The ETF market just hit $1.1 trillion in 2025.

The money is moving fast.

But what happens when $70 billion flows into Bitcoin ETFs in 12 months, then $2 billion exits in five days?

The ETF market isn't just growing, it's restructuring from the ground up.

ETFs Record Inflows

Here's what we know.

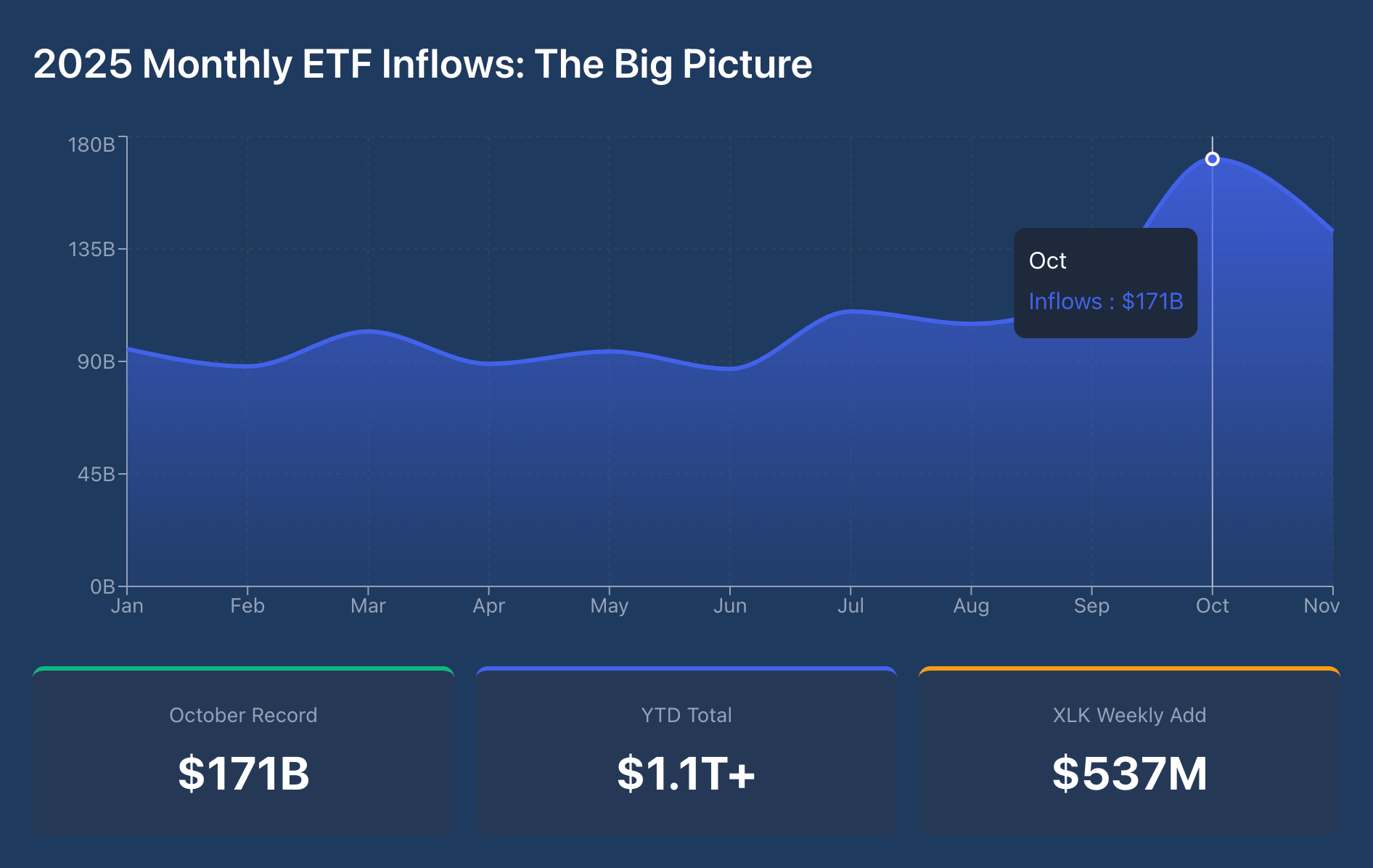

U.S. ETFs drew over $171 billion in October, the biggest monthly inflow on record.

Top ETF Movers:

$VOO ( ▲ 0.84% ) $17.7B

$SPLG ( ▲ 0.83% ) $6.7B

$QQQ ( ▲ 1.45% ) $6.3B

$IBIT ( ▲ 7.39% ) $4.3B

$GLD ( ▼ 0.25% ) $3.6B

$BBEU ( ▲ 0.79% ) $4B

$GOVT ( ▼ 0.09% ) $4.1B

Fixed income led the charge with $55.6 billion. Equity funds grabbed $54 billion.

And taxable bonds? They're now sitting on $74 billion for the year.

Investors aren't just chasing returns. They're repositioning for what comes next.

Single Stock ETFs

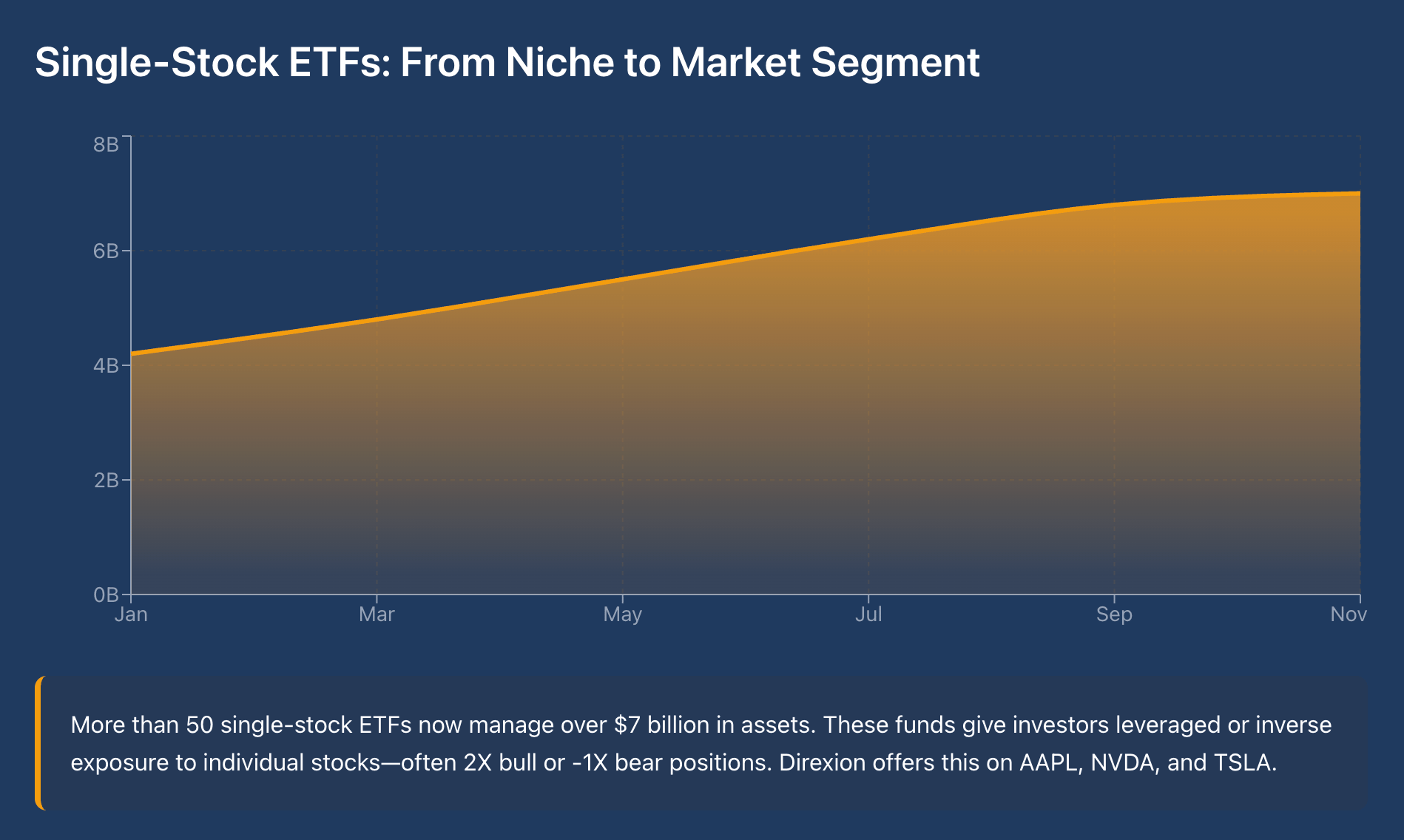

More than 50 single-stock ETFs now operate in the market, managing over $7 billion in assets.

That's not a niche anymore. That's a market segment.

These funds give investors leveraged or inverse exposure to individual stocks, often 2X bull or -1X bear positions on a single day's movement.

Direxion Daily Semiconductor Bull 3X Shares $SOXL now offers this structure on Apple $AAPL ( ▲ 0.77% ) , Nvidia $NVDA ( ▲ 1.41% ) , and Tesla $TSLA ( ▲ 1.96% ) .

MicroStrategy $MSTR became the most-watched ticker of the year.

Tech stocks account for 40% of new leveraged single-stock ETF launches in 2025. The concentration tells you where the risk appetite lives.

Retail investors want magnified exposure to names they already follow. These products deliver exactly that.

But here's the thing: single-stock ETFs carry concentrated risk.

A 2X leveraged position on one company is not portfolio diversification. It's a directional bet with daily resets that can erode value in volatile markets.

Digital Assets Move

Bitcoin Spot ETFs reached $70 billion in AUM by the end of 2024, just one year after SEC approval.

That pace of adoption had no precedent in ETF history.

But November 2025 tells a different story.

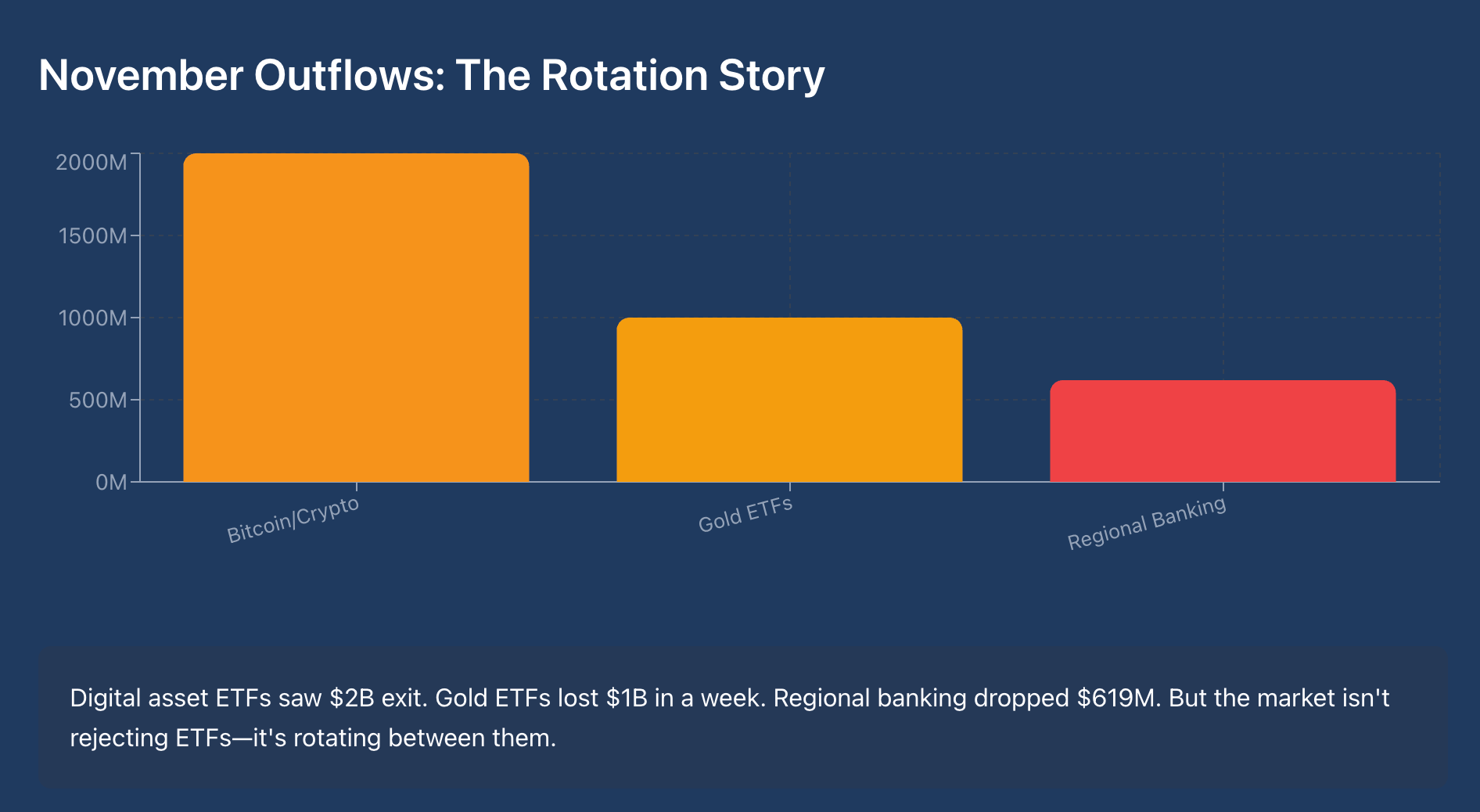

Bitcoin and Ethereum ETFs posted nearly $2 billion in outflows over five days, while Solana, HBAR, and Litecoin ETFs buck the market trend with steady inflows.

BlackRock's $IBIT ( ▲ 7.39% ) and Fidelity's $FBTC ( ▲ 7.43% ) , the two largest Bitcoin funds, led the exodus. Institutional accumulation has slowed materially.

The infrastructure gap that kept Bitcoin out of traditional portfolios no longer exists.

The question now is whether demand can sustain the initial momentum.

Mutual Funds

Regulatory changes now allow mutual funds to offer an ETF share class within the same structure. This wasn't possible before 2024.

Now it's reshaping product development.

The advantage is operational efficiency. Funds can execute capital operations faster and cheaper.

Investors can access the tax efficiency of ETFs while maintaining the dollar-cost-averaging features of mutual funds. It's a structural improvement.

Expect active and hybrid strategy funds to lead this shift.

These products benefit most from the dual share-class structure, particularly in categories where portfolio managers trade frequently but investors want tax-efficient wrapper.

AI Infrastructure & Defense ETFs

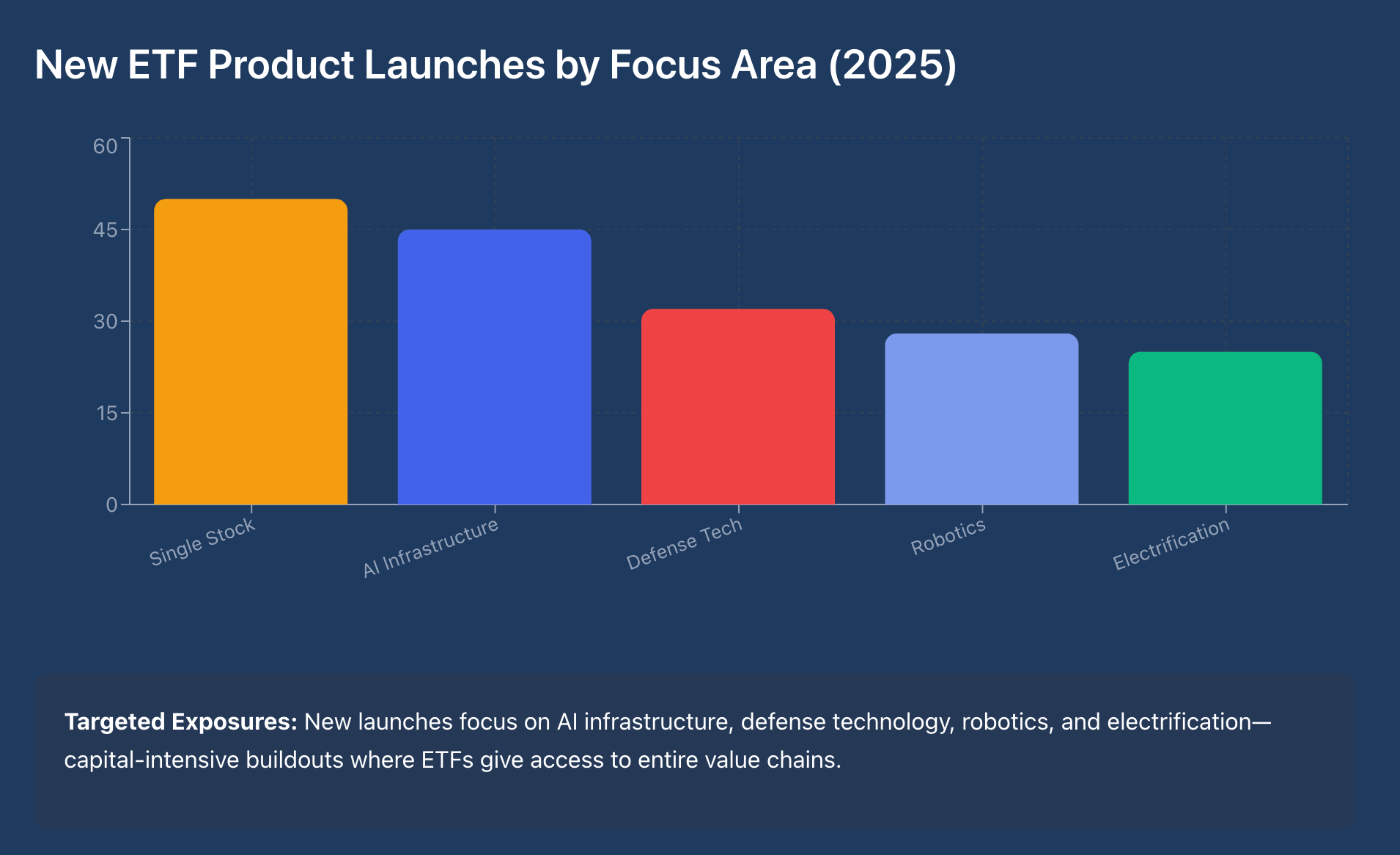

New product launches in 2025 focus on AI infrastructure, defense technology, robotics, and electrification.

These aren't broad-market beta plays. They're targeted exposures to capital-intensive buildouts.

AI infrastructure ETFs hold data center operators, semiconductor manufacturers, and power suppliers.

Defense tech ETFs capture autonomous systems and cyber capabilities.

Electrification funds track grid modernization and industrial equipment upgrades.

The thesis is simple: these sectors require multi-year capital deployment cycles. Public equity markets are funding the buildout.

ETFs give investors access to the entire value chain in a single trade.

Which new ETF sector holds the most promise for the next three years?

Retail Investors

Nasdaq's 2025 survey data shows that 50% of U.S. investors plan to increase their ETF holdings by more than 10% over the next 12 months.

That's not institutional rebalancing. That's retail demand.

Retail investors now represent the primary growth driver for ETF adoption.

Brown Brothers Harriman's survey confirms the trend. Access to low-cost, liquid, and transparent investment vehicles is democratizing portfolio construction.

Citadel Securities views this as a "positive macro signal reflecting democratized decision-making and portfolio growth."

When retail investors have the tools to build diversified portfolios, market participation broadens.

That's structurally healthy for capital markets.

Ticker Symbols Competition

Companies now compete for catchy four-letter combinations, and some reserve tickers in advance of product launches.

It's a minor detail, but it signals market saturation in certain categories. The best tickers are already taken. New entrants need differentiation beyond branding.

The ETF market in 2025 looks different than it did 24 months ago.

Digital assets are institutional. Single stocks have scale. And tokenization is moving from concept to infrastructure.

Reality Check

The contrast is sharp. Digital asset ETFs pulled in $70 billion in their first year. Now they're cashing out.

Gold ETFs saw $1 billion leave in a single week despite record inflows earlier this year.

Regional banking funds dropped $619 million.

But the numbers tell a different story.

U.S.-listed ETFs recorded $171 billion in October inflows alone, pushing YTD totals past $1.1 trillion.

Tech funds continue absorbing capital, with $XLK ( ▲ 1.92% ) adding $537 million last week.

Fixed income ETFs are tracking toward their best year on record.

The market isn't rejecting ETFs. It's rotating between them.