Looking for ETFs that actually pay you to hold them?

Schwab U.S. Dividend Equity ETF (SCHD) has been a dividend investor's darling for over a decade, but its recent stumble has everyone asking questions.

Schwab U.S. Dividend Equity ETF $SCHD managed just 1.63% returns YTD.

Here’s what we know.

Numbers Don't Lie

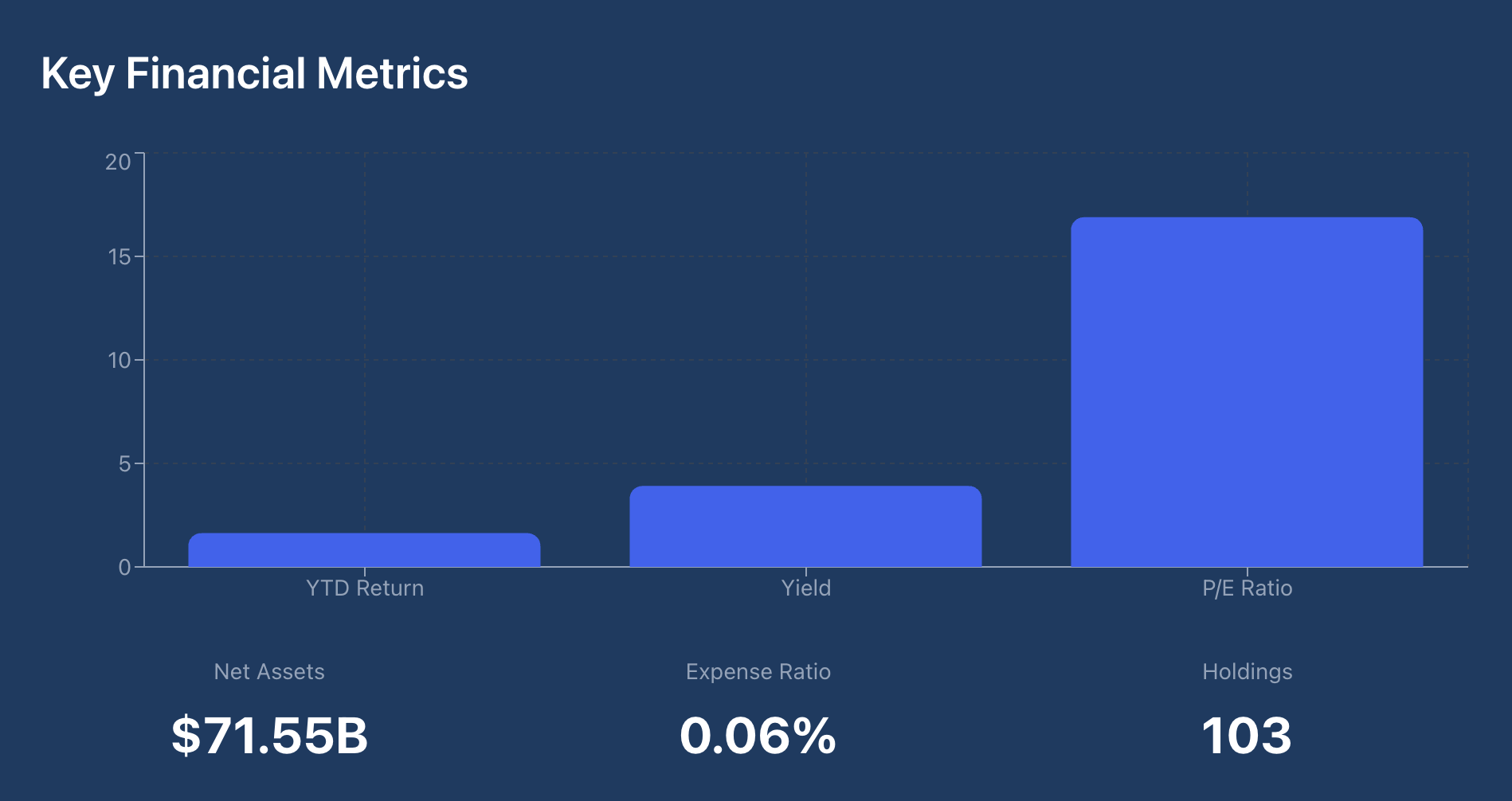

Key Financial Metrics:

YTD Return: +1.63%

Net Assets: $71.55B

Yield: 3.91%

$SCHD ( ▼ 0.41% ) 's AUM stands over $71 billion, making it one of the largest dividend ETFs in the market.

The current dividend yield sits at 3.91% with $1.03 per share paid over the past year.

The P/E ratio of 16.89 suggests value territory compared to the broader market's elevated multiples.

But here's the thing, past performance tells a different story.

The 10-year average annual return for SCHD stock is 11.50%, and since the fund's inception, the average annual return has been 12.14%.

That gap matters more than you might think.

In 2023, it fell into the bottom 11%. In 2024, it improved slightly but still landed in the bottom quarter.

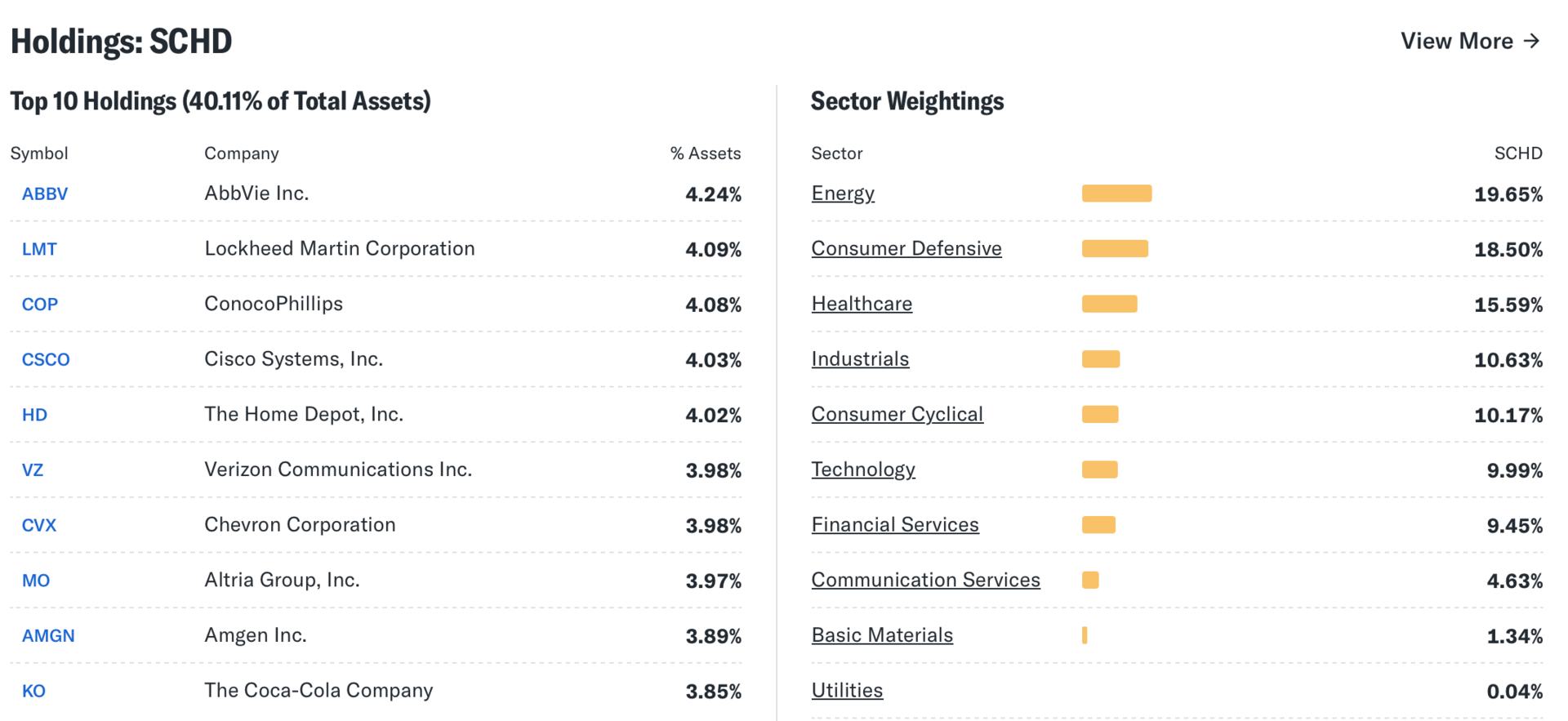

SCHD Sector Allocation

$SCHD ( ▼ 0.41% ) holds 103 companies, focusing on Energy (19.65%), Consumer Defensive (18.50%), and Healthcare (15.59%).

These sectors underperformed dramatically during the AI boom.

Meanwhile, SCHD's 0.06% expense ratio remains among the lowest in its class.

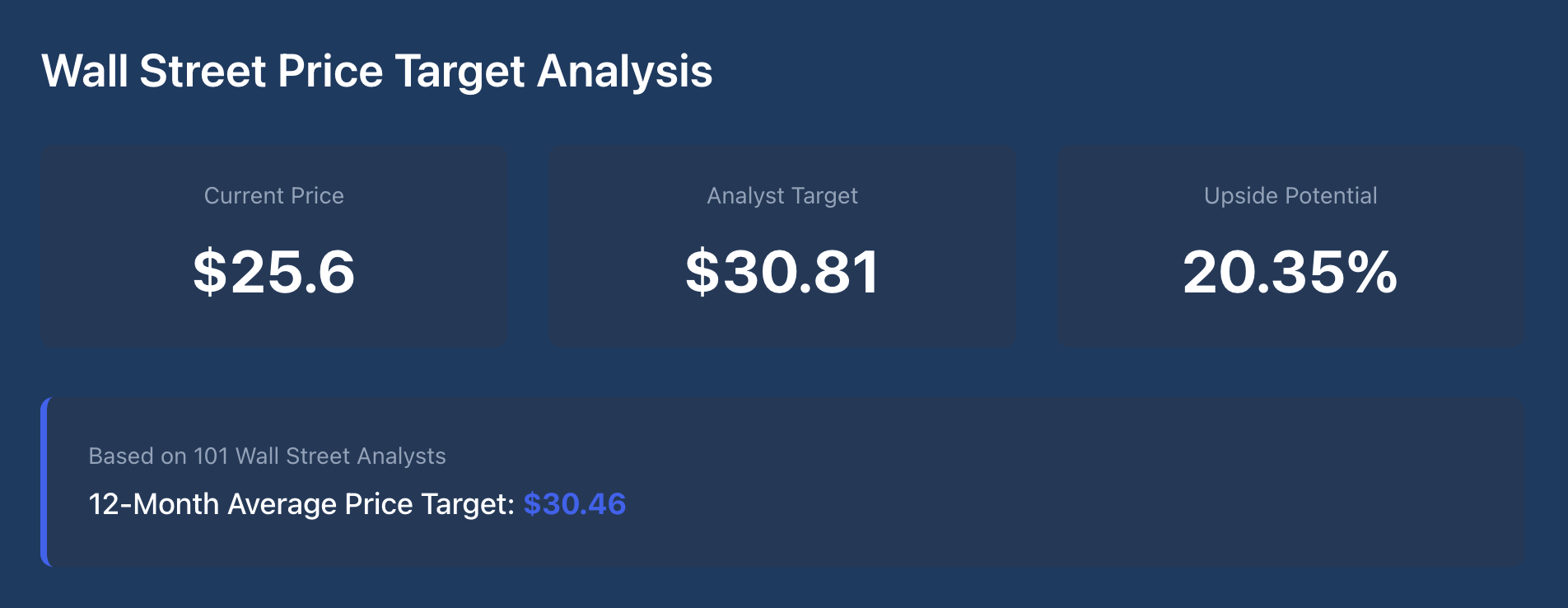

Wall Street Sees Opportunity

Analysts predict $SCHD ( ▼ 0.41% ) based upon its underlying holdings has an implied target price of $30.81 per unit, suggesting 20.35% upside.

Based on 101 Wall Street analysts' 12-month price targets, the average is $30.46.

Schwab US Dividend Equity ETF stands out for its sensible, transparent, and risk-conscious approach that should generate better long-term risk-adjusted returns than the Russell 1000 Value Index

Bottom Line

The question isn't whether $SCHD is broken.

It's whether defensive value stocks get their turn.

For investors with patience, the setup looks compelling.

Quality companies at reasonable valuations with growing dividends rarely stay cheap forever.

The market just needs to remember that.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.