This is real!

Donut Lab delivers the first in history all-solid-state battery to Verge Motorcycles for Q1 2026 production. Not a prototype. Not a lab demo.

Actual vehicles on actual roads.

The market hasn't priced this in yet.

Donut Lab at CES 2026

Now at CES 2026, Donut Lab's all-solid-state battery delivers 400 Wh/kg energy density, roughly 60% higher than current lithium-ion cells. That translates to 600 km range in EVs without adding weight.

Charge time? 5 to 10 minutes for 20-80%.

Compare that to the 30-45 minutes most EVs need today. You're looking at 60 km of range per minute plugged in.

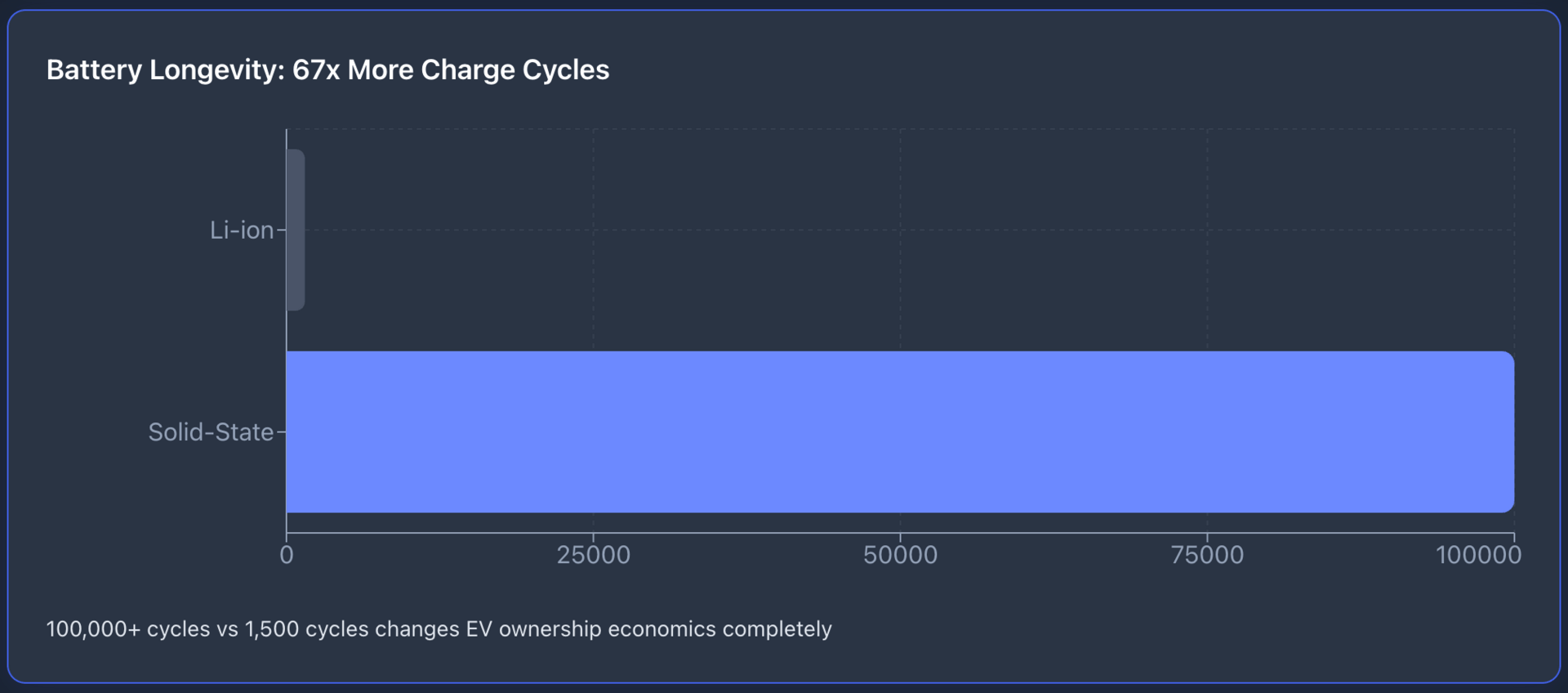

But here's what matters for your portfolio: over 100,000 charge cycles with 99% capacity retention from -30°C to +100°C. Current lithium-ion batteries degrade to 80% capacity after 1,000-2,000 cycles.

This technology changes the economics of EV ownership completely.

Why This Announcement Is Different

We've heard solid-state promises before.

Toyota said 2025. QuantumScape has been "two years away" since 2020. Solid Power is still testing prototypes.

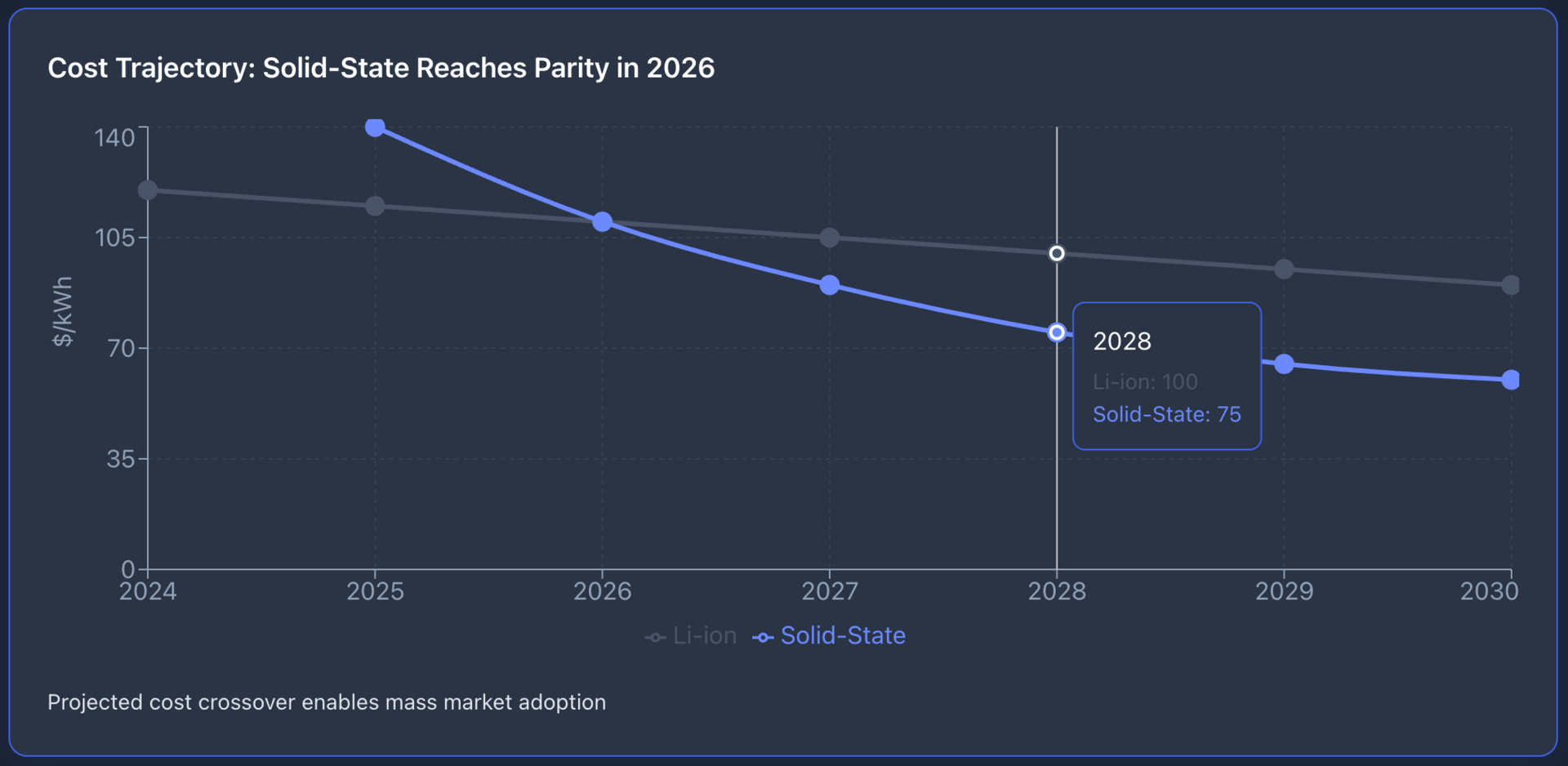

Donut Lab did something else. They eliminated rare earth metals. They removed liquid electrolytes. They built a manufacturing process that costs less than lithium-ion at scale.

Quote Block:

"Donut Lab has engineered a new high performance solid state Donut Battery that can be scaled to major production volumes and seen now in real world use in the Verge Motorcycles bikes out on the road in Q1."

Marko Lehtimäki, Donut Lab's CEO

Not "will be" or "could be." Shipping product in 2026.

Ville Piippo, the company's CTO, was even more direct: "Our technology is ready for the mass market now, not in a decade."

Over 200 OEMs are currently testing Donut Lab's batteries. That pipeline represents the entire EV supply chain rethinking their assumptions about battery technology.

When did you think solid-state batteries would reach commercial production?

The Market Opportunity

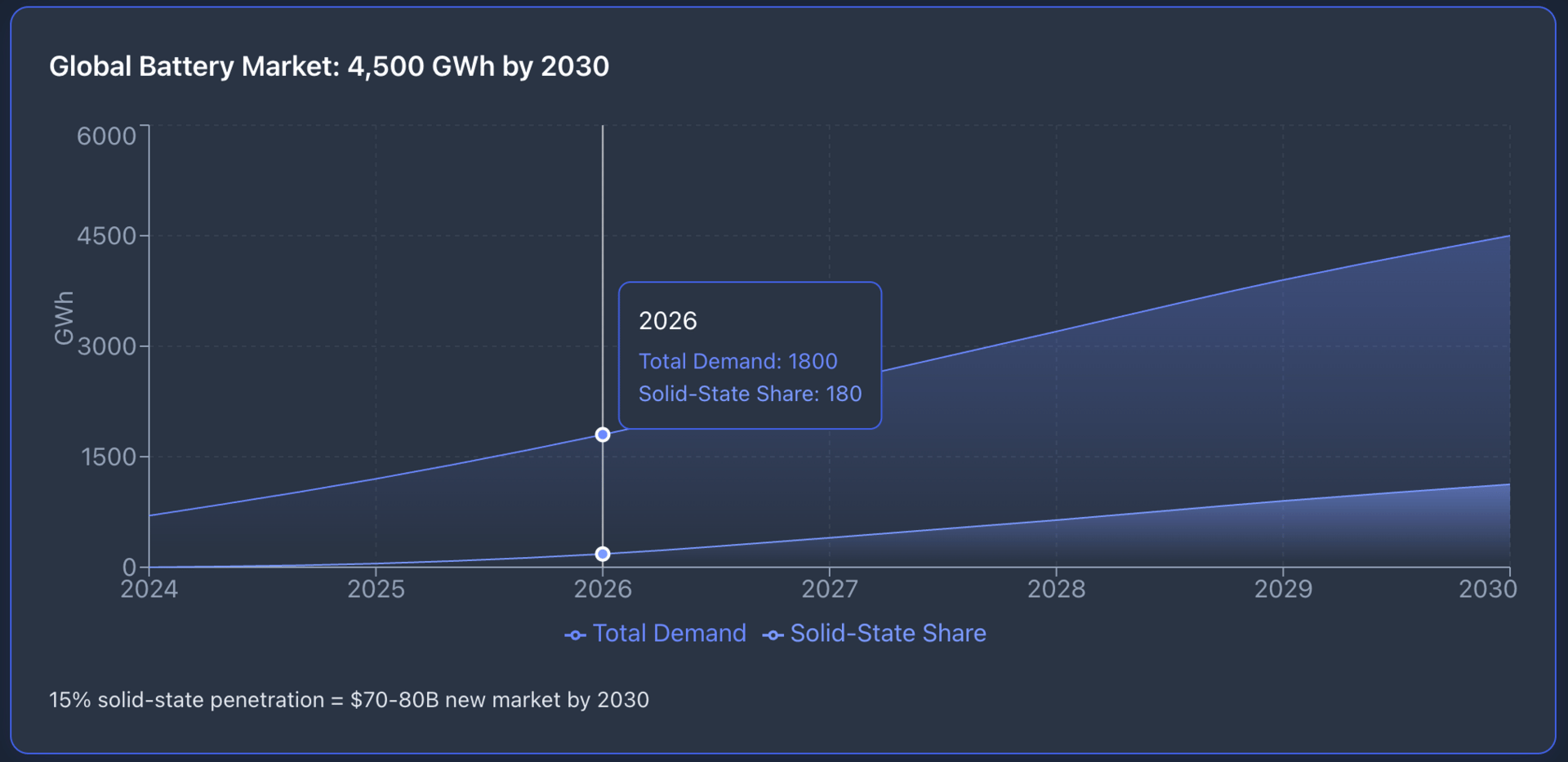

Global battery demand is projected to hit 4,500 GWh by 2030, up from roughly 700 GWh in 2024. That's 6.4x growth in six years.

Current estimates assume incremental improvements in lithium-ion technology. They don't account for a manufacturing-ready alternative that charges 6x faster, lasts 50x longer, and costs less to produce.

If solid-state captures even 15% of that 2030 market, you're looking at 675 GWh of new production capacity. At current battery prices of $100-120 per kWh, that's a $70-80 billion market that didn't exist in analyst models six months ago.

The Verge TS Pro ships with a 217-mile range. The Ultra version hits 370 miles. These aren't city scooters. They're highway-capable motorcycles with performance specs that match traditional combustion engines.

Which Investments Move First

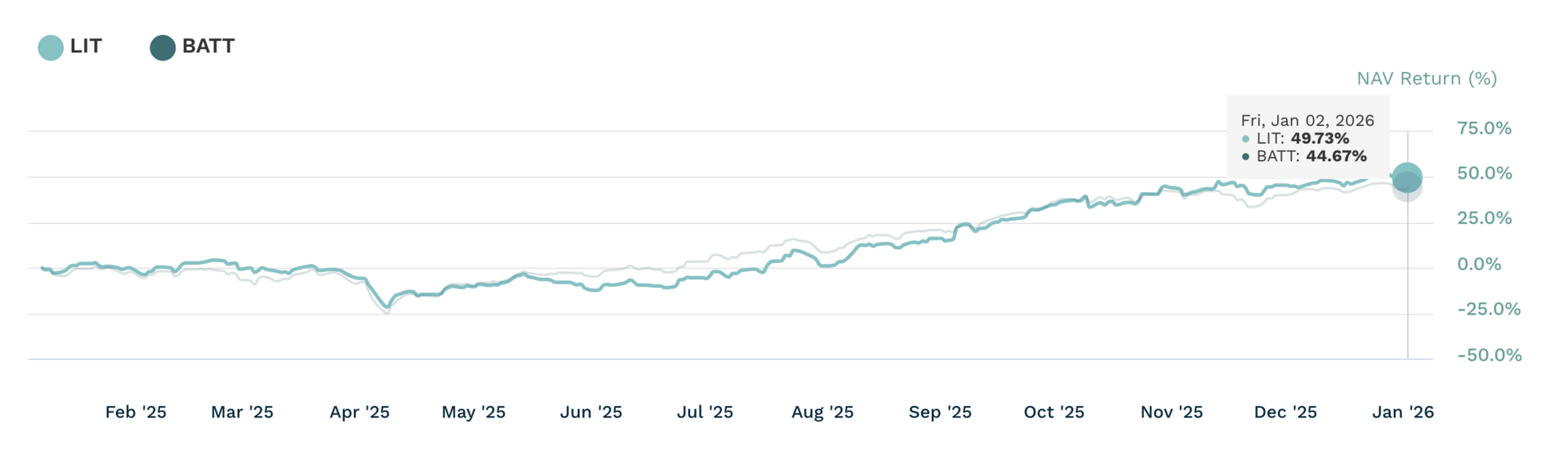

ETF Comparison, LIT vs BATT (etf.com)

$LIT (Global X Lithium ETF) holds the miners and processors that feed battery production. Lithium demand doesn't disappear with solid-state—it intensifies. The ETF is down 22% over three years because the market priced in slower EV adoption. That assumption just changed.

$BATT (Amplify Lithium ETF) focuses directly on battery manufacturers. It holds the companies that will license, produce, or compete with solid-state technology. Current trading volume suggests institutional investors haven't connected these dots yet.

$TAN (Invesco Solar ETF) captures the solar-EV ecosystem. Faster charging and longer battery life make solar-powered EV charging stations economically viable in locations that couldn't support 45-minute charge times. The infrastructure thesis just got stronger.

$QS (QuantumScape) is a publicly traded solid-state pure play. The stock is down 85% from its peak because investors lost patience with development timelines. Donut Lab's production announcement validates the entire category. QS either becomes a competitor or an acquisition target—either way, the multiple expands.

$SLDP (Solid Power) is developing similar technology with backing from Ford and BMW. Their partnership deals looked speculative when solid-state was theoretical. Now they look strategic.

$0005D0 (Korean SOL ETF) gives exposure to Samsung and LG's solid-state programs. South Korea committed $7 billion to battery R&D specifically targeting solid-state commercialization. That investment thesis just got validated by a Finnish startup beating them to market.

How are you positioning for solid-state battery production in Q1 2026?

The Risk Nobody Is Talking About

Donut Lab is privately held. You can't buy shares. The company might get acquired before it ever lists publicly.

That's actually bullish for battery ETFs. If BMW, Tesla, or BYD acquires Donut Lab in the next 12 months, it confirms that solid-state is commercially viable and major manufacturers are willing to pay premiums for the technology. ETFs holding battery supply chains and competing developers benefit either way.

The real risk is production scaling. Verge ordered enough batteries for motorcycle production, maybe 10,000-50,000 units annually. Passenger vehicles need 10-20 million units annually just to meet current EV demand.

But that gap matters more than you might think. Verge proved the manufacturing process works. They demonstrated real-world durability. They eliminated the "it only works in a lab" objection that has plagued solid-state development for 15 years.

The question is no longer "can solid-state be produced?" It's "how fast can production scale?"

What Happens Next

Watch Q1 2026 delivery data from Verge. If those motorcycles hit the road without battery failures or recalls, institutional investors will start modeling solid-state penetration into their EV forecasts.

Track licensing announcements from Donut Lab. Those 200+ OEMs testing batteries will either commit to orders or scramble to develop competing technology. Either path drives battery sector valuations higher.

Monitor lithium and cobalt prices. Solid-state batteries use different material ratios than lithium-ion. If industrial buyers start shifting orders, commodity prices will telegraph the transition before earnings reports confirm it.

Pay attention to charging infrastructure investments. If batteries can charge in 10 minutes, charging stations become convenience retail locations instead of 30-minute waiting areas. Real estate and infrastructure investors will reprice those assets accordingly.

When will the market price be in Donut Lab's production announcement?

The Trade

$LIT and $BATT offer direct exposure with enough liquidity to enter and exit positions cleanly. Both trade with reasonable spreads and sufficient daily volume for institutional money to move in without pushing prices.

$QS and $SLDP are higher volatility plays for investors who want concentrated exposure to solid-state development. The risk is higher, but so is the potential return if either company announces major production contracts.

$TAN is the macro play. If solid-state enables the next wave of EV adoption, solar infrastructure benefits from increased electricity demand and improved economics for distributed charging networks.

The setup is straightforward: Q1 2026 production removes the "when" from solid-state commercialization. The market is still pricing these ETFs like solid-state is 5-10 years away. That gap closes over the next 90 days as Verge motorcycles ship and OEM testing data becomes public.

Solid-state isn't science fiction anymore. It's shipping product in Q1 2026. Position accordingly.

What's catching investor attention today: Qualcomm Dragonwing IQ10: CES 2026's Robotics Revolution

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.