The White House wants AI supremacy.

Everyone's modeling electricity costs. Almost nobody's pricing in water risk.

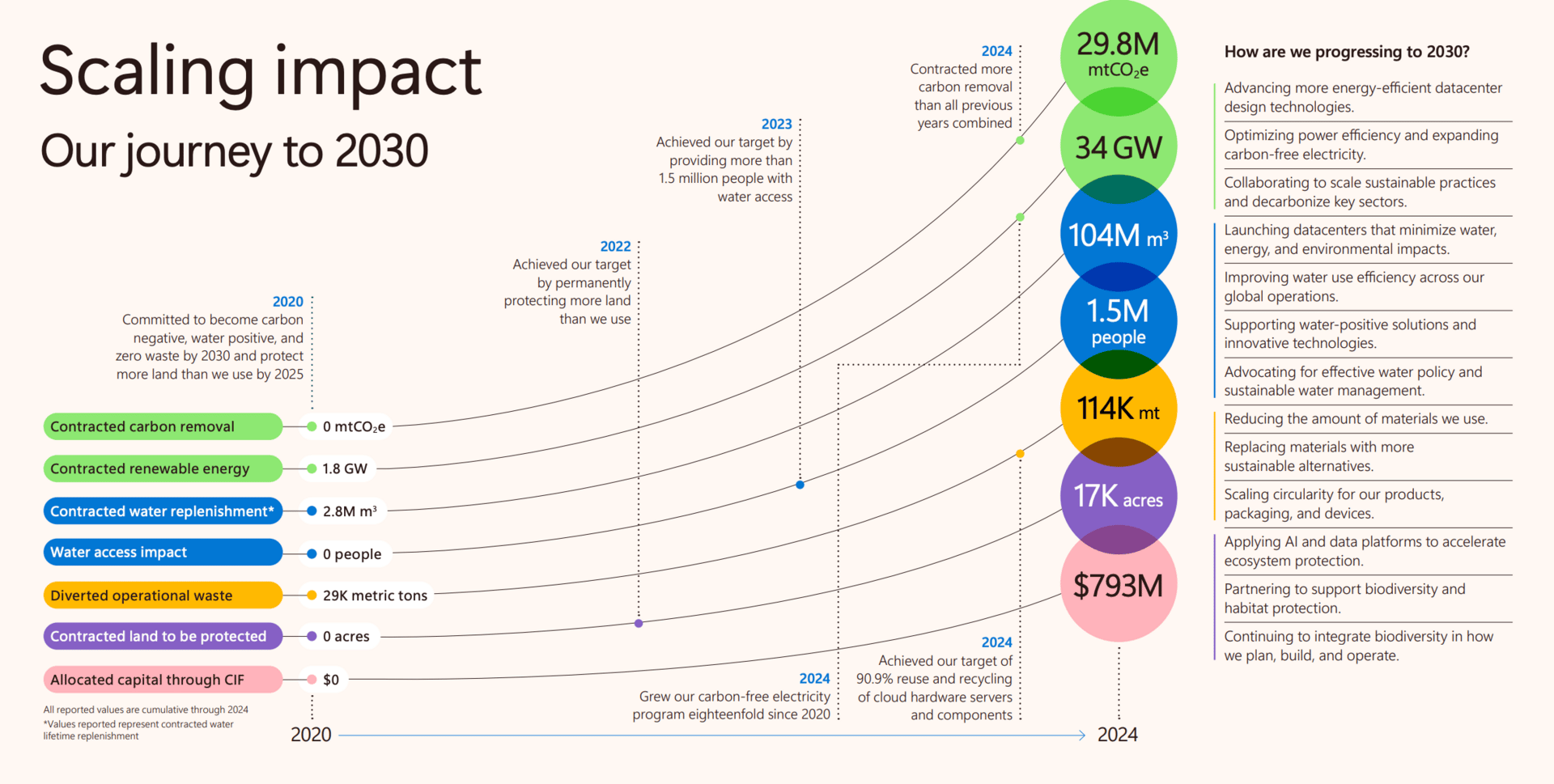

Microsoft's data centers consumed 34% more water in 2024 than the year before. That number alone tells you something structural is changing in how we build and run AI systems.

The gap between water consumed and water replenished keeps widening, even as companies set sustainability targets.

The Numbers Behind the Noise

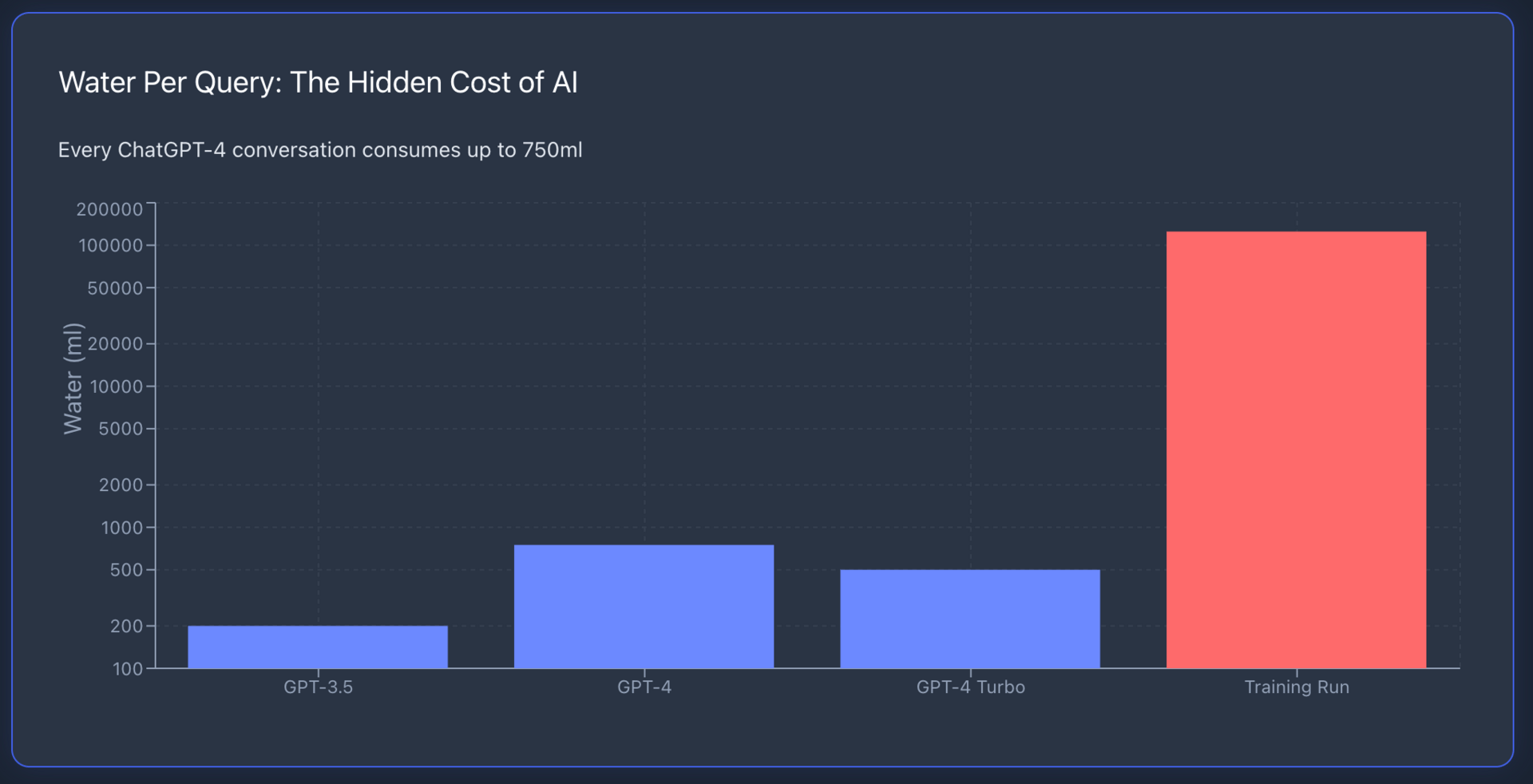

A single GPT-4 query uses enough water for cooling systems and power generation. Multiply that by billions of daily queries, and you're looking at consumption that rivals small municipalities.

The semiconductor side shows even steeper requirements.

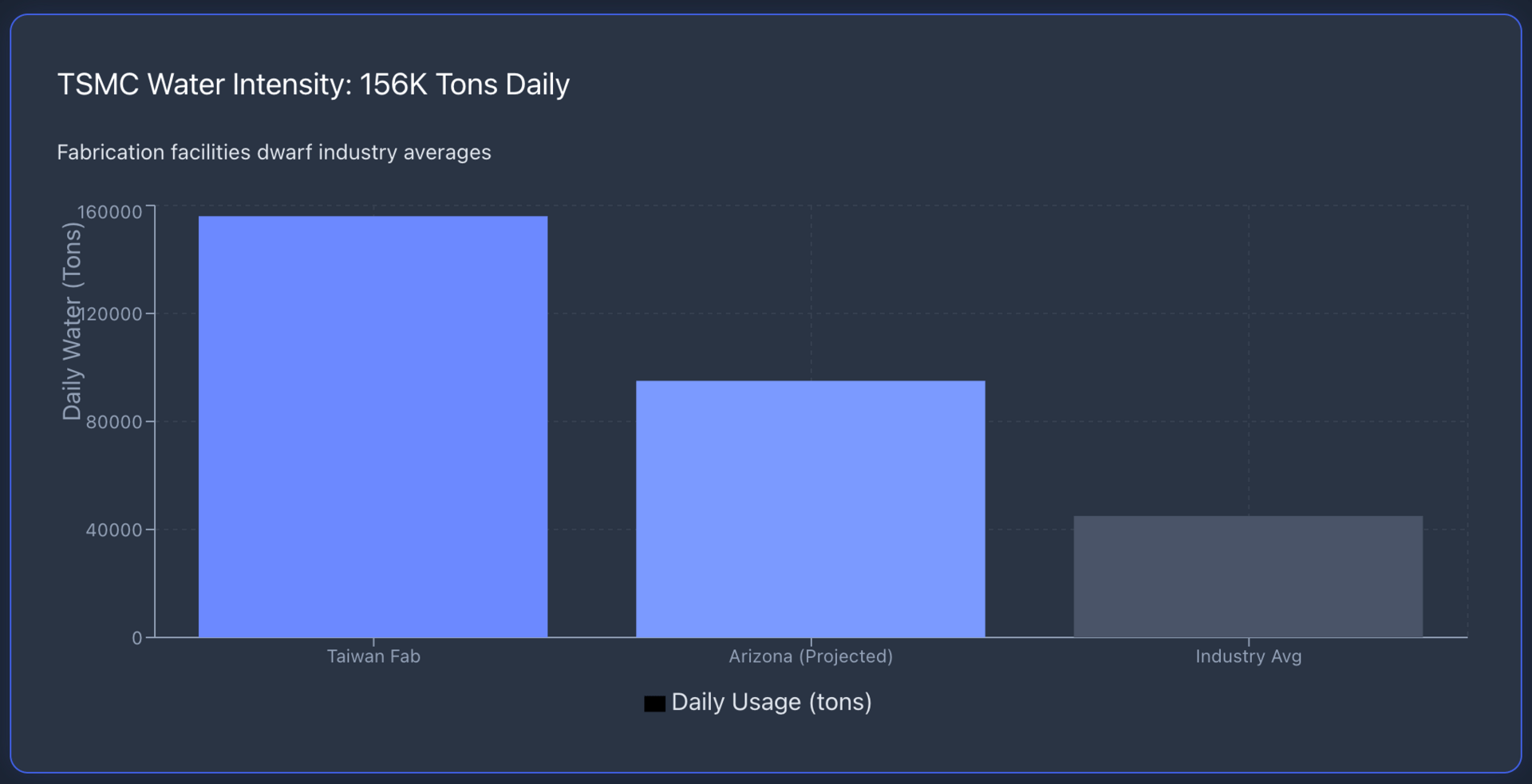

TSMC uses ultra-pure water in volumes that make data centers look modest. One fabrication plant in Taiwan processes roughly 156,000 tons of water daily. That's not a typo. These facilities need water purity at 18 megohm levels—cleaner than what most pharmaceutical operations require.

Taiwan faced severe drought conditions in 2021. Water trucks rolled through Hsinchu Science Park. TSMC had to choose between cutting production or diverting agricultural water supplies. The company kept fabs running, but that decision created friction with farmers who depend on the same reservoirs.

Arizona tells a parallel story. TSMC's Phoenix fabrication facility sits in a region where groundwater levels have dropped 300 feet in some areas since 2000. The company committed to building advanced packaging facilities there, but local officials already warn about strain on the Central Arizona Project canal system.

Why This Matters

Water stress creates supply chain brittleness that doesn't show up in quarterly earnings until it's too late.

When TSMC can't manufacture at capacity because of water allocation disputes, NVIDIA's GPU delivery schedules slip. When data centers face cooling restrictions during heat waves, cloud computing margins compress.

The infrastructure gap is measurable.

Google reports an average PUE (Power Usage Effectiveness) of 1.11 liters per kilowatt-hour across its data center fleet. That means every unit of computing power requires nearly two liters of water for cooling.

Google 2025 PUE Yearly Report (Google)

As AI workloads push power density higher, some new GPU clusters exceed 100 kilowatts per rack, water demand scales proportionally.

Equinix, one of the largest data center operators globally, publishes PUE metrics by electricity consumption.

Equinix, PUE (Power Usage Effectiveness)

That shift signals recognition that water availability will constrain growth in specific markets before electricity does.

The Build-Out Response

Three ETFs track companies positioned around water infrastructure: $PHO, $CGW, and $FIW.

These funds hold positions in companies that design filtration systems, operate desalination plants, and manufacture pumps and valves for industrial water recycling.

Some holdings overlap with broader industrial exposure, but the core thesis stays consistent: tightening water access creates pricing power for companies that solve purification and recycling problems at scale.

TSMC itself now invests in closed-loop water systems that reclaim over 86% of water used in production. That percentage will need to climb further as the company expands Arizona operations and builds new capacity in drought-prone regions.

Microsoft committed to becoming "water positive" by 2030, meaning it plans to replenish more water than it consumes.

2025 Microsoft Environmental Sustainability Report (Microsoft)

That target requires significant capital deployment into watershed restoration and local infrastructure projects.

The execution risk is high, and the capital intensity is real.

Microsoft aims to be "water positive" by 2030, but usage jumped 34% last year. Do you think Big Tech will hit their sustainability targets?

What Gets Missed

Most infrastructure models focus on megawatt capacity and grid interconnection timelines. Water permits and allocation rights rarely appear in the same spreadsheets. But in jurisdictions with established water markets, parts of California, Arizona, and increasingly Taiwan, securing water rights can take longer and cost more than connecting to the electrical grid.

Climate projections show precipitation patterns shifting in ways that stress existing water infrastructure. The Western U.S. faces structural drought conditions that models suggest could persist for decades. Taiwan's rainy season has become less predictable over the past ten years.

The companies that control water treatment technology and recycling infrastructure will see demand that doesn't correlate neatly with tech sector performance.

That creates diversification value in portfolios otherwise concentrated in AI and semiconductor exposure.

This isn't about predicting when water constraints cause visible disruptions.

It's about recognizing that building density at scale requires solving for water before you solve for power, and that most market participants haven't priced that sequence correctly yet.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.