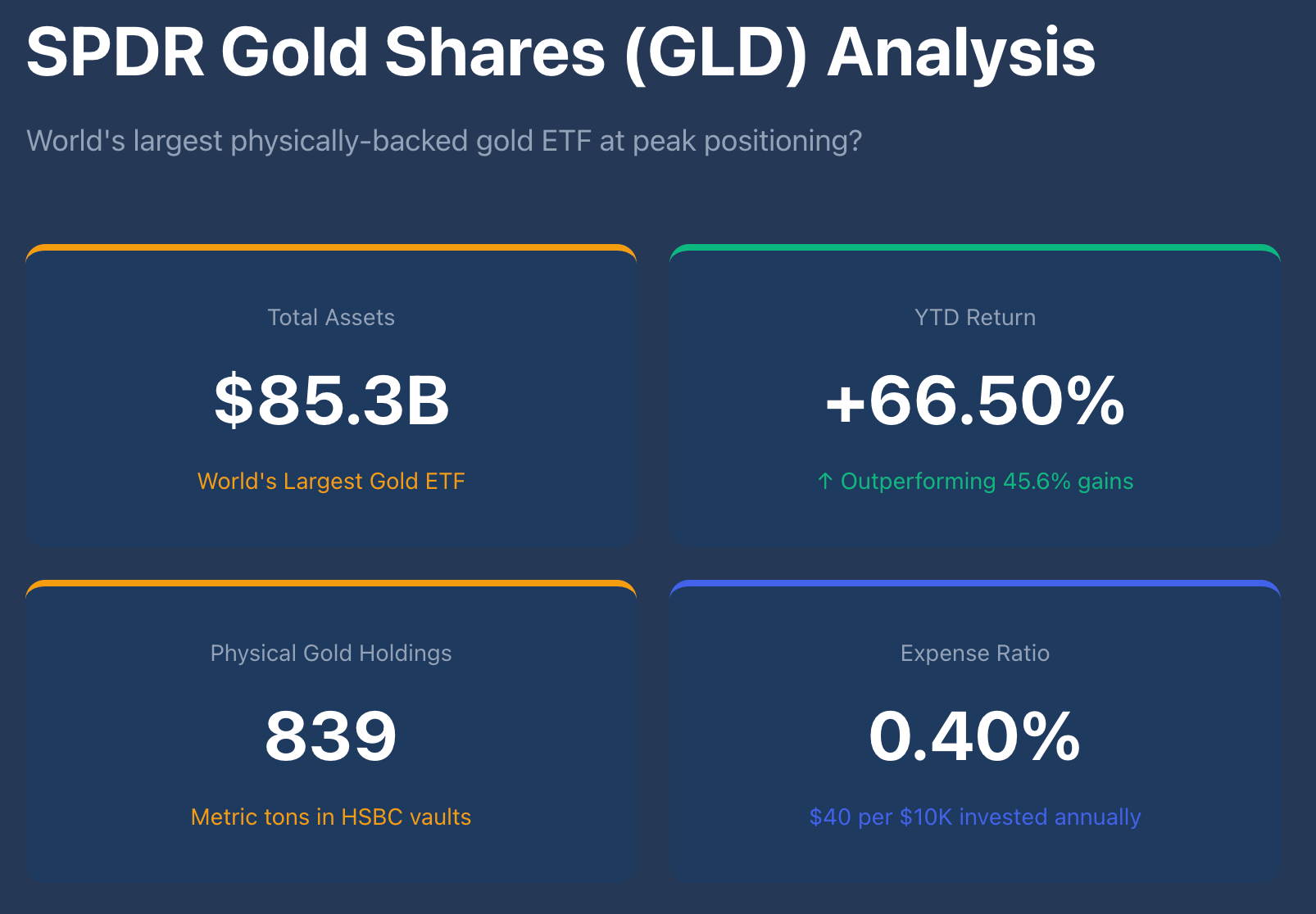

SPDR Gold Shares (GLD) just crossed $85 billion in assets, making it the world's largest physically-backed gold ETF.

But with 45.6% gains already banked and inflows at decade highs, are we looking at peak positioning?

The timing of your entry matters more than you think.

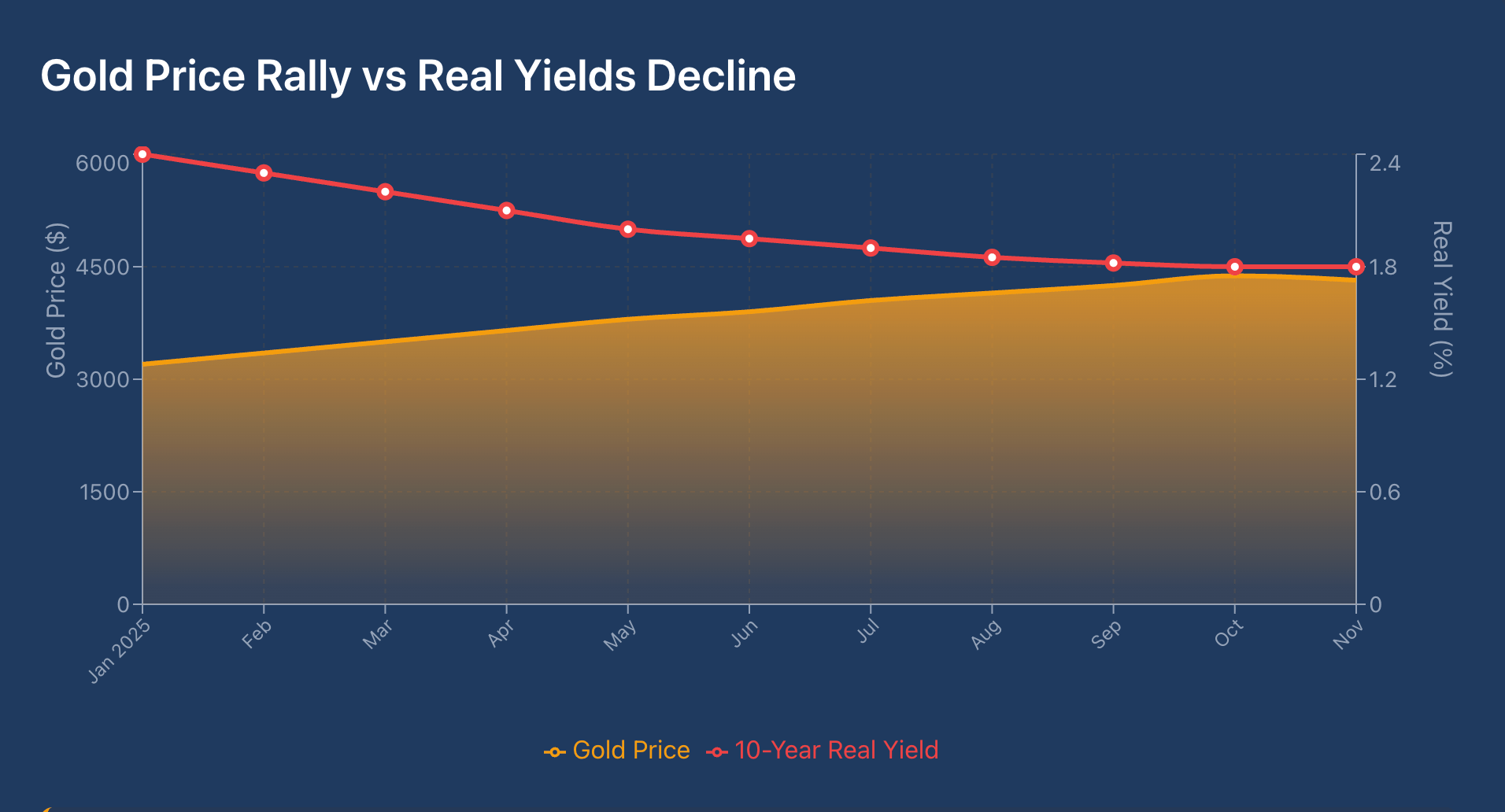

The Fed Factor

Gold's rally accelerated after the Federal Reserve signaled rate cuts in 2025.

Real yields on 10-year Treasuries dropped to 1.8%, down from 2.4% in January.

When real yields fall, gold becomes more attractive since it pays no dividend but preserves purchasing power.

Gold hit an all-time high in mid-October 2025, surpassing $4,380 per ounce.

But here's the thing: GLD doesn't behave like equity ETFs.

$GLD holds physical gold bars in HSBC vaults in London, and each share represents approximately one-tenth of an ounce.

That structure means no counterparty risk beyond the custodian, which matters when markets get choppy.

Portfolio Positioning

Key Financial Metrics:

YTD Return: +66.50%

Net Assets: 124.53B

Focus on the expense ratio of 0.40%, which translates to $40 annually per $10,000 invested.

That's higher than equity index funds but competitive within the precious metals category.

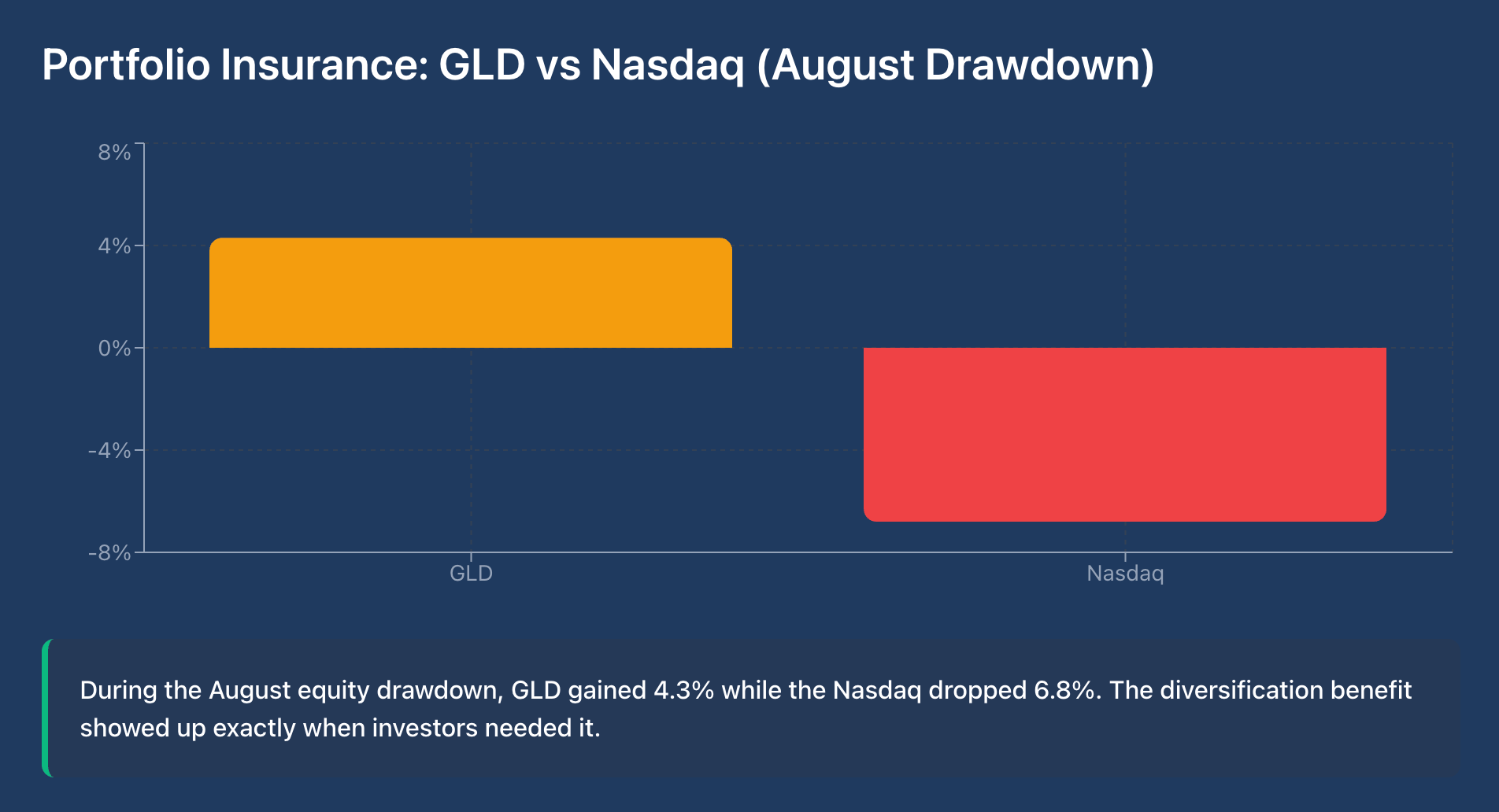

JPMorgan's asset allocation team recommends a 5-8% gold position in balanced portfolios. "Gold works as portfolio insurance," notes their Q3 strategy report. "The correlation to equities remains near zero over rolling 12-month periods."

During the August equity drawdown, $GLD gained 4.3% while the Nasdaq dropped 6.8%

The diversification benefit showed up exactly when investors needed it.

What the Data Shows

Investors buy $GLD ( ▲ 1.04% ) for capital appreciation and portfolio hedging, not income.

The fund rebalances daily to track spot gold prices, with tracking error under 0.15% over the past three years.

State Street Global Advisors manages the fund with $85.3 billion in custody, backed by 839 metric tons of gold.

Institutional ownership runs at 42%, with pension funds and endowments using GLD as a liquid alternative to direct bullion purchases.

Should you add exposure now?

That depends on your inflation outlook and current portfolio risk.

Gold historically performs when currency devaluation concerns rise or when equity volatility spikes above 20 on the VIX.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.