Pharma stocks are currently at risk due to Trump’s MFN policy.

The U.S. government just secured price cuts up to 79% on ten high-cost medications.

Major pharma companies are now staring at billions in lost revenue starting January 2026.

Here’s what we know.

What Happened

For the first time in Medicare's history, federal negotiators have locked in lower prices for drugs that collectively cost the program $50.5 billion in 2023.

The initial round targets insulins and blockbuster GLP-1 weight-loss drugs, with negotiated prices taking effect in just weeks.

The deal covering Novo's Wegovy and Lilly's Zepbound, will reduce monthly prices for U.S. government programmes, including Medicare and Medicaid, and cash payers to between $149 and $350, down from $500 to $1,000.

A second wave of 15 additional drugs has already been selected for 2027 implementation.

Also, Metsera chose Pfizer's $86.25-per-share offer due to legal risks with Novo Nordisk's proposal, including antitrust concerns.

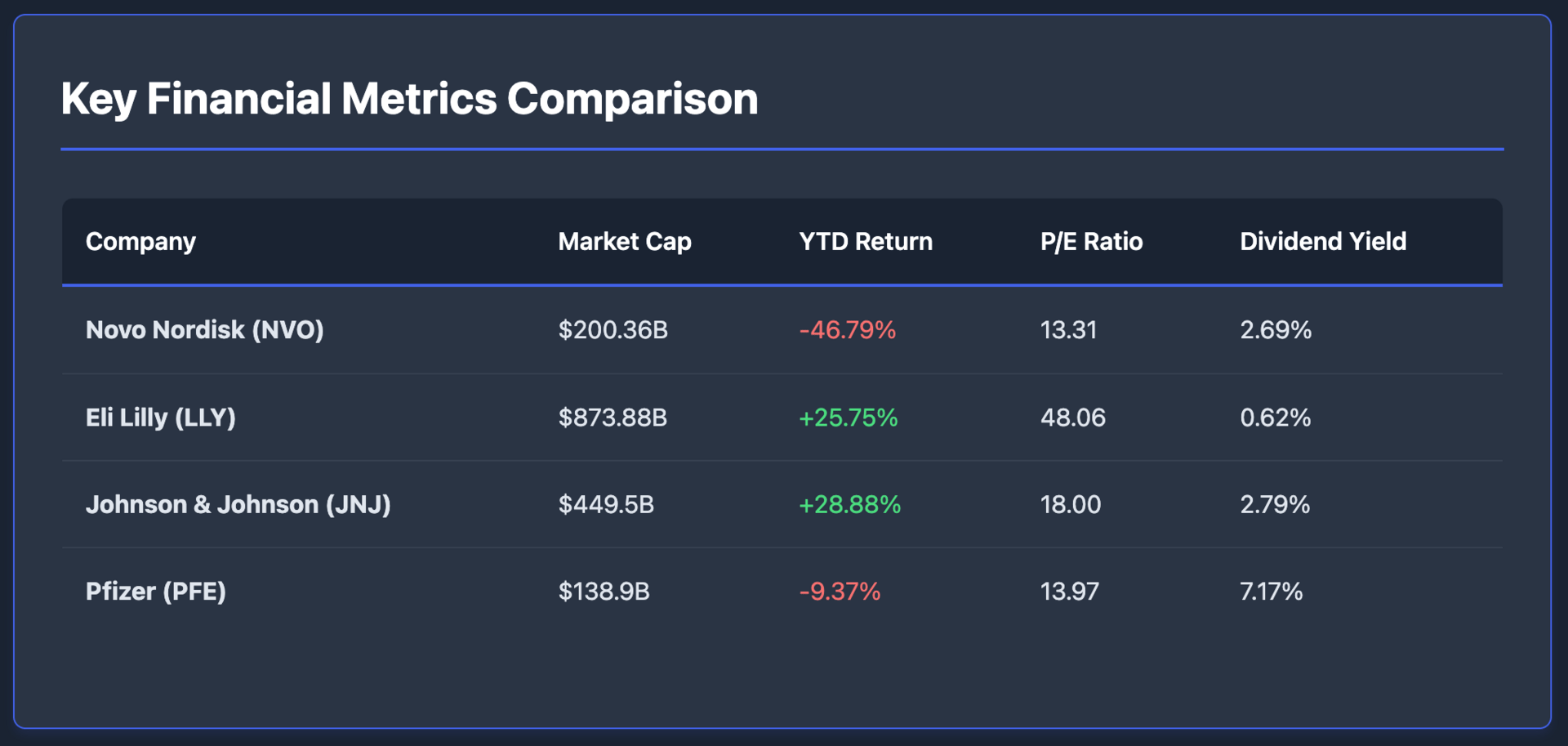

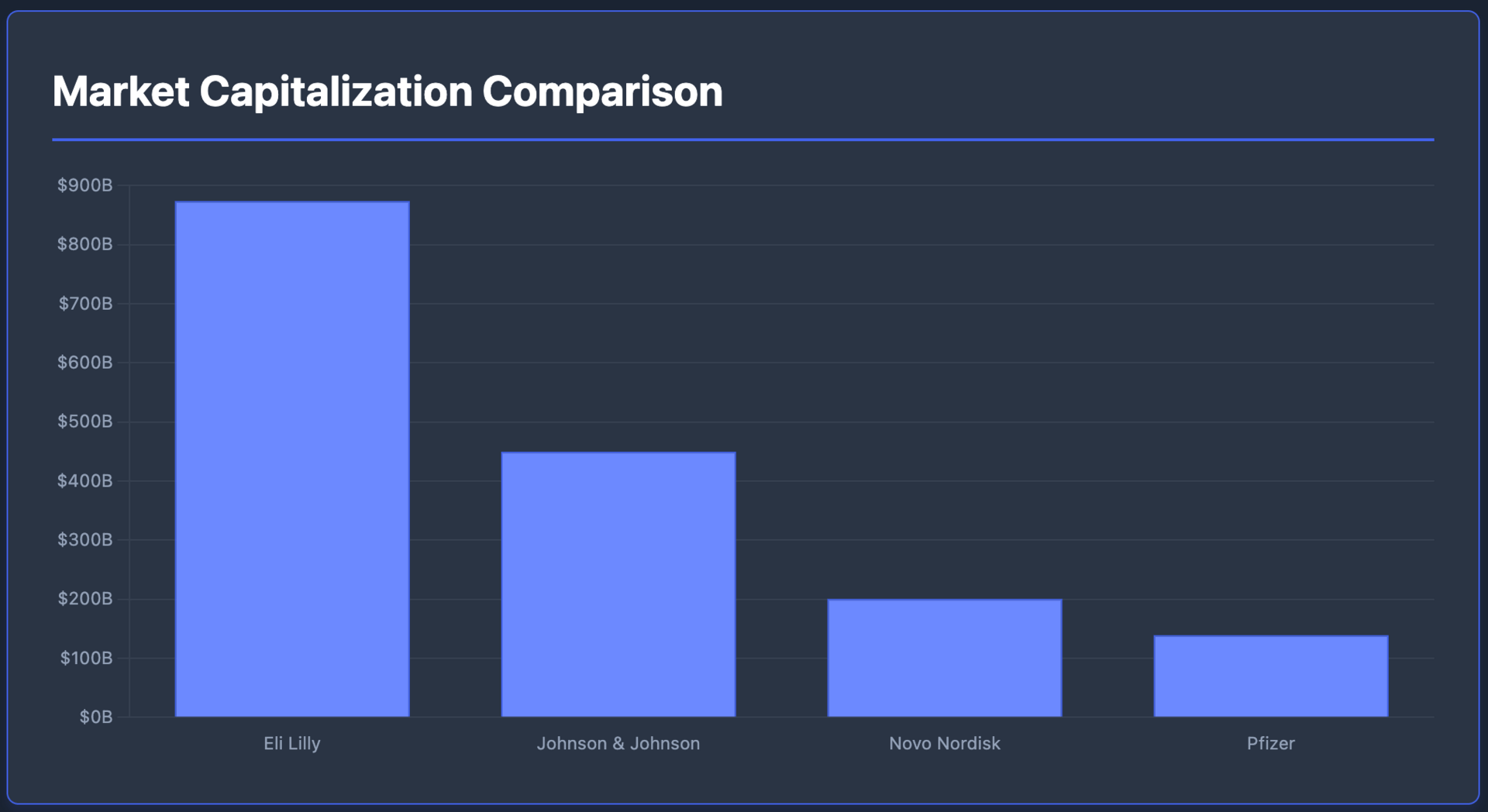

The numbers tell a clear story.

Novo Nordisk $NVO and Eli Lilly $LLY face direct exposure through their diabetes portfolios, while Johnson & Johnson $JNJ and Pfizer $PFE confront pricing pressure on key revenue drivers.

These four companies generated combined revenues exceeding $220 billion in 2024, with significant portions tied to Medicare reimbursements.

Companies Performance

Novo Nordisk (NVO)

Market Cap: $200.36B

YTD Return: -46.79%

P/E Ratio: 13.31

Dividend Yield: 2.69%

CEO Lars Fruergaard Jørgensen acknowledged the regulatory shift: "We're adapting our U.S. pricing strategy while maintaining R&D investment at 13% of revenue."

The company's Ozempic and Wegovy franchises face heightened scrutiny as GLP-1 agonists enter subsequent negotiation cycles.

Eli Lilly (LLY)

Market Cap: $873.88B

YTD Return: +25.75%

P/E Ratio: 48.06

Dividend Yield: 0.62%

Management called the negotiations "a fundamental shift in market dynamics."

We're modeling mid-single-digit percentage headwinds to U.S. revenue growth from government pricing programs through 2027.

Johnson & Johnson (JNJ)

Market Cap: $449.5B

YTD Return: +28.88%

P/E Ratio: 18

Dividend Yield: 2.79%

The company's Stelara and Xarelto face negotiations in the second cycle.

Our diversified portfolio provides resilience, but we're factoring in $2-3 billion annual revenue pressure from Medicare pricing reforms.

Pfizer (PFE)

Market Cap: $138.9B

YTD Return: -9.37%

P/E Ratio: 13.97

Dividend Yield: 7.17%

With Eliquis under immediate negotiation, Pfizer projects 8-10% revenue impact on this $6 billion franchise.

Morgan Stanley analysts wrote: "Pfizer's post-COVID revenue stabilization now collides with structural pricing risk."

What Comes Next

The second negotiation cycle adds complexity.

15 drugs selected for 2027 pricing include additional diabetes treatments and cardiovascular medications. Goldman Sachs estimates aggregate revenue exposure of $18-22 billion across the sector by 2028.

But here's the thing.

Companies are responding differently.

Novo said that lower prices would have a negative "low single-digit" impact on global sales growth next year, bigger volumes under Medicare were expected in the mid to long-term.

Lilly CEO David Ricks also said that Lilly is expected to boost sales volume.

Novo Nordisk $NVO and Eli Lilly $LLY are accelerating obesity drug launches at higher initial price points before potential negotiations.

J&J is emphasizing its medical device growth. Pfizer is banking on oncology pipeline maturation.

JPMorgan's analyst team summed it up: "This isn't a one-time adjustment. Medicare negotiation becomes a permanent variable in pharma valuation models."

The question for investors: which business models can absorb sustained pricing pressure while funding the innovation pipelines that justify premium multiples?