ETF Rally Ahead of EU-US Trade Deal: Market Optimism Meets Economic Uncertainty

The announcement of a preliminary trade framework between the European Union and the United States on July 27, 2025, has triggered a significant rally in ETFs and global equity markets, providing much-needed clarity for investors while raising important questions about long-term economic implications. The agreement, establishing a 15% baseline tariff on most EU goods entering the U.S., represents a substantial de-escalation from the 30% tariffs originally threatened by President Trump, delivering immediate relief to financial markets that had been bracing for a full-scale trade war between the world's two largest economic blocs.

EU and US flags flying together representing transatlantic trade partnership and cooperation

Market Response: European ETFs Lead the Charge

Financial markets responded with immediate optimism to the trade framework announcement. European ETFs experienced particularly strong performance, with major funds tracking European equities posting significant gains in the days leading up to and following the agreement. The STOXX 600 index reached its highest level since early June, while futures for European stocks gained 1.1% immediately following the deal announcement. U.S. stock futures also advanced, with the S&P 500 rising 0.5% as markets interpreted the agreement as a positive step toward trade stability.

ETF Performance Rally Ahead of EU-US Trade Deal (July 20-28, 2025)

The rally in European ETFs has been particularly pronounced, reflecting investor relief over the avoidance of more punitive tariff measures. According to market data, U.S. investors invested $10.6 billion in European ETFs during the first quarter of 2025, representing a seven-fold increase compared to the same period in 2024. This surge in capital flows demonstrates growing institutional confidence in European markets ahead of the trade agreement.

Rick Meckler, partner at Cherry Lance Investments, noted that the deal is "really in line with the Japan deal, and I assume investors will view it positively as they viewed the Japan deal". The euro strengthened against the dollar, rising 0.27% to $1.177, while also gaining 0.2% against both the British pound and Japanese yen.

EU-US Tariffs Outlook: A Framework for Stability

The trade framework announced on July 27 establishes several key parameters that provide much-needed clarity for businesses and investors. The 15% baseline tariff applies to most EU goods entering the U.S., including automobiles, which had previously faced uncertainty regarding potential 30% or even 50% tariffs. This rate, while higher than historical norms, represents a significant compromise that both sides appear willing to accept.

European Commission President Ursula von der Leyen characterized the agreement as bringing "stability" and "predictability" to transatlantic trade relations. The deal includes substantial commitments from the EU, with $600 billion in additional U.S. investments and $750 billion in U.S. energy purchases over the coming years.

John Plassard, head of investment strategy at Cité Gestion, emphasized that the deal provides "what equity markets needed most: visibility," noting that "tariff escalation risk is now off the table". This sentiment reflects broader market relief that negotiations have avoided the worst-case scenario of an escalating trade war.

However, expert analysis suggests the framework remains incomplete. Douglas Irwin, professor of economics at Dartmouth, expressed surprise at "how the European Union gave in to Trump's demands," highlighting concerns about the asymmetrical nature of the agreement.

Uncertainty Still Remains: 50% Tariff on Steel and Aluminum

A significant area of continued concern involves the treatment of steel and aluminum imports, where the 50% tariff rate implemented in June 2025 remains unchanged. President Trump explicitly stated during the announcement that steel and aluminum tariffs would "remain unchanged," representing a "world thing that the way is".

Industrial rolls of steel or aluminum in a manufacturing facility representing sectors impacted by EU-US trade tariffs

The steel and aluminum sector faces particular challenges under the current tariff regime. BCG estimates that the 50% tariffs will add $50 billion in tariff costs, effectively doubling the impact compared to the previous 25% rate. This creates significant cost pressures for industries dependent on these materials, including automotive manufacturing, construction, and infrastructure development.

Janice Lee, who co-leads BCG's global work on metals, noted that "the 25% tariffs that came into effect in March have already had an impact on commodity prices, investments in US capacity building, sourcing, and supply chains". The doubling of these rates intensifies these pressures considerably.

The persistence of high steel and aluminum tariffs creates challenges for European manufacturers, particularly in the automotive sector where these materials represent significant input costs. This could potentially offset some of the benefits of the broader 15% framework tariff for European car manufacturers.

Confusion Over Pharma Tariffs: Analysis and Risk Outlook

One of the most contentious aspects of the trade framework involves pharmaceutical products, where significant discrepancies emerged between U.S. and EU interpretations of the agreement. President Trump initially stated that pharmaceuticals would be excluded from the 15% tariff, suggesting they might face higher rates. However, senior U.S. officials later clarified that pharmaceutical exports would be subject to the 15% tariff level.

This confusion reflects broader challenges in implementing the framework agreement. European Commission President von der Leyen acknowledged that while the EU agreed to a 15% rate for most goods, "other decisions later by the U.S. – that's on a different sheet of paper". This ambiguity creates ongoing uncertainty for pharmaceutical companies and investors in the healthcare sector.

The pharmaceutical industry represents a particularly important component of EU-U.S. trade, with Ireland serving as a major supplier of pharmaceutical products to the U.S. market. Any higher tariffs on pharmaceuticals could significantly impact European pharmaceutical companies and related ETFs focused on healthcare sectors.

Analysts estimate continued uncertainty around Section 232 investigations into pharmaceuticals and semiconductors, with decisions expected within two weeks of the agreement. This regulatory uncertainty contributes to ongoing volatility in sector-specific ETFs and individual pharmaceutical stocks.

EU-US Trade Deal Brings "Stability" and "Predictability": Expert Analysis

Leading economists and market analysts have provided mixed assessments of the trade framework, recognizing both its immediate benefits in preventing trade war escalation while questioning its long-term economic implications.

EU and US officials shake hands symbolizing cooperation amid trade deal talks in 2025

Seth Carpenter, Morgan Stanley's Chief Global Economist, warns that "the economic damage is underway, and even fully undoing the tariffs would not restore global growth to where it would have been without them". Morgan Stanley Research forecasts global economic growth of 2.9% in 2025, down from 3.3% in 2024, largely attributed to trade policy uncertainty.

The OECD forecasts a sharp economic slowdown, with U.S. GDP growth sliding to 1.6% in 2025 and 1.5% in 2026, compared to 2.8% growth recorded previously. The organization specifically cites "new tariffs as one of the primary causes of the economic slowdown".

However, some analysts view the agreement more positively. A Market Monetarist analysis suggests the deal represents "a European victory disguised as defeat," noting that the EU has committed to maintaining zero tariffs on American goods while accepting only 15% on its exports. This analysis argues that the arrangement moves the EU toward "more free trade, not less".

Bruce Kasman, chief global economist at J.P. Morgan, notes that while "tariff scenarios are murkier in the short term," the bank continues to believe "the average effective tariff rate should eventually settle around 15-18%".

Five-Year Economic Outlook and Market Analysis

Looking ahead to the next five years, economic forecasts paint a complex picture of moderate growth amid persistent trade tensions. The European Commission's spring 2025 economic forecast projects EU real GDP growth of 1.1% in 2025 and 1.5% in 2026, with inflation expected to decline from 2.4% in 2024 to 2.1% in 2025 and 1.7% in 2026 in the eurozone.

Deloitte's U.S. economic forecast expects inflation to accelerate due to tariffs, with CPI growth averaging 2.9% in 2025 and 3.2% in 2026. This inflationary pressure could complicate Federal Reserve policy decisions and impact ETF performance across sectors.

EY's economic outlook anticipates real personal consumption expenditures slowing from 2.8% in 2024 to just 1.9% in 2025 and 1.4% in 2026. This deceleration in consumer spending could particularly impact consumer discretionary ETFs and retail-focused funds.

The Federal Reserve Bank of Philadelphia's Survey of Professional Forecasters shows a more pessimistic outlook, with 36 forecasters predicting economic growth of 1.4% in 2025, down 1.0 percentage point from previous estimates. The unemployment rate is forecast to increase from 4.2% to 4.5% by early 2026.

Investor Fears and Concerns

Despite the immediate market rally following the trade agreement, significant investor concerns remain regarding the long-term implications of elevated tariff levels and ongoing trade policy uncertainty.

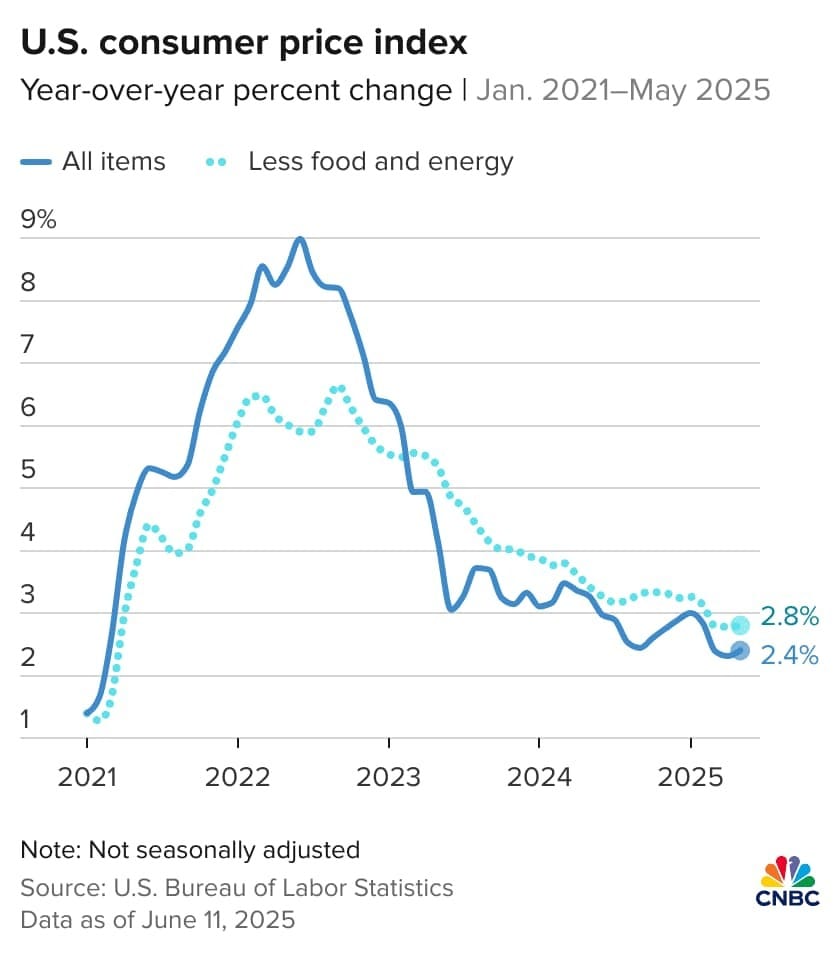

U.S. consumer price index shows inflation trends from 2021 to May 2025, highlighting a peak in 2022 followed by a steady decline to around 2.4% for all items and 2.8% excluding food and energy

Inflation risks represent a primary concern for investors, with tariffs expected to contribute to persistent price pressures. Walmart and other major retailers have warned of price increases related to tariffs, with estimates suggesting tariffs could lead to an approximate 1.4% increase in overall prices over a relatively short period.

The fragmented nature of global trade relationships creates additional complexity for multinational corporations and ETFs with international exposure. The deal "creates a more fragmented global trade environment, benefiting some EU sectors with zero tariffs while penalizing others".

Currency volatility represents another significant concern, as trade policy changes continue to impact exchange rates and international investment flows. The euro's recent strengthening following the deal announcement may reverse if implementation challenges emerge or if additional tariff measures are introduced.

Sector-specific risks remain elevated, particularly for industries dependent on steel and aluminum inputs, where the 50% tariff rate continues to create cost pressures. Healthcare and pharmaceutical ETFs face ongoing uncertainty regarding final tariff determinations.

Economic Data and Inflation Outlook

Recent economic indicators suggest that inflationary pressures may intensify as tariff policies take effect. The U.S. consumer price index showed a 0.2% month-over-month increase in February 2025, with core inflation remaining above Federal Reserve targets.

U.S. consumer price index month-over-month percent change shows fluctuating inflation trends from 2021 to February 2025, with a 0.2% increase in February 2025

The Observatory of Economic Complexity projects that global exports to the U.S. could plummet by over 46% by 2027 compared to recent averages, translating to approximately $2.68 trillion in reduced trade flows. Conversely, U.S. exports to global markets are anticipated to rise by 12% in 2027, highlighting the asymmetrical impact of current trade policies.

ING's Chief Economist characterized the EU-US deal as a "face-saving compromise" that still poses economic challenges for Europe, warning that "the EU economy may still take a hit" despite the agreement.

The Tax Foundation notes that effective U.S. tariff rates have increased to 15.4% from 2% last year, marking the highest rate since 1938. This dramatic increase in trade barriers represents a fundamental shift in U.S. trade policy with long-lasting implications for global economic integration.

The EU-US trade framework announced on July 27, 2025, represents a significant de-escalation of transatlantic trade tensions while establishing a new baseline for economic relations between the world's two largest economic blocs. For ETF investors, the agreement provides immediate clarity that has driven substantial rallies in European equity funds and broader market indices.

However, the 15% baseline tariff rate, combined with the persistence of 50% tariffs on steel and aluminum, creates a more complex investment environment that requires careful sector and geographic allocation strategies. The framework's incomplete nature, particularly regarding pharmaceutical and semiconductor products, suggests that additional volatility and policy announcements are likely in the coming months.

Long-term economic forecasts indicate slower growth trajectories for both the U.S. and EU, with inflation pressures likely to persist as tariff costs work through supply chains. These macroeconomic headwinds suggest that while ETFs may continue to benefit from reduced trade war risks, underlying economic fundamentals point toward more challenging conditions for sustained market growth.

For sophisticated investors, the current environment presents both opportunities and risks. European ETFs may continue to outperform as markets price in trade stability, while sector-specific funds focusing on steel, aluminum, and pharmaceuticals face ongoing policy uncertainty. Currency hedging strategies may become increasingly important as trade policy continues to influence exchange rate movements.

The agreement ultimately represents a tactical success in preventing immediate trade war escalation while highlighting the strategic challenges of managing economic relationships in an increasingly fragmented global trade environment. Investors should monitor implementation details closely, as the gap between announced frameworks and operational realities often creates both risks and opportunities in financial markets.