Russia launched 242 drones and 36 missiles at Ukraine overnight, including the first confirmed combat use of the Oreshnik hypersonic missile hitting Lviv.

Four people are dead in Kyiv, 600,000 homes lost power, and defense stocks just posted their strongest rally in months.

Here's what happened and why your defense portfolio just became more relevant than ever.

The Strike: Numbers That Tell the Story

The assault started at 6:30 PM local time on January 8. Russia deployed:

242 Shahed/Gerbera drones from Primorsko-Akhtarsk

22 Kalibr cruise missiles from Black Sea naval positions

13 Iskander-M ballistic missiles from Crimea and Kursk

1 Oreshnik intermediate-range ballistic missile from Kapustin Yar

Ukrainian and NATO air defenses knocked down 84% of incoming threats—226 drones and 18 missiles.

But the penetration rate was enough. The Oreshnik hit an industrial facility in Lviv. Energy infrastructure took damage across Kyiv, Kharkiv, and Odesa. Residential buildings burned.

That Oreshnik missile matters more than the headline numbers suggest. It's Russia's new intermediate-range ballistic missile.

Flies at Mach 10+. Carries nuclear capability. This was its first battlefield deployment. The weapon changes the calculus for NATO defense planning.

What Oreshnik Actually Means

Here's the thing about hypersonic missiles. They're nearly impossible to intercept with current systems.

The Oreshnik traveled from launch to impact faster than existing Patriot or THAAD batteries can track and engage.

Zelensky called it a "massive signal" to allies. He's asking for more air defense systems, longer-range strike capabilities, and accelerated weapons deliveries.

Russia claims the test was successful against "strategic facilities." Both statements point to the same conclusion: the conflict just escalated into a new technological tier.

Lviv isn't on the eastern front. It's 40 kilometers from Poland, a NATO member state.

When hypersonic weapons land that close to alliance territory, defense ministers pay attention. And when defense ministers pay attention, procurement budgets expand.

The Market Response Was Immediate

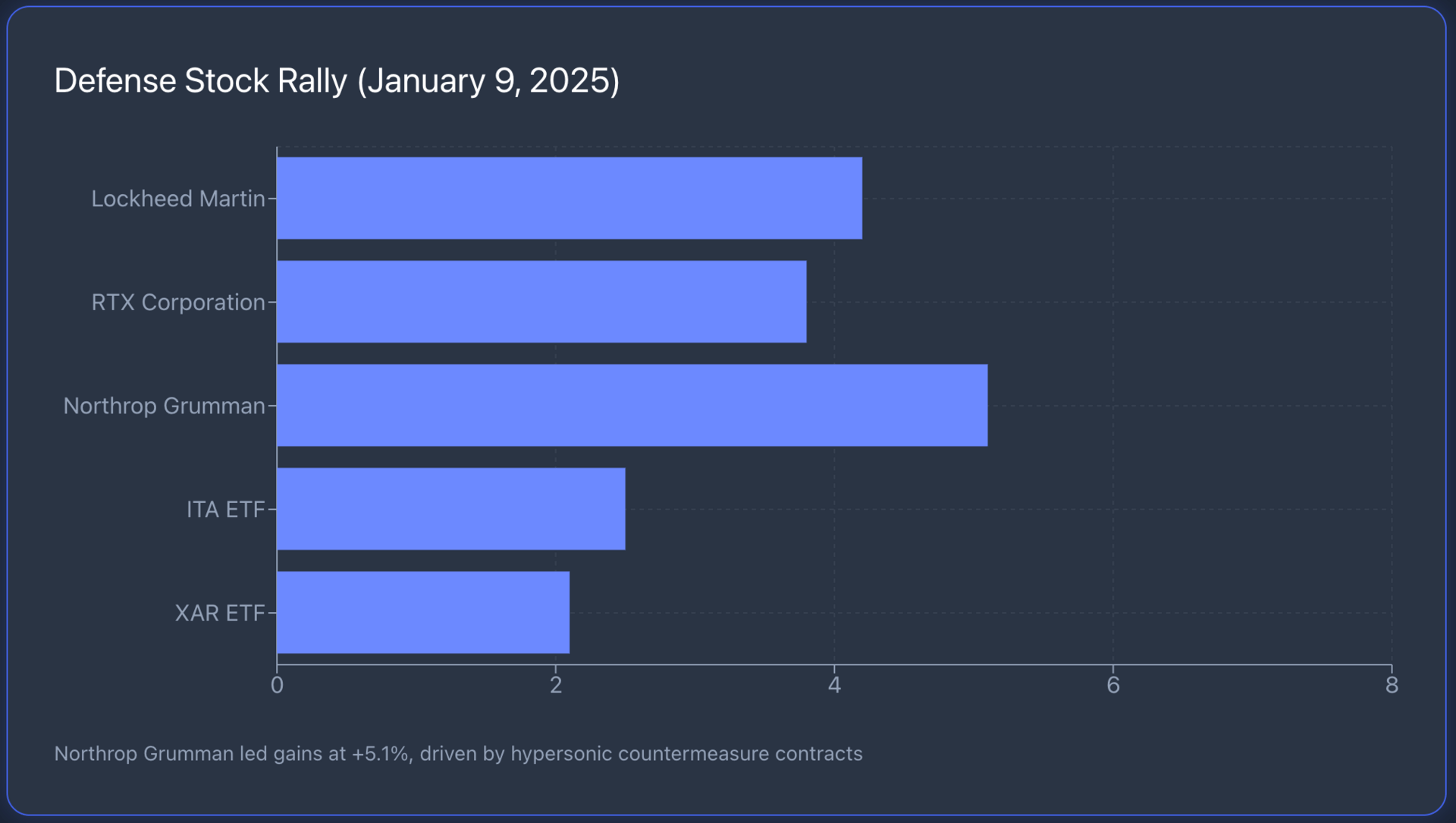

Defense stocks rallied hard on January 9:

Lockheed Martin: +4.2% (Patriot system supplier, hypersonic defense contracts)

RTX Corporation: +3.8% (JASSM, HIMARS production)

Northrop Grumman: +5.1% (hypersonic countermeasure programs)

The iShares U.S. Aerospace & Defense ETF $ITA jumped 2.5% in a single session.

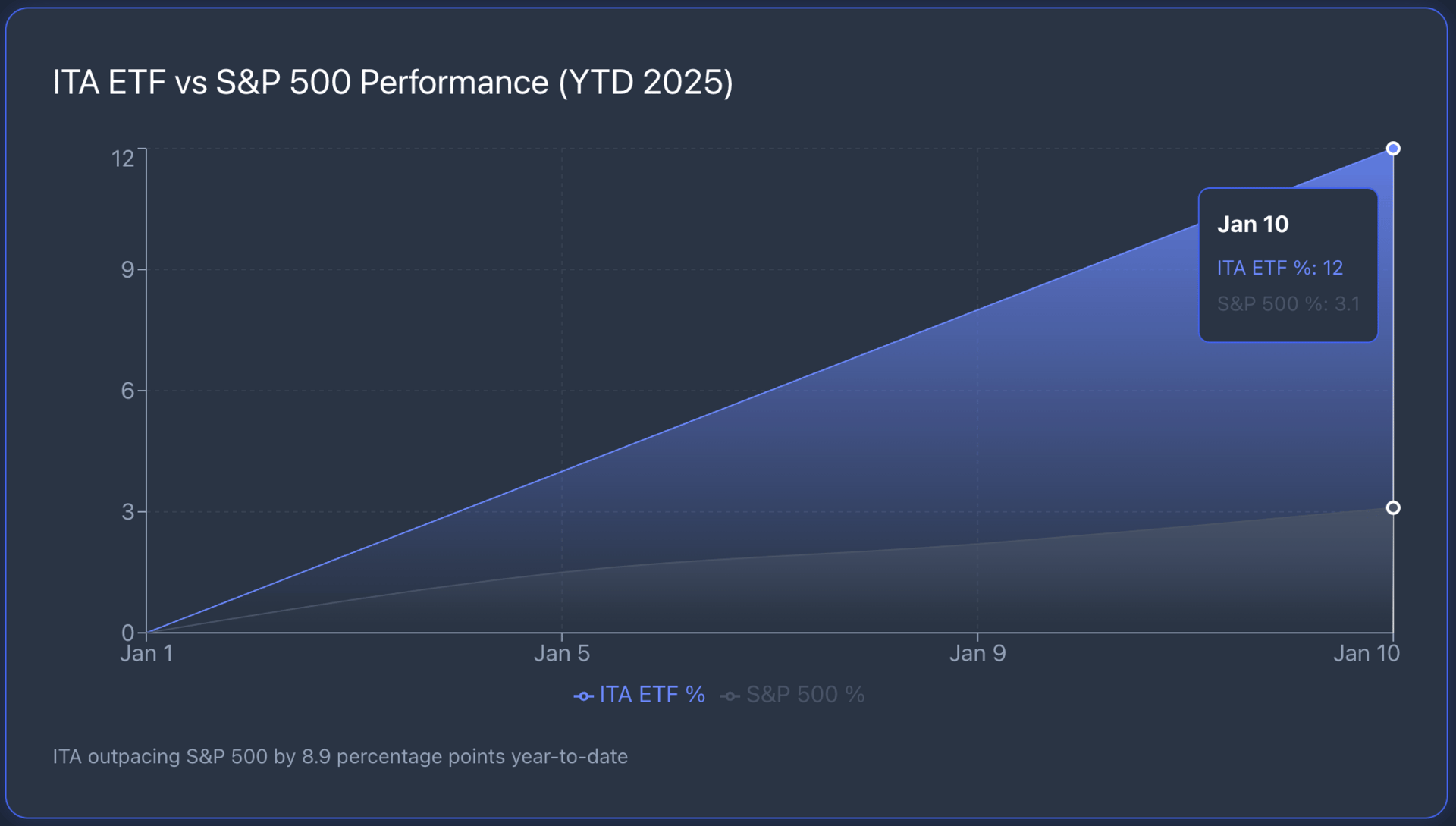

ITA is up 12% YTD, outpacing the S&P 500 by a wide margin.

The SPDR S&P Aerospace & Defense ETF $XAR gained 2.1% and tracks at similar YTD performance.

It's a direct correlation. Every major escalation in the Ukraine conflict has preceded defense sector rallies.

The difference now is the weapon class involved. Hypersonic missiles require an entirely new layer of defense infrastructure. That means multi-year, multi-billion-dollar contracts for U.S. defense contractors.

Was the 2.5% ITA rally on January 9 justified by the Oreshnik strike?

Trump's $1.5 Trillion Defense Budget

The timing couldn't be more relevant. Trump proposed a $1.5 trillion military spending surge just days before this strike. The budget prioritizes missile defense modernization, hypersonic weapons development, and NATO force readiness. Congress hasn't passed it yet, but geopolitical events like Lviv make passage more likely.

Investment analysts are already modeling the impact. Lockheed and Northrop hold the primary contracts for U.S. hypersonic defense programs. RTX supplies the radar and tracking systems. These companies stand to capture a significant share of any expanded defense appropriations.

But there's a broader point here. The defense sector operates differently than most industries. Revenue doesn't depend on consumer sentiment or quarterly earnings beats. It depends on threat assessment and government budget allocation. Both just got reinforced.

What's the bigger catalyst for defense stocks through Q1 2026?

Why ITA ETF Looks Positioned for Q1 Earnings

ITA ETF holds a concentrated portfolio of aerospace and defense stocks: Lockheed, RTX, Northrop, Boeing, General Dynamics.

It's not diversified across sectors. It's a pure-play bet on defense spending and geopolitical tension.

Right now, that concentration is working. Defense contractors are entering Q1 earnings season with strong tailwinds:

Order backlogs at record highs (Lockheed reported $160 billion in backlog last quarter)

Government contracts accelerating (hypersonic defense, air defense systems, munitions replenishment)

Bipartisan political support (defense spending is one of the few areas with cross-party consensus)

Volatility creates opportunity. Defense stocks historically perform well during escalation phases, then consolidate during diplomatic lulls. The pattern repeats. For investors willing to navigate short-term swings, the risk-reward profile favors entry points near current levels.

Some analysts call this "buying the dip" on geopolitical tension. That framing misses the substance. This isn't about timing tweets or news cycles.

It's about recognizing that hypersonic weapons just entered active combat, and the U.S. defense industrial base is the only entity capable of responding at scale.

If you're adding defense exposure today, which approach makes more sense?

The Bigger Picture: Geopolitics as Market Fuel

Ukraine isn't the only theater. Taiwan tensions remain elevated. Middle East conflicts continue. Defense budgets globally are expanding, not just in the U.S. NATO members are hitting 2% GDP defense spending targets for the first time in years.

Poland is building one of Europe's largest armies. Germany is rearming.

This isn't temporary. The post-Cold War peace dividend is over. We're in a multi-year cycle of defense investment. The Oreshnik strike over Lviv is one data point in a longer trend. But it's a significant one. It demonstrates that adversaries are deploying advanced weapons systems in live combat, and Western defense infrastructure needs to respond.

For portfolio allocation, that means defense exposure deserves consideration.

ITA and XAR offer liquid, diversified access to the theme without single-stock concentration risk.

Both ETFs have delivered double-digit returns over the past 12 months, and analyst consensus expects continued strength through 2026.

The market is pricing in escalation. The question is whether you're positioned for it.

What Happens Next

NATO will monitor.

Zelensky will request more weapons.

Russia will likely deploy Oreshnik again to demonstrate capability.

Defense contractors will submit bids for countermeasure systems. Congress will debate budget allocations. And defense stocks will trade on each development.

The pattern is predictable. The execution requires attention.

If you're watching the defense sector, focus on companies with hypersonic defense contracts, air defense system production, and established Pentagon relationships. Those are the names that capture the next wave of spending. ITA holds most of them in a single ticker.

Geopolitics doesn't sleep. Neither should your portfolio strategy.

What defense sector insight would be most valuable to your investment decisions right now?

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.