GeopoliticsThe high-stakes diplomatic summit between President Donald Trump, Ukrainian President Volodymyr Zelensky, and seven European leaders on August 18, 2025, marks a potential inflection point for global markets, defense spending, and geopolitical risk calculations. Following Trump's controversial meeting with Russian President Vladimir Putin in Alaska just days earlier, this Washington gathering delivered concrete financial commitments and security frameworks that could reshape investment strategies across multiple sectors.

1. The $90 Billion Defense Spending Catalyst

Ukraine's massive procurement commitment emerges as the summit's most market-relevant outcome. Zelensky confirmed that Ukraine would purchase approximately $90 billion worth of American military equipment through European intermediaries as part of the security guarantee framework. This figure represents nearly 75% of the total $120 billion the U.S. has provided to Ukraine since 2022, but structured as commercial sales rather than aid.

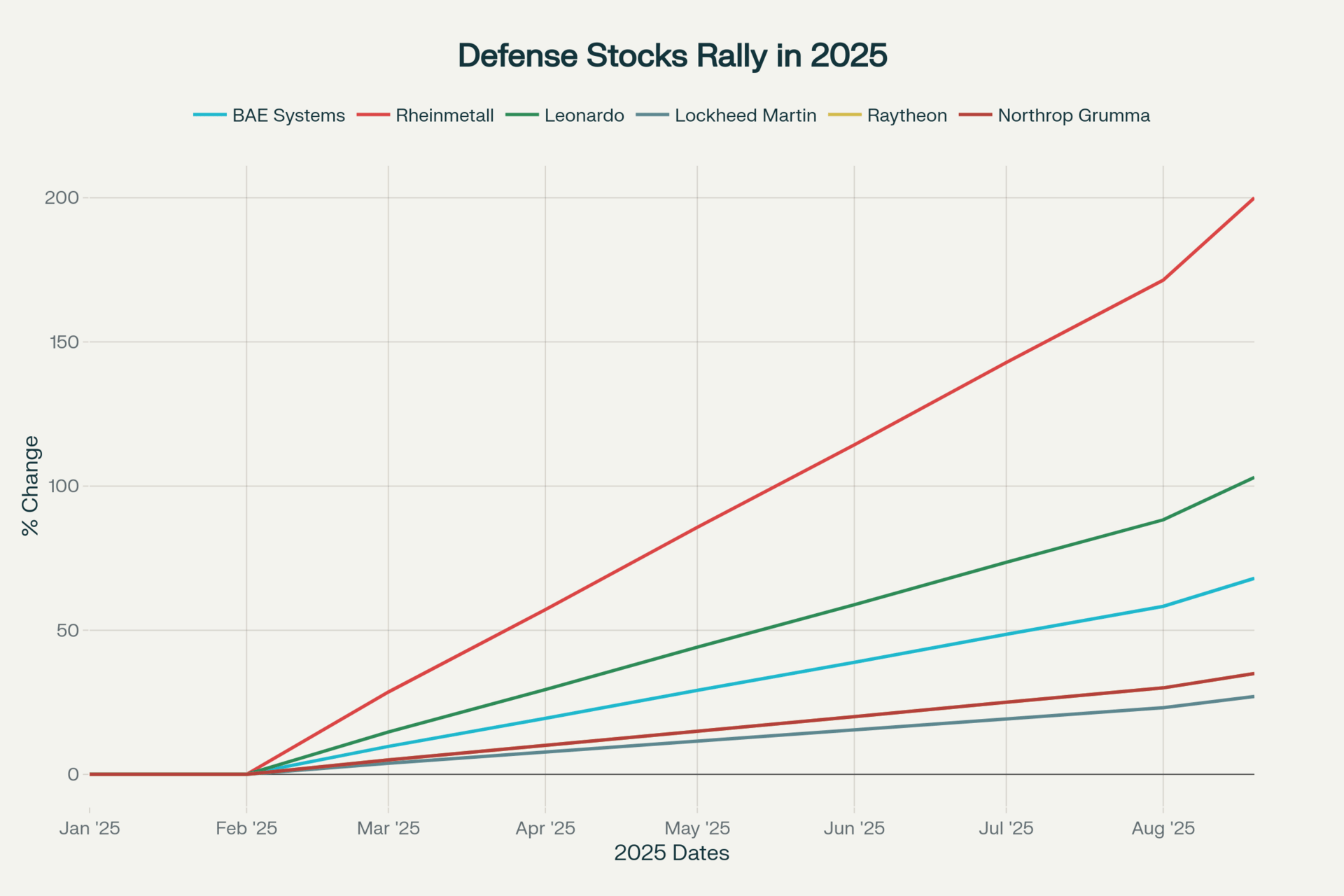

The procurement package encompasses advanced systems including Patriot missile interceptors, F-35 fighter jets, HIMARS rocket launchers, and AI-enabled drone countermeasures. Defense contractors are already capitalizing on this spending surge, with year-to-date performance showing remarkable gains: Rheinmetall up 200%, Leonardo climbing 103%, and BAE Systems advancing 68%.

However, European defense stocks experienced volatility following the summit announcement, with some analysts questioning whether peace prospects might dampen long-term demand. J.P. Morgan's defense analysts counter this concern, emphasizing that "all outcomes from any deal between Ukraine and Russia will lead to higher European defense spending".

2. Security Guarantees: Beyond Article 5 Protections

The security framework transcends traditional NATO Article 5 commitments, offering Ukraine more robust protections than previous arrangements. Unlike the failed Budapest Memorandum of 1994, these guarantees incorporate "military aid, personnel training, and intelligence sharing" with formal documentation expected within 7-10 days.

NATO Secretary-General Mark Rutte confirmed discussions regarding security guarantees "akin to Article 5," but stressed that the new framework would provide more comprehensive support than standard NATO collective defense provisions. The arrangement positions European nations as the "first line of defense" while maintaining significant U.S. involvement in coordination and financing.

This represents a fundamental shift in transatlantic security architecture, potentially creating a precedent for non-NATO security arrangements that could influence future geopolitical risk assessments across Eastern Europe and beyond.

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

3. Putin's Calculated Diplomatic Victory

Despite the lack of concrete agreements, Putin achieved significant strategic objectives through the Alaska summit. The mere occurrence of the meeting elevated Putin from Western pariah to welcomed guest on American soil, marking his first U.S. visit in nearly a decade. Intelligence analysts note that Putin's warm reception—including riding in Trump's presidential limousine—exceeded Kremlin expectations.

The summit's failure to produce a ceasefire or peace framework left Trump exposed to criticism of appearing weak. Atlantic Council experts observed that "Putin got a meeting and slipped away without offering anything other than bromides about US-Russian friendship". This dynamic could pressure Trump toward more aggressive secondary sanctions or military support for Ukraine to restore negotiating leverage.

4. Secondary Sanctions: The Nuclear Option for Markets

Trump's threat of secondary sanctions represents the highest-leverage economic weapon remaining in the U.S. arsenal. Senate legislation sponsored by Senators Lindsey Graham and Richard Blumenthal proposes 500% tariffs on countries trading with Russia, specifically targeting China and India—which collectively absorb over 70% of Russian oil exports.

Economic analysts project that such measures could reduce Russian oil exports by 0.5-1 million barrels per day within 1-2 months. However, the global ramifications could be severe, potentially triggering oil price spikes and supply chain disruptions across Asia. The threat alone has already influenced market positioning, with energy stocks rallying on reduced sanctions expectations following the Alaska summit.

China and India's combined imports from Russia totaled approximately $240 billion in 2024, making secondary sanctions a potential catalyst for significant market volatility. Russian payment systems, including the "China Track" mechanism designed to circumvent Western financial controls, remain vulnerable to comprehensive secondary sanctions enforcement.

5. Geopolitical Risk Recalibration and Investment Implications

The diplomatic developments signal a fundamental shift in geopolitical risk assessment methodologies. Family offices managing an estimated $6 trillion globally now cite geopolitical uncertainty as their primary concern, with 84% increasing portfolio diversification strategies.

The summit outcomes create divergent scenarios for key sectors:

Energy markets face continued uncertainty despite short-term relief from avoided secondary sanctions. New U.S. sanctions on Gazprom Neft and Surgutneftegas—Russia's third and fourth-largest oil producers—could reduce exports by 200,000-400,000 barrels per day. However, Russian adaptation mechanisms may limit long-term supply disruptions.

Inflation outlook remains elevated as Trump's broader tariff policies contribute to wholesale price pressures. Producer Price Index data shows the fastest inflation acceleration in nearly three years, with consumer expectations rising from 4.5% to 4.9% year-ahead. The Federal Reserve faces increased pressure to maintain higher rates, potentially limiting monetary policy flexibility.

Defense sector fundamentals appear robust regardless of peace prospects. Morningstar analysts project $200 billion in increased NATO defense spending over the next decade, driven by lessons learned from the Ukraine conflict rather than its continuation. The shift toward modern warfare capabilities—including drone defense and AI-powered systems—supports sustained investment demand.

Strategic Investment Positioning

The summit outcomes suggest three primary investment themes for sophisticated portfolios:

Defensive positioning in aerospace and defense remains compelling, with European companies particularly well-positioned to benefit from increased NATO spending commitments. The sector's 54% year-to-date gain reflects fundamental demand shifts rather than speculative positioning.

Energy sector exposure requires nuanced positioning, balancing supply disruption risks against potential peace dividend effects. The current low oil price environment ($63.91 WTI) may present opportunities if secondary sanctions materialize or conflict escalation resumes.

Geopolitical risk hedging through precious metals and alternative assets remains relevant despite gold's recent volatility near record highs. The absence of panic buying suggests markets may be underpricing tail risks from potential diplomatic failures.

Currency implications favor the dollar in scenarios involving secondary sanctions or renewed conflict escalation, while a comprehensive peace deal could strengthen the euro through reduced uncertainty premiums.

The Trump-Zelensky summit represents more than diplomatic theater—it establishes financial frameworks and security architectures that will influence global markets for years to come. Investors positioning for 2026 and beyond must account for these evolving geopolitical dynamics while maintaining flexibility for rapidly changing scenarios.