The defense industry just hit a turning point.

And you’re looking in the wrong direction.

Pete Hegseth dropped a statement last week that should make every defense investor stop and rethink their positions.

On Monday, Hegseth and Elon Musk vowed “to make Star Trek real.”

The message was clear: produce capable systems on schedule and on budget, or get cut out. No more free passes for legacy contractors.

President Trump backed this up with a $500 billion defense spending boost demand. But here's the twist: traditional giants like RTX Corp. are now on thin ice.

The administration is actively pushing for smaller, more agile tech companies to grab market share.

This isn't just policy talk. It's a complete restructuring of how defense dollars flow.

The old guard built empires on cost overruns and delayed timelines. That model is dead. The new winners?

Companies like Rocket Lab (RKLB), Palantir (PLTR), and Kratos Defense (KTOS) that actually deliver what they promise, when they promise it.

The Numbers Don't Lie

The shift is already showing up in the data.

Defense-focused ETFs with heavy exposure to these emerging tech players have been outperforming traditional aerospace and defense funds. Not by a little. By margins that matter.

Look at what happened in just the past week. While legacy defense contractors stumbled through earnings concerns and government scrutiny, the tech-forward names surged.

RKLB posted double-digit gains.

PLTR continued its relentless climb.

KTOS broke through key resistance levels.

Most defense ETFs are still weighted heavily toward the old names. Boeing. Lockheed Martin. General Dynamics. These are solid companies with decades of history. But they're not the ones Hegseth is talking about when he emphasizes companies that deliver "on schedule and on budget."

The market is starting to catch on. But it's early. Very early.

Why It Matters Now

The Pentagon announcement came alongside some revealing developments. New reports about technological breakthroughs in directed energy weapons and advanced surveillance systems. Companies that can move fast and adapt quickly are suddenly worth their weight in gold.

Here's what we know: The administration wants competition. Real competition. Not the usual suspects dividing up contracts behind closed doors. They want companies of all sizes fighting for every dollar.

That opens doors that have been shut for decades.

Small-cap defense tech firms suddenly have a path to major contracts. Mid-sized innovators can compete with giants. The playing field just got leveled in a way we haven't seen since the Cold War buildup.

Will Trump's $500B defense spending boost actually reshape contractor dominance?

But here's the thing: Most ETFs haven't adjusted yet.

The big defense funds are still running last year's playbook. Heavy on aerospace. Light on emerging tech. Minimal exposure to the companies actually winning the new contracts.

The ETF Landscape Right Now

The data tells a clear story.

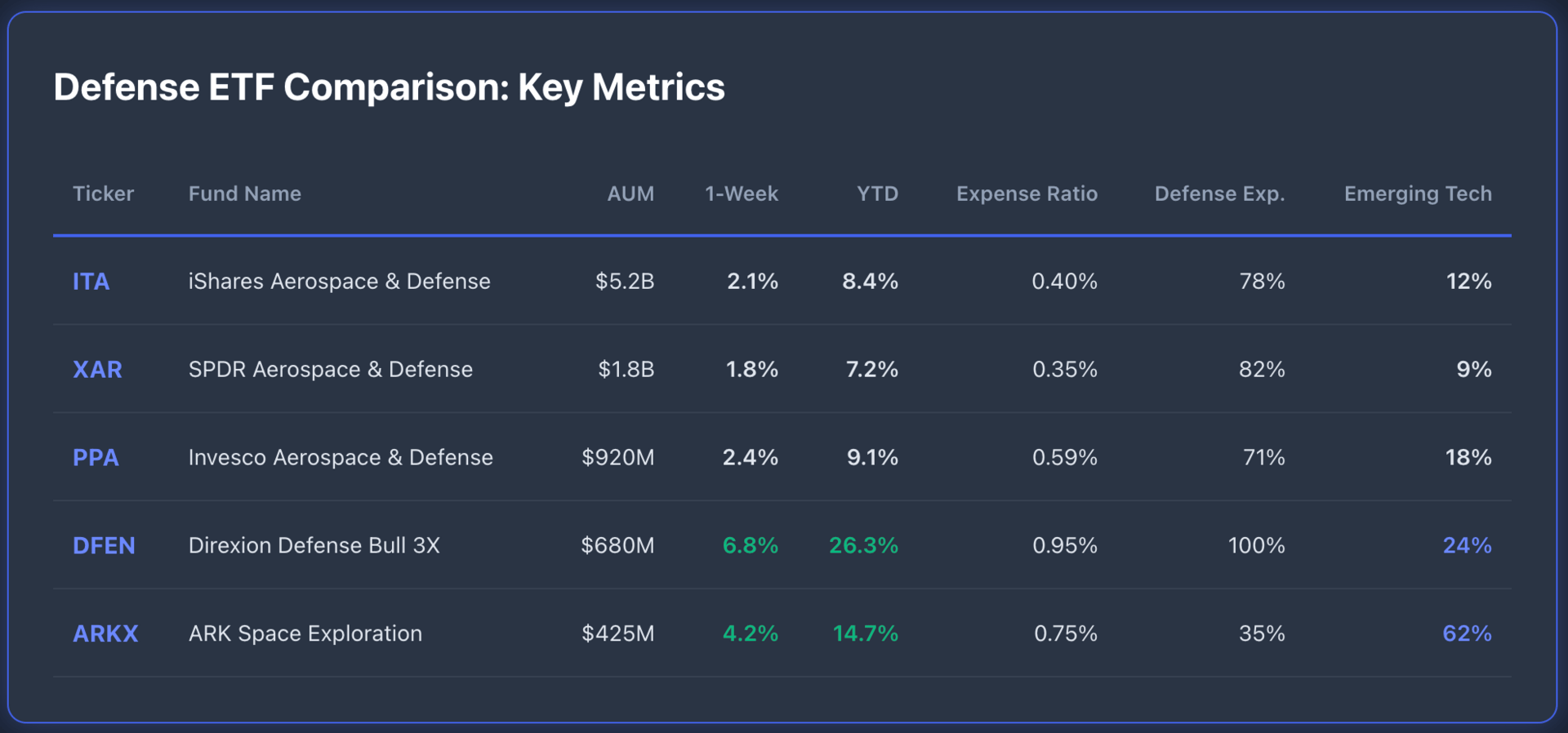

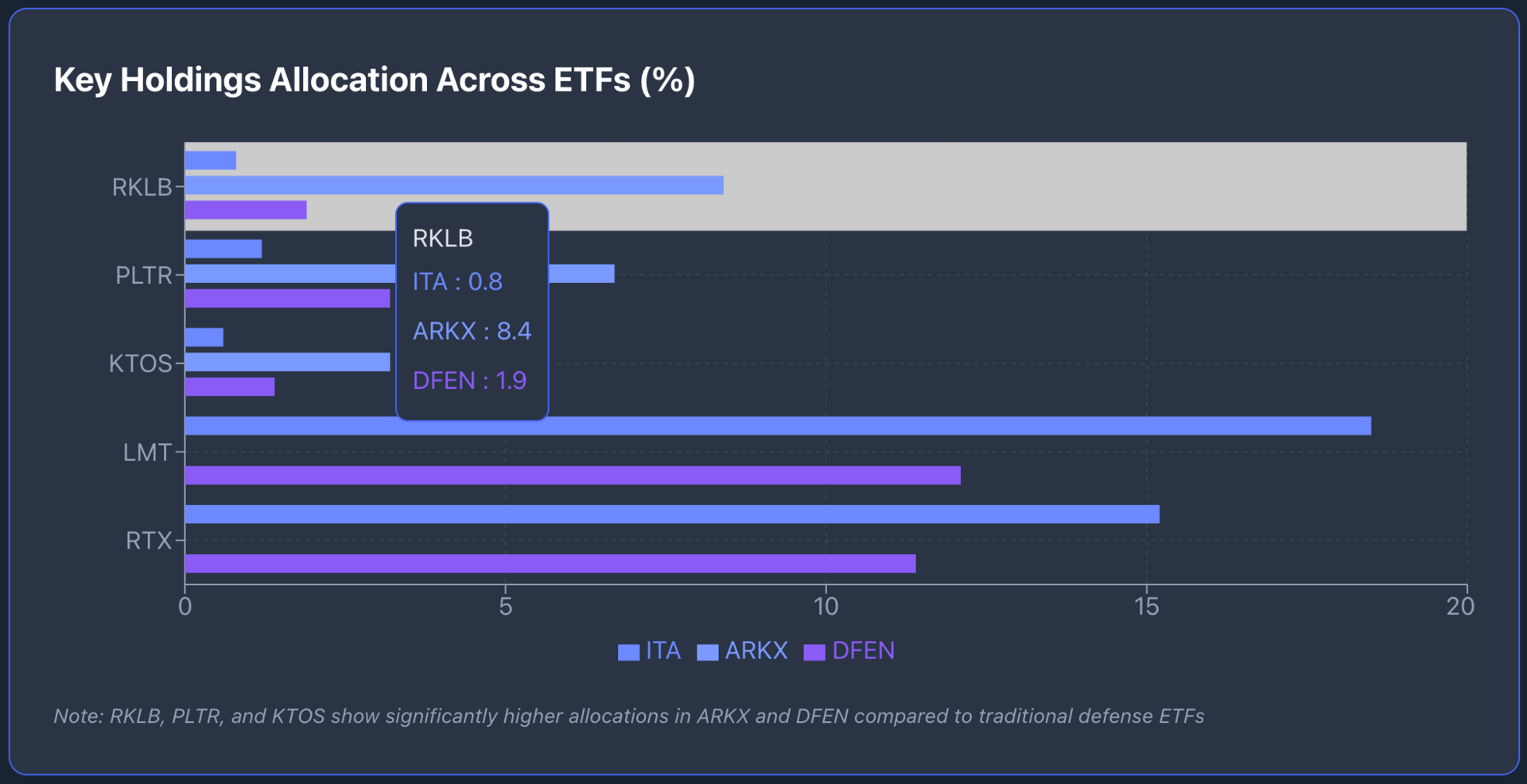

Traditional defense ETFs like ITA and XAR are heavily weighted toward legacy contractors. Lockheed Martin and RTX often make up 30-35% of their total holdings. These are the exact companies now facing political pressure to shape up or ship out.

Compare that to funds like ARKX or the leveraged DFEN. Their exposure to emerging tech companies is 2-5 times higher than traditional defense funds.

ARKX allocates 8.4% to Rocket Lab. That's more than ten times what ITA holds.

When the Pentagon starts redirecting contracts away from cost-overrun giants and toward efficient innovators, which basket do you want to be in?

The Companies Actually Winning Right Now

Rocket Lab $RKLB isn't just launching satellites. They're becoming the go-to provider for rapid response space missions. The Pentagon needs that capability. Commercial pricing with military reliability.

Palantir $PLTR owns the data integration space for defense and intelligence. Every major initiative needs their software. The Army, Navy, and Air Force are all locked into multi-year deals. Their revenue visibility is exceptional.

Kratos Defense $KTOS builds unmanned systems and directed energy weapons. Exactly the kind of next-gen capabilities Hegseth keeps talking about. Low cost, high performance, delivered on time.

These companies are winning contracts that would have automatically gone to Boeing or Lockheed five years ago. The landscape shifted. Most ETFs haven't caught up.

Do you currently own any of these emerging defense tech stocks?

What This Means

The typical defense investor owns ITA or XAR and thinks they're covered. They're not wrong. These funds will continue to perform.

But they're leaving money on the table.

The real alpha is in funds that recognized this shift early.

DFEN, despite its leveraged structure and higher expense ratio, has crushed traditional defense ETFs YTD. Up 26.3% vs 8.4% for ITA. That's not luck. That's exposure to the right names at the right time.

But leverage cuts both ways. DFEN isn't appropriate for every investor. The volatility will shake out anyone without conviction.

ARKX offers a middle ground. Significant exposure to defense tech without the 3x leverage risk. Their focus on space exploration naturally overlaps with military priorities. Satellite networks. Launch capabilities. Space-based surveillance.

The Pentagon is pushing billions into these areas. ARKX investors benefit directly.

If you had $10K to invest in defense TODAY, where would it go?

The Risk Everyone Is Ignoring

Here's what keeps me up at night: policy reversal. Trump leaves office in 2029. What if the next administration goes back to coddling legacy contractors?

It's possible. Washington has a long history of saying one thing and doing another. The revolving door between the Pentagon and major defense contractors is well-established.

But I don't think it matters anymore.

The technology gap is too wide now. Rocket Lab can launch payloads faster and cheaper than ULA. Palantir's software actually works while legacy systems crash. Kratos delivers drones at a fraction of Northrop Grumman's price.

The economics changed. Politics will follow eventually. They always do.

The Bottom Line

Defense spending is about to surge. $500 billion is a real number with real implications. The question isn't whether defense stocks will benefit. They will.

The question is which ones benefit most.

Legacy contractors might capture some of that spending. But they'll also face unprecedented scrutiny and competition. Their margins are under pressure. Their timelines are scrutinized. Their dominance is ending.

Emerging defense tech companies are entering their golden era.

Small enough to move fast. Capable enough to deliver results. Connected enough to win contracts. And finally, they have political backing from the top.

Most defense ETFs are still positioned for the old world. Heavy on aerospace. Light on innovation. Minimal exposure to the names actually driving returns.

That creates opportunity. For investors willing to look past the brand names and focus on who's actually winning contracts today.

The data is clear. The momentum is building. The policy support is real.

What you do with that information is up to you.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Greenland: Trump’s Vision of the New World Order

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.