$VOO ( ▼ 0.79% ) made history in 2025 by overtaking $SPY to become the largest ETF by assets under management.

That's not just a milestone.

It's proof that investors finally figured out you don't need to pay extra for the same thing.

Here's what we know.

Vanguard S&P 500 ETF (VOO)

Key Financial Metrics:

YTD Return: 15.62%

AUM: $762.28B

P/E Ratio: 28.91

Yield: 1.15%

$VOO ( ▼ 0.79% ) pulled in massive cash this year.

The fund attracted $68 billion in assets YTD, bringing total AUM to nearly $760 billion.

Recent data shows 5-day net flows of about $4 billion, which means investors are still buying.

But that gap matters more than you might think.

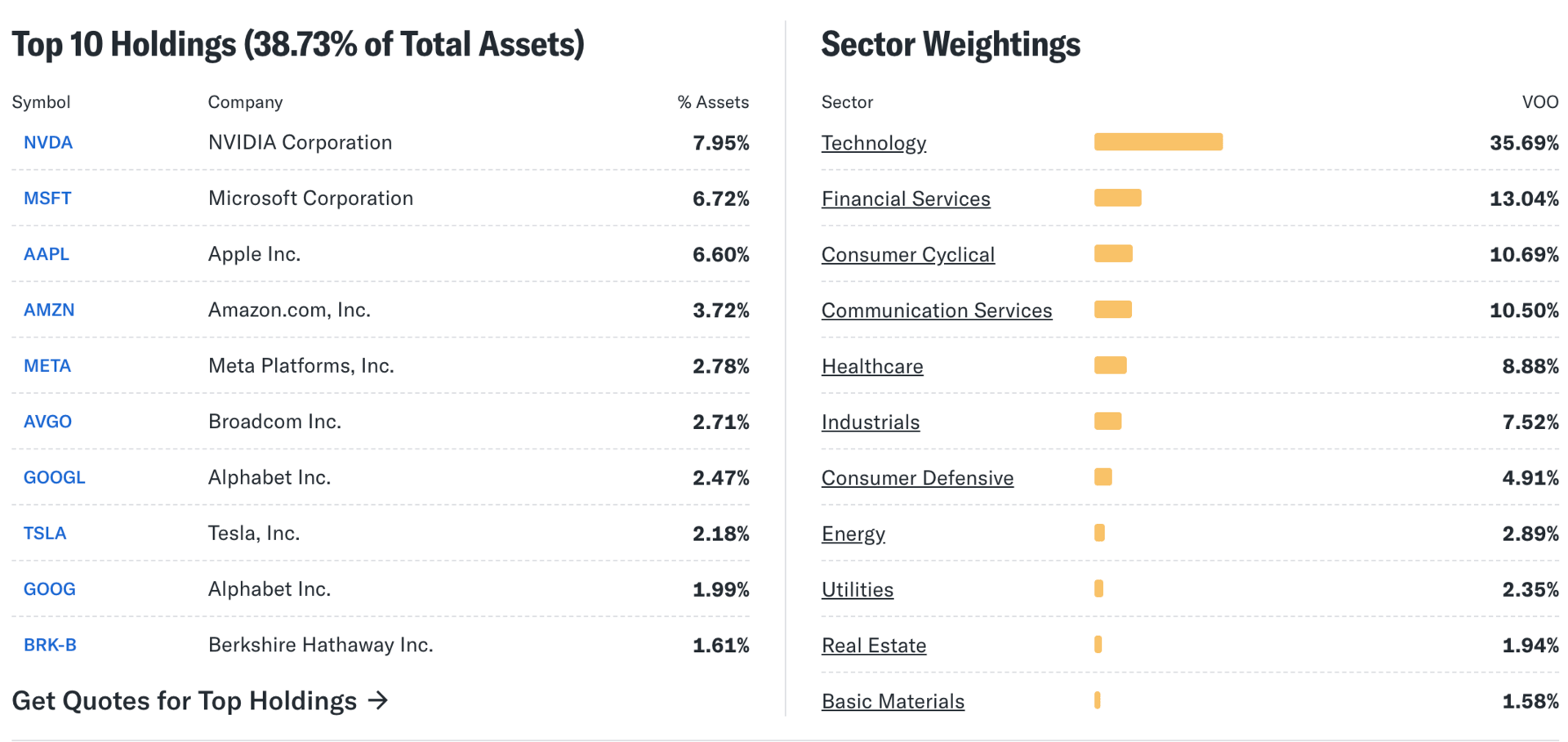

While everyone talks about passive investing and buy-and-hold, market strategists note that technology now represents over 35% of the S&P 500, a record high, while defensive sectors including consumer staples, healthcare, energy and utilities sit at an all-time low of 19%.

So much for diversification.

Analysts’ Comments

Wall Street analysts maintain a ‘Moderate Buy’ rating on $VOO based on the consensus of 417 ‘Buy’ ratings, 82 ‘Hold’ ratings and 7 ‘Sell’ ratings.

The average analyst price target sits at $697.61, suggesting 12.06% upside potential.

The high forecast of $821.23 and a low forecast of $545.54.

Kent Thune from ETF.com offered this perspective earlier this year: the fund's surge reflects confidence sparked by April's 90-day tariff pause, but may also suggest investors betting on momentum rather than fundamentals.

Tidal Financial's Gavin Filmore points out that investors are looking beyond the "VOO and chill approach" where you just buy the index, because they're not finding adequate diversification within the product itself.

Technical indicators show mixed signals.

Analysts note that $VOO holds buy signals from both short and long-term moving averages, but there's currently a ‘Sell’ signal from the 3-month MACD.

Trade War Factor

Markets reacted when Trump threatened new tariffs.

Recent reports suggest the US and China negotiators reached a framework for a trade truce that could include repealing Trump's threat of 100% tariffs on Chinese exports.

$VOO ( ▼ 0.79% ) remains what it's always been: broad market exposure at rock-bottom cost.

The question isn't whether VOO is a good fund. It's whether buying the S&P 500 at current valuations makes sense for your portfolio right now.

Bottom Line

$VOO ( ▼ 0.79% ) gives you 500 companies for three cents per hundred dollars invested.

That's the deal.

But when tech makes up over a third of your holdings and analysts see 12% upside, you're not buying diversification anymore.

You're buying concentration with a discount price tag.

What's catching investor attention today: The US Government's Been Shut Down for Three Weeks. Why Isn't Anyone Panicking?

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.