Rivian jumped 25% in a single day after Q3 earnings.

$RIVN ( ▲ 0.86% ) hit $16.33, levels not seen since June. For a company that once traded at $170, this looks like progress. But here's what matters: Is this a genuine turnaround or just another rally before the next drop?

The numbers tell two stories. And they're both true.

Earnings Report

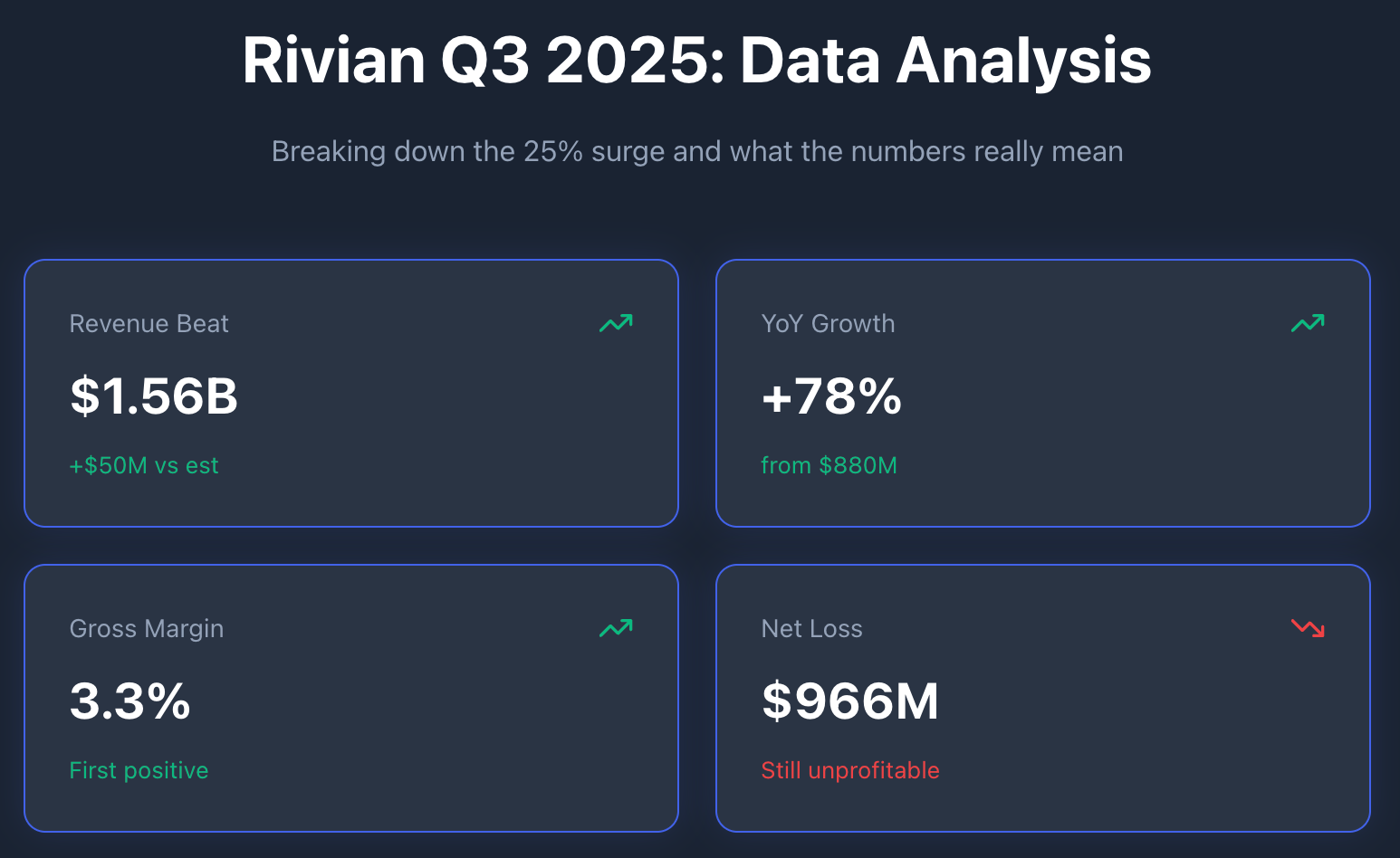

Rivian reported Q3 2025 results last week. Wall Street liked what it saw:

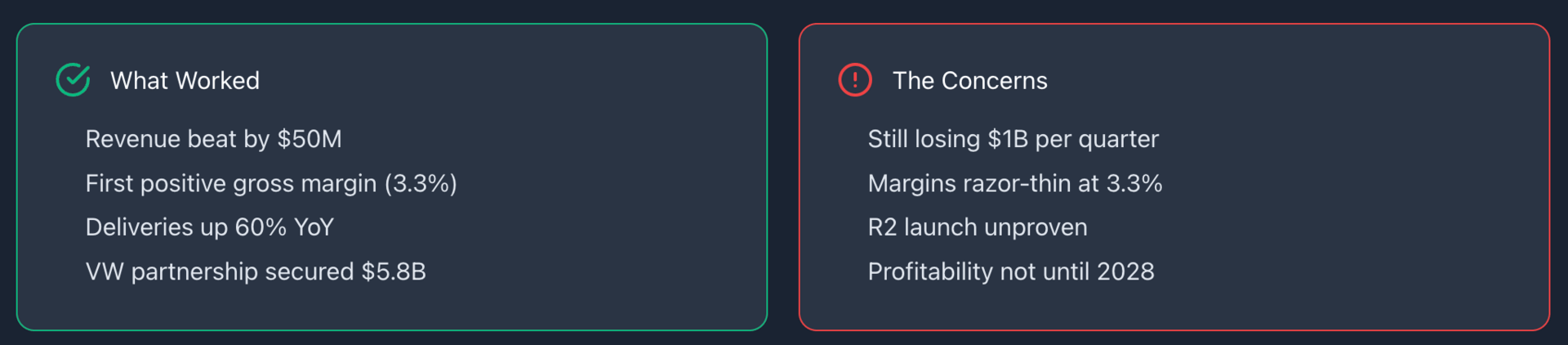

Revenue came in at $1.56 billion. That beat estimates by $50 million.

YoY growth hit 78%, up from $880 million in Q3 2024.

Deliveries reached 4,078 vehicles. That's 60% higher than the 2,552 units from a year ago. Production is scaling, no question.

Gross margin turned positive for the first time: 3.3%. This is the number that got investors excited. After years of losing money on every vehicle sold, Rivian finally made a profit at the unit level.

But there's another number.

Net loss: $966 million. Slightly worse than last year's $932 million loss. Operating expenses are still crushing any profit the company generates from building cars.

The Profitability Problem

A 3.3% gross margin means Rivian makes about $3,300 in profit for every $100,000 vehicle sold.

Tesla makes $25,000. Ford makes $15,000 to $20,000. Traditional automakers operate with margins between 15% and 20%.

Rivian's margin is fragile. One supply chain disruption, one price cut to compete with Tesla, one spike in aluminum or battery costs—and that 3.3% disappears.

We've seen this story before with other EV startups.

The company needs to roughly double production just to break even.

Management says profitability won't arrive until 2028. That's three years of burning cash while hoping nothing goes wrong.

Goldman Sachs has a price target of $13. That's 20% below where the stock trades today.

The R2 SUV

Rivian's entire future rests on the R2 launch in early 2026.

This is the $45,000 mid-market SUV that's supposed to compete with Tesla's Model Y, Hyundai's Ioniq 5, and VW's ID.4.

Here's what we know:

First variant will be dual-motor, mid-level trim

Production capacity: 175,000 units per year at the Normal, Illinois plant

Full pricing reveal: early 2026

Georgia plant won't come online until 2028

Moving from $100,000+ trucks and SUVs to a $45,000 mass-market vehicle creates a brutal margin squeeze. The R2 will have thinner margins than R1 models.

Rivian needs massive volume to make this work.

If R2 succeeds and hits 100,000+ units in 2026-2027, the stock could double. If it stumbles, delayed production, quality issues, weak demand, $RIVN ( ▲ 0.86% ) could fall 50% or more.

CEO's $4.6B Package

On October 31, Rivian's board approved a $4.6 billion performance-based compensation package for CEO RJ Scaringe. It vests through 2032 and ties to stock price milestones, profitability targets, and production goals.

Optimistic view: The board believes Scaringe can execute. They're betting big on the 2026-2027 transformation.

Realistic view: $4.6 billion is enormous. Companies grant massive CEO packages when they're in crisis mode and need to keep leadership locked in. Shareholders may challenge this the same way Tesla's $56 billion Musk package faced scrutiny.

The size of this package tells you how much pressure the company is under.

VW's Lifeline

Volkswagen committed $5.8 billion to a joint venture with Rivian in November 2024. This saved the company from immediate liquidity problems.

VW gets access to Rivian's EV platform, software stack, and autonomy development. Rivian gets cash to fund R2 and the Georgia plant. First VW vehicles using Rivian tech arrive in 2027.

But VW will demand returns. If R2 launch fails or Rivian burns through cash faster than expected, VW could reduce future funding or force strategic changes.

Key Financial Metrics

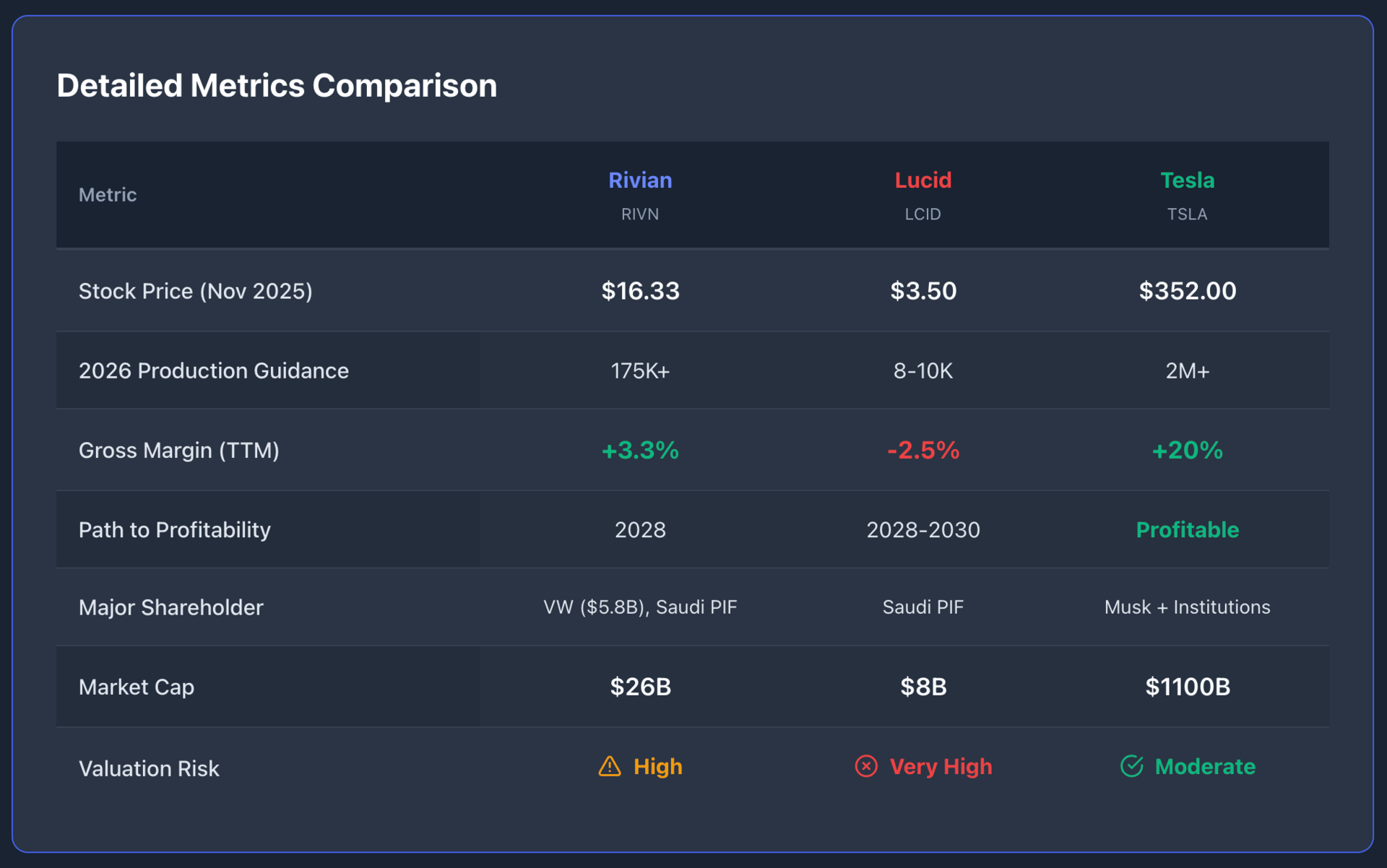

Market cap: $26 billion. That's a premium to traditional automakers (Ford $F ( ▲ 1.62% ) and GM $GM ( ▲ 1.4% ) trade at $100-150 billion each) but at a steep discount to Tesla $TSLA ( ▲ 1.96% ) ($1.4 trillion).

Price-to-sales: 6-8x. Tesla trades at 8-10x. Ford and GM trade at 0.3-0.5x.

Profitability: Negative. Tesla is highly profitable.

Rivian trades like a growth company with Tesla upside, but it operates like a startup burning cash.

If R2 stumbles, the valuation could correct 50% or more.

What is the single most critical factor for Rivian's long-term success?

What to Watch Closely

Watch these dates and milestones:

December 11, 2025: Autonomy & AI Day. Rivian showcases self-driving capabilities. Will it be innovative or overhyped?

Early 2026: R2 pricing event. Can they hit $45,000? Will features justify the price against Model Y and Ioniq 5?

H1 2026: First R2 deliveries. Production ramp quality will determine everything. Delays here would be fatal.

Every quarter through 2027: Gross margin progression. Can they reach 10%+ margins? This is the only metric that matters for long-term survival.

2027-2028: VW partnership results become visible. Revenue-sharing model gets clearer. Georgia plant construction progresses.

The Bear Case

R2 fails to gain traction. Customers choose Tesla, Hyundai, or traditional automakers. Charging infrastructure concerns, range anxiety, or simply brand preference sink demand.

Margins compress again. Competitive pricing forces Rivian to cut prices. Margins flip back to zero or negative. The positive margin story was a one-quarter fluke.

Cash burn accelerates. R&D spending on autonomy, Georgia plant capex, and R2 ramp drain the VW money faster than expected. Another capital raise heavily dilutes shareholders.

Recession kills luxury EV demand. Economic downturn craters R1S and R1T sales. R2's mass-market appeal gets tested in a weak economy.

Chinese EV makers dominate. BYD, NIO, and others offer competitive products at lower prices. Rivian's "Made in America" story isn't enough.

The Bull Case

R2 hits the market perfectly. Priced at $45,000-$55,000 with compelling features, it captures middle-income buyers upgrading from gas vehicles or choosing over Model Y.

Scale improves margins. Once Normal plant hits 175,000 units per year, gross margins expand to 8-12%, approaching industry average.

VW partnership accelerates revenue. Joint-venture vehicles launch in 2027, opening new revenue streams for Rivian's technology.

Amazon demand stays strong. 100,000 EDV order provides steady revenue base. Potential for expansion if Amazon scales logistics.

Autonomy becomes a differentiator. Rivian's practical approach to semi-autonomous driving appeals to customers tired of Tesla's vaporware robotaxi promises.

Rivian vs. Lucid vs. Tesla

Lucid is in survival mode. Production guidance for 2026: 8,000-10,000 units. Gross margin: -5% to 0%. Path to profitability: 2028-2030 at best. Valuation risk: extremely high.

Rivian is at a critical juncture. Production guidance: 175,000+ with R2 ramp. Gross margin: 3.3% now, needs to reach 8-10%. Path to profitability: 2028. Valuation risk: high, execution-dependent.

Tesla is in a different league. Production: 2 million+ units. Gross margin: ~20%. Already profitable. Valuation risk: moderate—premium valuation, but earned through execution.

Lucid needs a miracle. Rivian needs flawless R2 execution. Tesla needs to maintain dominance against growing competition.

What This Means

For speculators: High risk, high reward opportunity. If R2 launches successfully and scales to 100,000+ units in 2026-2027, Rivian could double to $30-40.

Max upside: +150% if margins reach 10%+. Max downside: -70% if R2 fails or another capital raise dilutes shareholders.

For long-term investors: This is a "show me" story. Wait for R2 launch data in H1 2026 before committing capital. Watch gross margin progression every quarter. If margins hit 5%+ by Q2 2026 and R2 deliveries exceed 10,000 per month, that's a buy signal.

For risk-averse investors: Too much execution risk. Too many unknowns. Profitability is 2+ years away. Better opportunities exist in profitable EV suppliers (Nvidia, Broadcom for chips) or traditional automakers (Ford's EV strategy, Toyota's hybrid dominance).

The Bottom Line

Rivian's 25% surge reflects real improvements: revenue growth, delivery acceleration, and positive gross margin. These are genuine wins.

But they mask a company still years from profitability, operating on thin financial margins, and betting everything on R2 execution.

The stock is no longer a bankruptcy candidate like Lucid. But it's far from a "buy and hold forever" story like Tesla. It's a binary bet on whether management can execute R2 production at scale and achieve healthy margins by 2027-2028.

If you own Rivian stock, it should represent no more than 2-5% of your portfolio given the risk profile. Build an exit plan now. Don't wait for a 50% drop to figure out your strategy.

The next six months will tell us everything we need to know.