Pat Gelsinger left Intel in December 2024 after a brutal three-year run.

Revenue dropped 32% in Q3. $INTC fell 60% in 2024. Intel's 18A node, the chip that was supposed to save the company, kept missing targets. Wall Street lost patience.

Now he's back.

The Trump administration announced a $150 million equity stake in xLight, a lithography startup Gelsinger now leads.

This marks the first time the U.S. government has taken a direct equity stake in a private chipmaking company under the CHIPS Act. That's not a subsidy or a loan. It's ownership.

The signal is clear: Washington wants back into the lithography game.

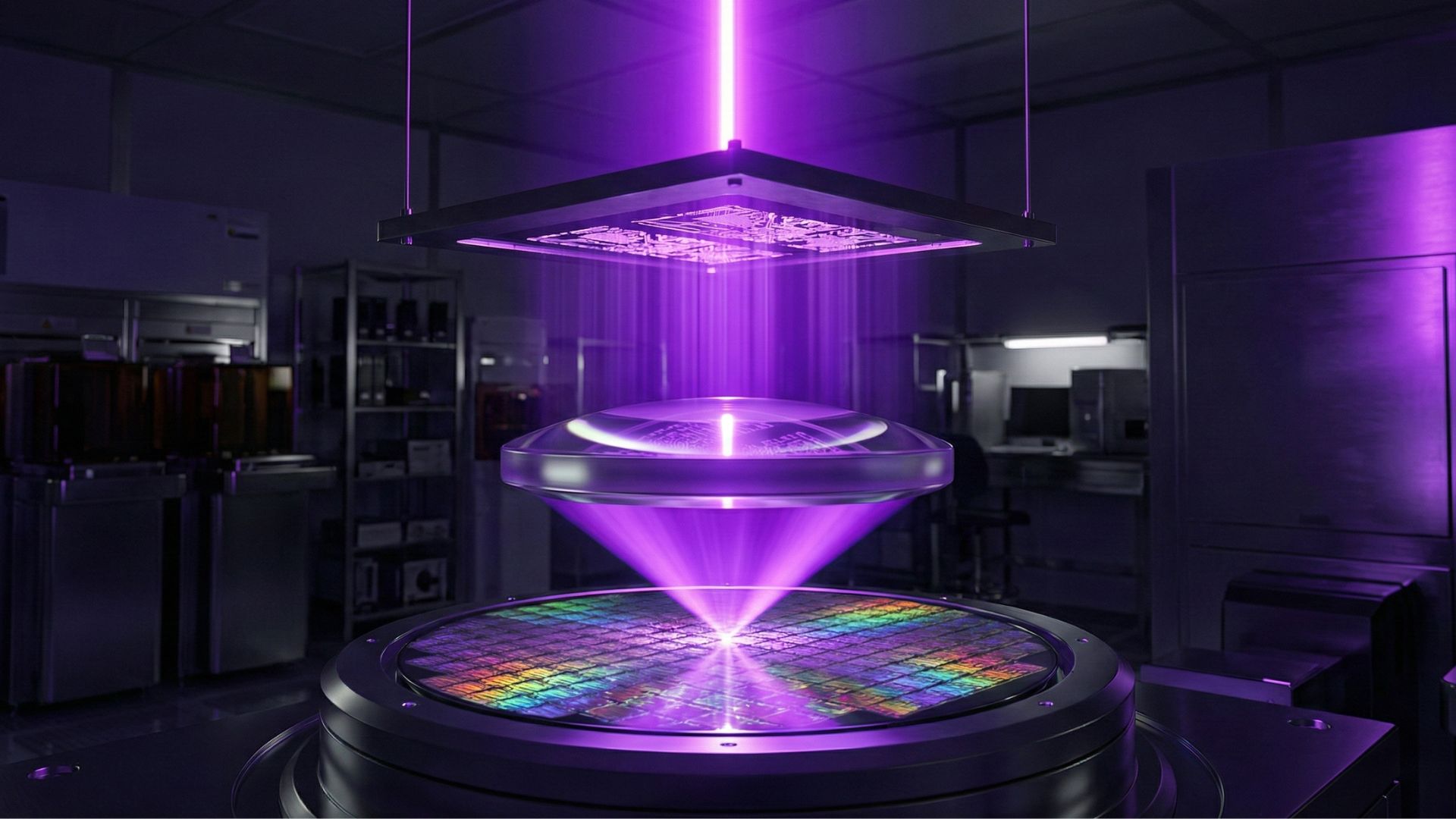

What xLight Actually Does

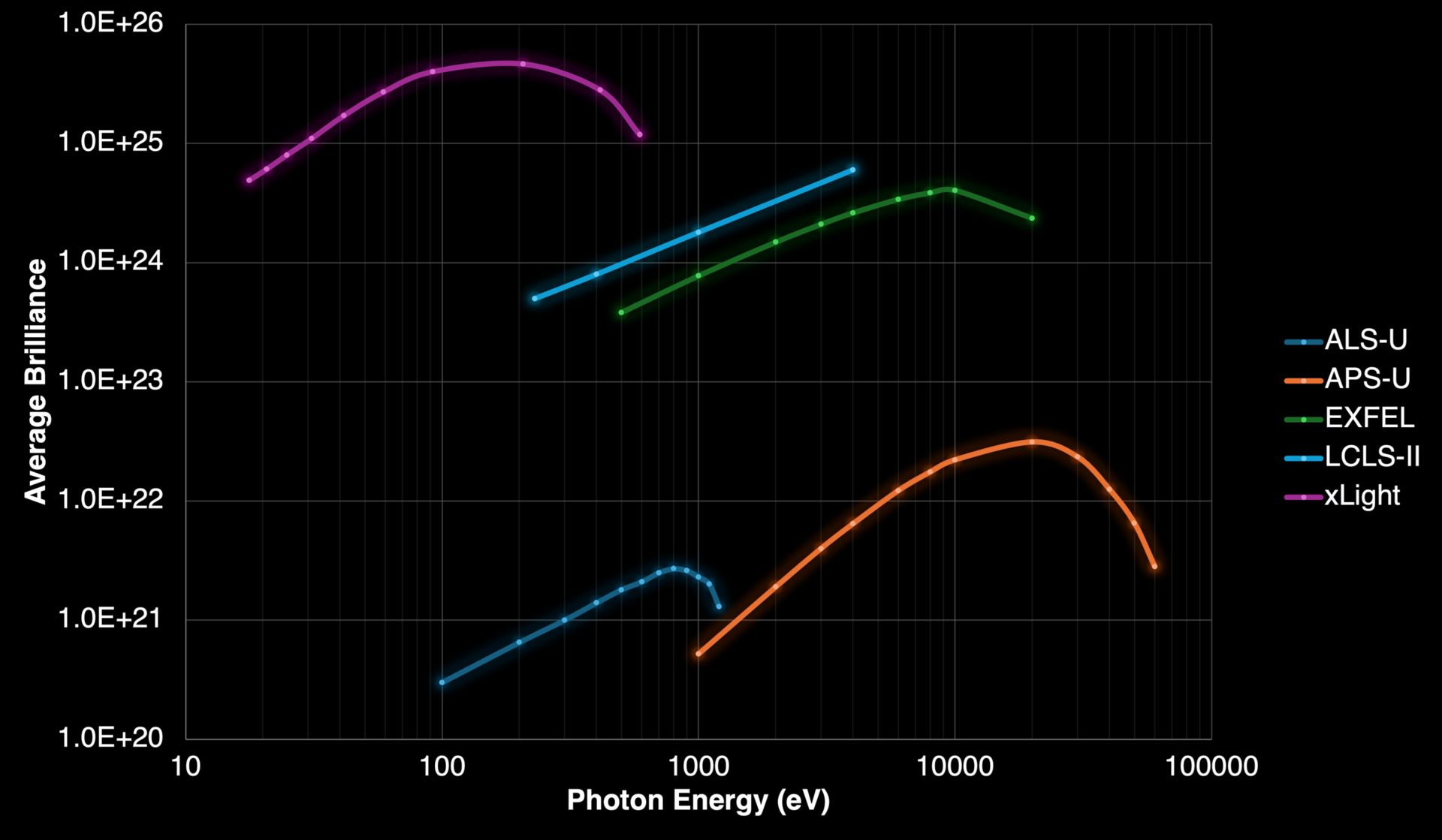

$ASML controls extreme ultraviolet lithography. Every advanced chip, whether it's from TSMC, Samsung, or Intel, relies on ASML's EUV machines. They cost $200 million each. They weigh 180 tons. And they define what's possible at 3nm and below.

But here's the thing: ASML's EUV systems are hitting physical limits. Power constraints restrict throughput. Pulse duration limits precision at sub-2nm geometries. The roadmap beyond 2028 gets blurry.

The Roadmap for Advanced Semiconductors (xLight)

xLight is building a free-electron laser system. The core difference is power density.

FEL lasers can deliver 4x the EUV intensity of ASML's current tin-plasma approach. It uses femtosecond pulses, far shorter than ASML's nanosecond bursts, which means sharper feature definition and less thermal damage to photoresists.

xLight new source will replace the current Laser-Produced Plasma source.

Gelsinger calls it "the next era of Moore's Law." That's not hype.

Why Gelsinger Left Intel

Intel's board gave Gelsinger an ultimatum in late 2024: spin off the foundry business or step down. He refused. The board wanted separation. Gelsinger wanted vertical integration. He lost.

The underlying problem was execution. Intel announced five nodes in four years—a compression schedule no one thought possible. But 18A faced yield issues.

Broadcom and other potential foundry customers stayed cautious. Qualcomm didn't commit. Intel Foundry Services burned cash without landing the anchor clients it needed.

Meanwhile, Nvidia $NVDA and AMD $AMD kept winning in AI accelerators. Intel's GPU strategy stalled. Data center share eroded. The stock became uninvestable.

But Gelsinger's thesis wasn't wrong—just early. Reshoring semiconductor manufacturing is a national priority. The U.S. can't rely on Taiwan for 90% of advanced logic production. Intel's foundry ambitions made strategic sense. The problem was proving it could execute at TSMC's level.

Free Electron Lasers Explained (XLight)

xLight gives him a different angle. Instead of competing with TSMC on process leadership, he's targeting the tooling layer.

If xLight's FEL becomes the standard for next-generation lithography, every foundry, including TSMC, has to buy from an American supplier.

What This Means

The U.S. government's $150M equity stake in xLight is:

Three sectors matter here.

Semiconductor capital equipment.

$ASML dominates now, but xLight's $150 million backing suggests the U.S. wants alternatives. Applied Materials $APLD and Lam Research could also benefit if domestic lithography gains traction.

$SMH and $SOXX ETFs track this space, but both carry ASML exposure, which faces new competition risk.

Intel's foundry revival.

If xLight's technology works, Intel Foundry could be the first adopter. That would reduce dependence on ASML's roadmap and potentially close the gap with TSMC.

$INTC remains speculative, but the foundry thesis isn't dead. It's just shifted timelines.

Defense-tech convergence.

xLight's FEL technology has dual-use potential.

Free-electron lasers aren't just for chipmaking, they're relevant for directed energy weapons, advanced sensing, and space-based systems.

$ITA ( ▼ 0.78% ) and other defense ETFs intersect here, especially as Pentagon spending shifts toward microelectronics and next-gen manufacturing.

The broader point is this: the U.S. government just signaled it's willing to take equity risk to rebuild domestic semiconductor infrastructure.

That's a policy shift. It's not just grants and tax credits anymore. It's co-investment.

Whether xLight succeeds or not, the move confirms that lithography is now a strategic priority. ASML's monopoly made sense when globalization was the default. That era is over. The question now is whether the U.S. can rebuild technical leadership in time to matter for the next node transition.

Gelsinger's track record at Intel was mixed. His vision wasn't.

If xLight delivers, it won't just help Intel. It redefines the entire supply chain.

Who will lead in lithography by 2030?

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.