software-focused IGV ETF declined -5% for the week. Oracle reversed gains despite announcing $50 billion in AI funding. C3.ai, a pure-play AI equity, touched 52-week lows at $10.15 after shedding -8.6% in a single session.

Valuation multiples face compression when forward earnings estimates must absorb both rising capex and uncertain AI monetization schedules.

The market's current stance: prove revenue generation before requesting patient capital.

The $650 Billion Question

Key Points:

Amazon: $200 billion

Google (Alphabet): $185 billion (near-doubling of prior spend)

Microsoft: Undisclosed, estimated $150+ billion

Meta: Undisclosed, estimated $100+ billion

Combined total: ~$650 billion in AI infrastructure commitments

Four of the world's largest tech companies simultaneously announced capex numbers growth for 2026. This represents the single largest coordinated sector investment in modern financial history.

The bull case hinges on network effects and infrastructure moats. Proponents argue this spending establishes 20-year competitive barriers, analogous to the railroad buildouts of the 1860s or the telecom infrastructure investments of the 1990s. Early spending leaders capture dominant market positions that generate decades of cash flow extraction.

The bear case centers on marginal return deterioration. If AI workload growth fails to match infrastructure expansion, or if open-source alternatives commoditize capabilities faster than anticipated, these expenditures represent permanent capital impairment. The absence of clear ROI timelines heightens execution risk, particularly when multiple competitors build parallel infrastructure chasing the same revenue pools.

Current market pricing suggests skepticism is winning. Technology equities declined -4% to -5% for the week despite companies articulating long-term strategic vision. Investors are demanding showcased monetization before rewarding infrastructure investment.

The next 12-18 months will test whether $650 billion in spending produces proprietary advantages or merely accelerates AI commoditization through oversupply.

How do you assess the $650 billion aggregate AI spending commitment?

Sector Rotation Signals

Nasdaq 100 (1-Month Performance)

Key Points:

Large-cap technology: down 4% to 5% weekly performance

Small-cap equities: Outperformed mega-cap growth

Financials, industrials: Held relative strength vs. broader indices

Value factor: Outperformed growth factor across style boxes

The market experienced three consecutive sessions of tech underperformance coupled with relative strength in value-oriented sectors, a technical pattern that historically precedes sustained factor rotation when it persists beyond 5-7 trading days.

Capital flows are seeking valuation refuge. After months of concentrated performance in the Magnificent Seven, breadth indicators suggest institutional rebalancing into sectors trading at discounts to long-term average multiples: financials, industrials, energy, and small-cap value.

This rotation carries significant portfolio implications. If AI spending concerns persist, the technology sector's 28-30% weighting in major equity indices creates mechanical headwinds for benchmark performance. Conversely, if AI revenue inflections materialize in 2026-2027, current sector rotation could prove tactically mistimed.

The rotation's sustainability depends on earnings growth distribution. Technology companies must either demonstrate AI monetization or risk prolonged multiple compression. Non-technology sectors must deliver earnings surprises to justify reallocated capital. One week of flows establishes a pattern; sustained divergence requires fundamental confirmation.

Will the three-day tech underperformance/value outperformance pattern persist?

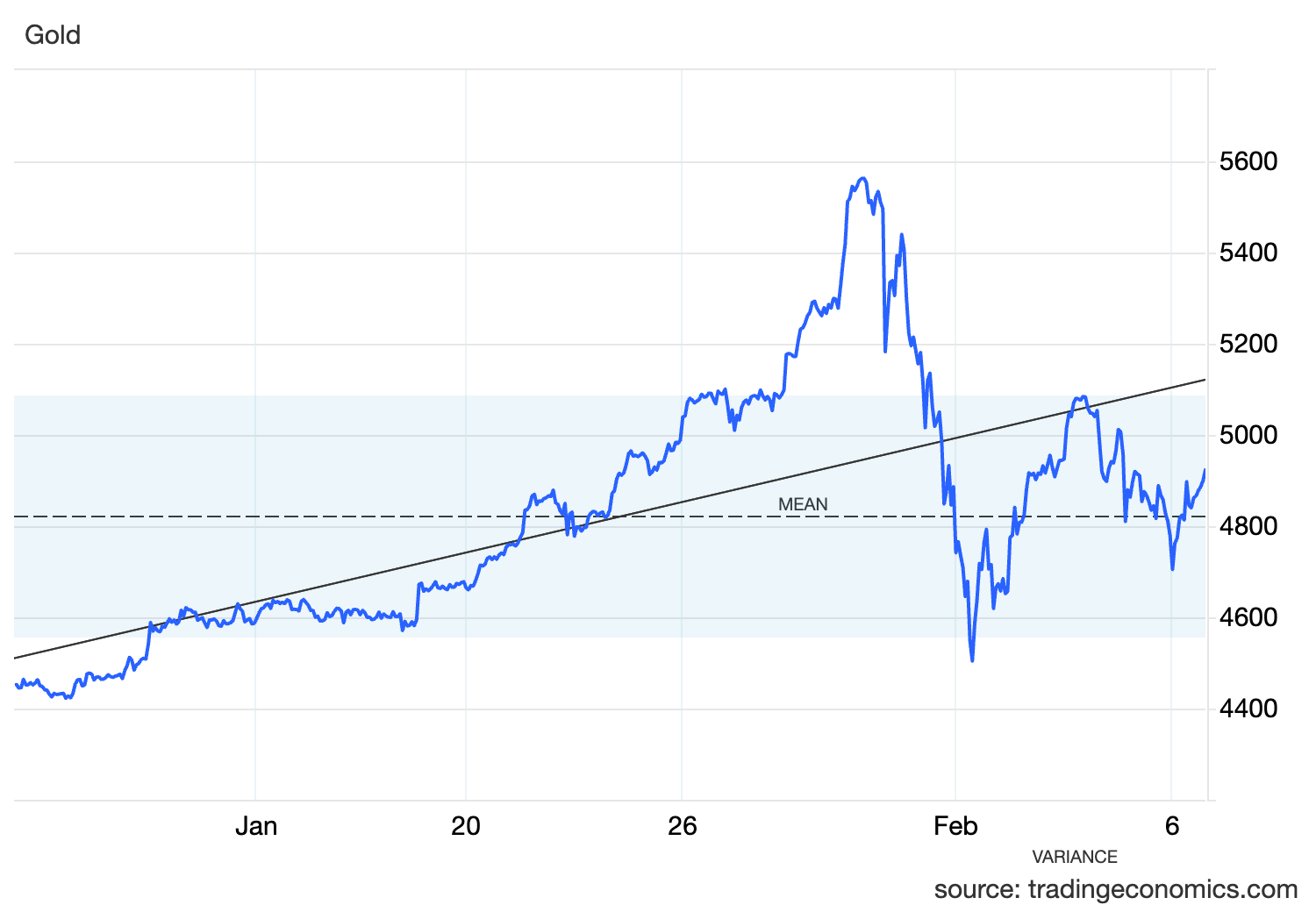

Precious Metals Volatility

Key Points:

Gold: Severe intraweek decline followed by partial recovery

Silver: High-volatility drawdown characterized as "multi-decade extremes"

Primary driver: Margin calls and forced speculative unwinds

Precious metals experienced volatility typically reserved for crypto or frontier equity markets. Both gold and silver sustained sharp early-week declines driven by cascading margin calls, instances where leveraged traders faced capital requirements exceeding available liquidity, triggering automatic position liquidation.

The mechanics matter. When leveraged long positions face margin calls simultaneously, selling pressure becomes self-reinforcing: declining prices trigger additional margin requirements, forcing more selling, depressing prices further. This creates reflexive downward spirals disconnected from fundamental supply-demand dynamics.

Partial recovery occurred mid-week as bargain-seeking capital entered at technically oversold levels and broader equity weakness renewed safe-haven demand. However, the whipsaw price action contradicts precious metals' traditional portfolio role as low-volatility diversifiers.

Silver's volatility particularly concerns strategic allocators. A metal with millennia-long monetary history should not exhibit price action resembling speculative technology equities. The breakdown suggests excessive speculative positioning had infiltrated a traditionally conservative asset class.

Portfolio implications: Investors relying on precious metals for tail-risk protection must reassess whether recent volatility represents temporary technical disruption or structural change in these markets' behavioral characteristics.

Technical Market Assessment

S&P 500: Gained 0.50% to 6,832.11, just barely reclaiming the broken support level.

Nasdaq Composite: 0.35% weekly decline marks worst performance since April 2025. 22,618.76 close on February 4 (down 1.4% session). Critical support at 23,000.

Dow Jones Industrial Average: Up 0.62% 49,212.43.

Relative outperformance vs. technology-heavy indices suggests defensive positioning.

Market breadth deteriorated substantially. Declining volume exceeded advancing volume by 2.5:1 ratios on down days, while up days showed weak participation below 50% of S&P constituents advancing.

Portfolio Positioning Considerations

This week's price action reflects fundamental uncertainty regarding AI infrastructure returns rather than cyclical economic deterioration. Corporate spending commitments totaling $650 billion lack sufficient visibility into revenue generation timelines, creating justifiable skepticism about near-term margin trajectories.

Investors face three scenarios over the next 12-18 months:

AI monetization materializes faster than expected: Technology equities recover losses and resume leadership. Early infrastructure investors capture disproportionate market share.

AI spending shows results but with extended timelines: Equities trade sideways to down as margins compress before eventual recovery. Rotation into value sectors persists through 2026.

AI infrastructure proves overbuilt relative to demand: Substantial capital impairment across technology sector. Aggressive multiple compression extends 18-24 months.

Current valuations suggest markets are pricing scenario 2 with scenario 3 tail risk increasing. Any evidence supporting scenario 1, particularly accelerating AI-driven revenue at AWS, Azure, or Google Cloud, would trigger sharp re-rating.

Which cloud provider holds the strongest competitive position following Q4 earnings?

The breach of S&P 500 support at 6,830 warrants attention. If the index fails to reclaim this level within 3-5 sessions, technical deterioration could accelerate toward 6,700-6,750 before finding buyers.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: "Groundhog Day": Zelensky Torches Europe's Defense Inaction

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.