Powell's Final Speech: Make-or-Break Moment?

Fed Chair Jerome Powell faces an impossible balancing act at Jackson Hole. The economy is showing two signals that could make or break your portfolio:

The Bad News

Job creation has collapsed to just 35,000 monthly (vs. 100,000 needed for a healthy economy). July's employment report was devastating, with the government admitting they overcounted jobs by 258,000 in previous months.

The Confusing News

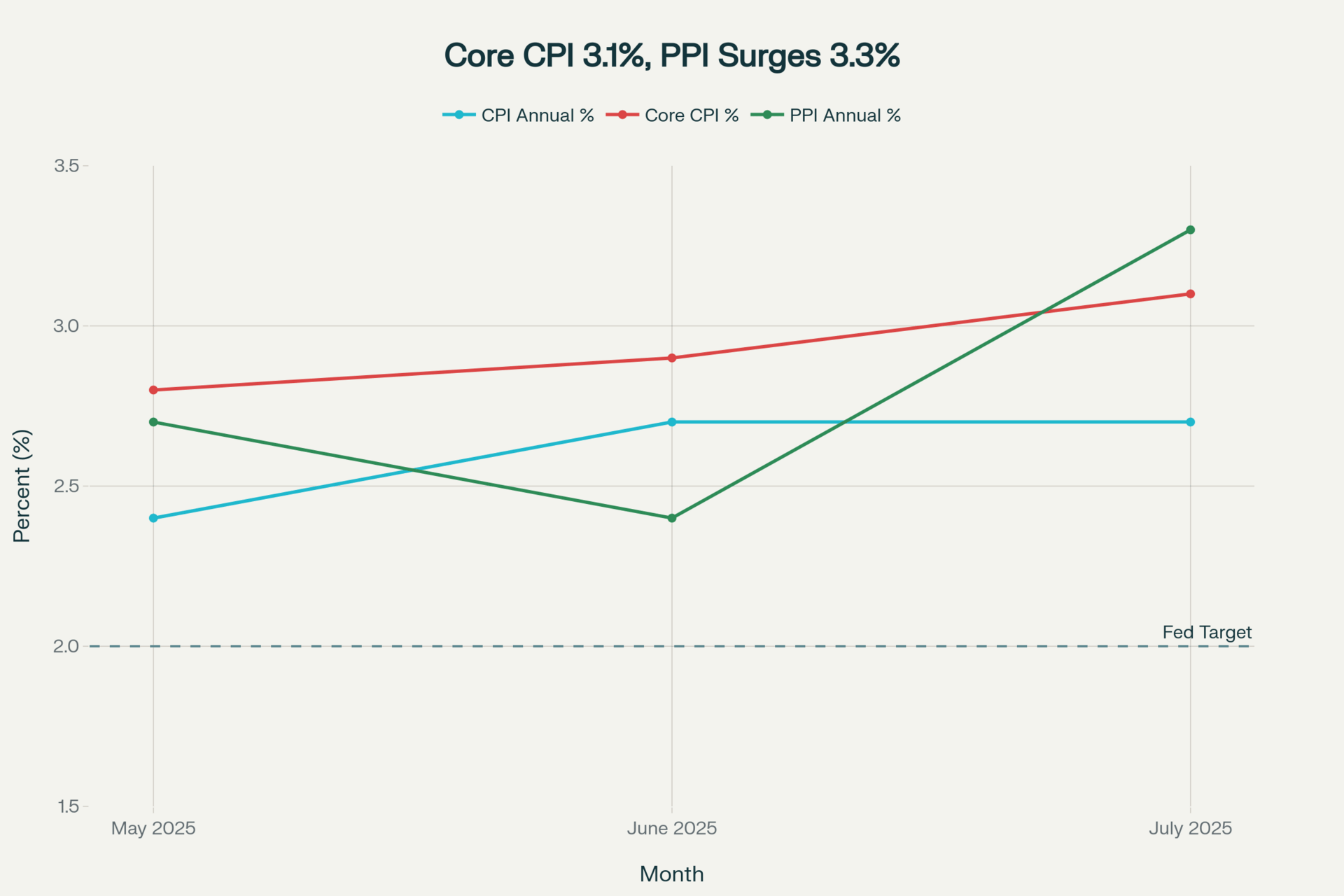

Inflation is still running hot at 3.1%, well above the Fed's 2% target. Producer prices are surging at the fastest pace since 2022, suggesting more price increases are coming.

The stakes couldn't be higher. Wall Street is betting there's a 75% chance the Fed will cut interest rates in September, but conflicting economic signals are making that decision far from certain. What Powell says, he could unlock significant opportunities for investors or set up major market volatility.

Powell's Impossible Mission

Think of it this way: Powell needs to grasp the bizarre economic situation we're in right now:

Weak job market demands lower rates to boost hiring

Persistent inflation requires higher rates to cool prices

Political pressure from Trump demanding "major rate cuts" complicates every decision

Adding fuel to the fire, Powell is quietly revolutionizing Fed policy by moving away from "average inflation targeting," the framework that contributed to their slow response to recent inflation.

Markets React

The anxiety is real and measurable:

S&P 500 stuck in longest losing streak since January

Treasury yields elevated (10-year at 4.33%, 2-year at 3.79%)

Options traders pricing in 0.8% daily moves - double normal volatility

Rate cut expectations dropped from 92% to 75% in recent weeks

Analysts warn of potential 7-15% market corrections if Powell's tone isn't changing.

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

3 Scenarios for Your Portfolio

Gradual Cuts: 0.25% rate cuts by December, bringing rates from about 5.5% to around 4%

Wait and See: No cuts until economic data becomes clearer, keeping your borrowing costs high for longer

Emergency Action: If unemployment spikes, bigger cuts could come quickly

Key Data That Decides Everything

These releases will determine September's fate:

August Jobs Report (Sept 6): Unemployment above 4.3% = higher cut probability

August CPI (Sept 11): Any inflation acceleration kills cut rates

Trump Tariff Impact: Ongoing trade policy effects on prices

Smart Money Moves Right Now

Already Happening:

Russell 2000 (small-caps) up 3.24% pre-speech as rate cut bets build

Regional banks under pressure on margin compression fears

Investment Opportunities:

Small-cap stocks: Most sensitive to rate changes

REITs and utilities: Dividend yields become more attractive

Infrastructure plays: Lower financing costs boost margins

Investment Opportunities in an Uncertain Environment

Powell likely delivers a last speech at Jackson Hole that keeps September cuts possible without committing to anything definitive.

Your Move: Position for the most probable scenario (gradual cuts starting September) while staying flexible. In this environment, risk management trumps big directional bets.

The Fed's next easing cycle could drive significant rallies in rate-sensitive assets, but timing remains genuinely uncertain. Focus on quality companies that benefit from lower rates while maintaining the flexibility to pivot as conditions evolve.

Remember, we're at a genuine inflection point. Powell's words may not provide all the answers, but they'll set the stage for the policy decisions that define the next phase of this economic cycle.