OpenAI and Nvidia's $100 billion deal is delayed?

What’s really happening behind closed doors?

Three months after announcing what was supposed to be the largest AI infrastructure partnership in history, Nvidia's CEO dropped a statement that should make every investor pause.

"We haven't given a penny," Jensen Huang told Fox Business on December 17th. Not a dollar of the much-publicized $100 billion OpenAI deal has changed hands.

That's not a typo. Zero dollars. And if you're holding positions in $NVDA, $AMZN, or $MSFT, this matters more than the market seems to realize right now.

What Actually Happened

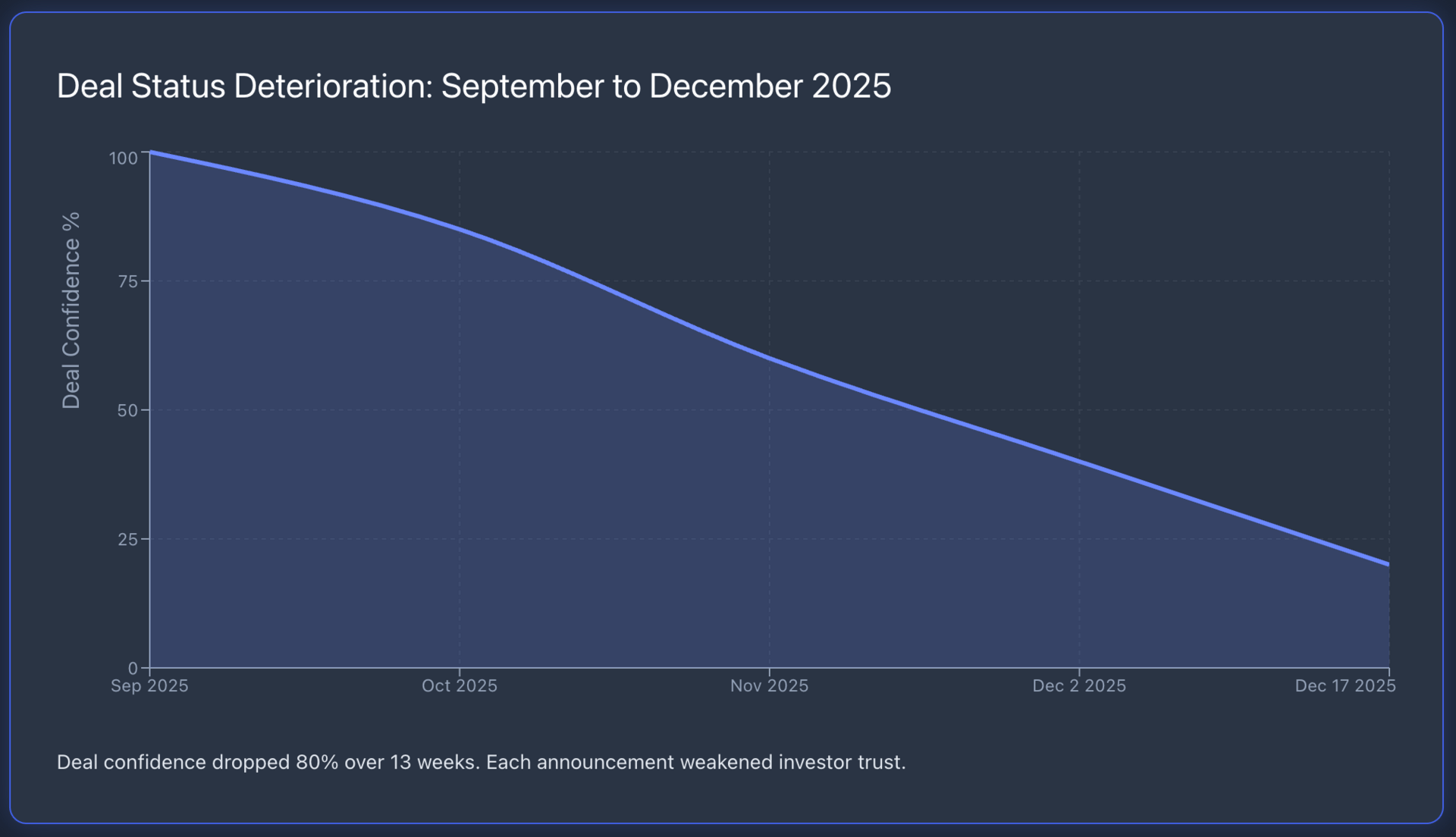

September 2025: Nvidia and OpenAI announced plans to build 10 gigawatts of computing capacity.

The press releases called it historic. Wall Street analysts upgraded their Nvidia price targets. The narrative was set: Nvidia would supply the chips, OpenAI would build the future of AI, and everyone would profit.

December 2nd: Nvidia CFO Colette Kress admitted during an investor update that "no definitive agreement" had been finalized. $NVDA barely moved. Most investors assumed this was just paperwork delays.

December 17th: Huang's statement confirmed what Kress hinted at. Three months in, nothing is signed. No contracts. No cash flow. No commitments.

The gap between announcement and execution is now 90 days and counting.

That timeline tells us what's happening behind closed doors.

What This Delay Means

When a company announces a $100 billion infrastructure project and then takes three months without signing a deal, there are only a few explanations. None of them are good for Nvidia bulls.

First possibility: OpenAI is negotiating harder than Nvidia expected. They want better pricing, more flexibility, or different terms.

This happens when the buyer has leverage. And right now, OpenAI has options.

Second possibility: OpenAI is using this announcement as a negotiating tool with other suppliers. Make a public commitment to create urgency with competitors, then shop around for the best deal. Standard corporate strategy, but it leaves Nvidia exposed.

Third possibility: The compute requirements changed. OpenAI might have recalculated their infrastructure needs. Maybe 10 gigawatts was always aspirational. Maybe their funding situation shifted their timeline.

Any of these scenarios means the deal Nvidia announced isn't the deal they'll actually close.

That's a problem for revenue forecasts built on this partnership.

Amazon & OpenAI’s Win-Win Play

While Nvidia waits for OpenAI to sign, Amazon $AMZN isn't waiting at all.

AWS is preparing a $10 billion investment package for OpenAI.

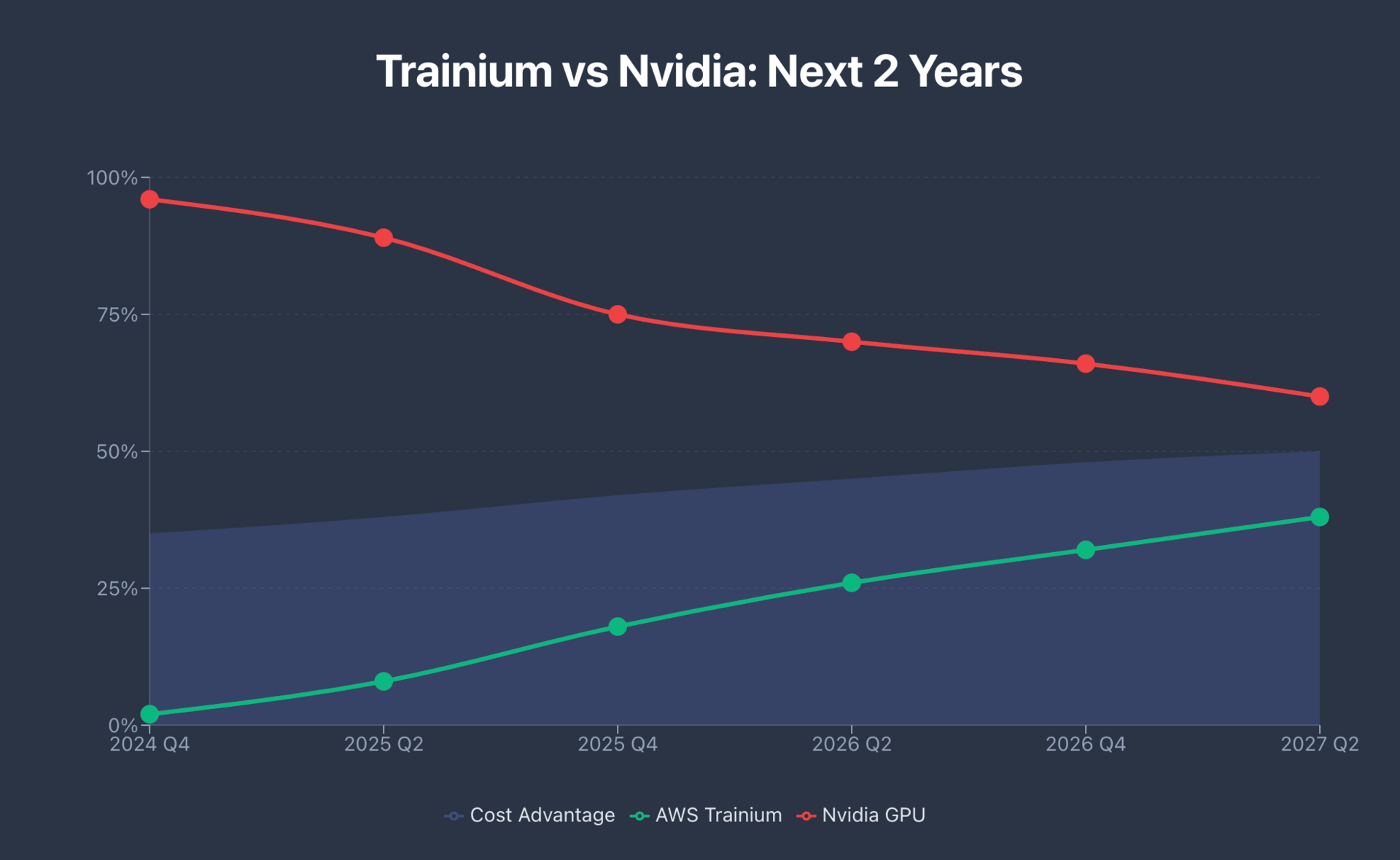

But here's what matters: Amazon isn't just offering money. They're offering Trainium chips.

Trainium is Amazon's custom AI accelerator. It's designed to compete directly with Nvidia's H100 and H200 GPUs.

Amazon also invested $8 billion in Anthropic. Anthropic uses AWS infrastructure. AWS revenue grows, justifying Amazon’s massive capex.

And it comes with something Nvidia can't match: full integration with AWS infrastructure that OpenAI already uses.

OpenAI Chairman Bret Taylor stated publicly that "the shortage of GPUs and demand for compute is reshaping everything." Read that carefully. He didn't say "we need Nvidia GPUs." They need compute capacity. Any compute capacity.

That distinction matters. OpenAI is hardware-agnostic now. They'll take chips from whoever delivers first and offers the best terms. Nvidia's delay gives Amazon an opening to become the primary supplier.

The game theory here is straightforward. OpenAI announced the Nvidia partnership to show the market they had secured compute capacity. That drove their valuation higher and gave them credibility with investors. But they never had to execute on it exclusively.

They can take Amazon's money, deploy Trainium chips, and keep the Nvidia option open for future expansion.

Nvidia might have just given away its negotiating position by going public too early.

What This Means

If you're holding $NVDA, this unsigned deal should be a yellow flag, not a red one yet. But it needs to be on your risk watchlist.

Nvidia's 2026-2027 revenue projections from multiple sell-side analysts include assumptions about OpenAI spending. If this deal shrinks or disappears, those forecasts drop. $NVDA is trading on expectations of continued AI infrastructure buildout. Any crack in that narrative will hurt valuations.

Watch the Q4 earnings call in February. If management still can't confirm signed contracts with OpenAI, the market will start pricing in deal risk. Options traders should consider hedging long positions now while volatility is relatively low.

For Amazon holders, this situation is increasingly bullish. AWS is already OpenAI's cloud provider. Adding chip supply to that relationship creates deeper integration and stickier revenue. If Amazon becomes the primary compute supplier for the most valuable AI company in the world, that's a structural advantage for the next decade.

AWS claims Trainium2 delivers 30-40% better price-performance than GPU-based instances for training workloads.

Other AI companies may follow OpenAI's lead. This could be the inflection point for Amazon's business.

Microsoft $MSFT holders should feel relatively secure.

Microsoft owns 27% of OpenAI and has technology rights that extend through 2032. Even if the Nvidia deal falls apart completely, Microsoft's position doesn't change. They're the backstop investor and the distribution partner for OpenAI's products.

But Microsoft also has its own compute infrastructure concerns. If OpenAI burns through Amazon's $10 billion quickly, Microsoft may need to write an even larger check. That impacts capital allocation and could pressure their own AI infrastructure spending.

The Real Risk

The biggest concern is what this delay signals about OpenAI's financial position and strategy.

Companies that are confident in their funding and growth trajectory don't delay $100 billion infrastructure partnerships. They sign quickly and start building.

The fact that OpenAI is still negotiating three months later suggests either cash flow concerns, uncertainty about future model requirements, or both.

If OpenAI is slowing down infrastructure spending because they're worried about burn rate, that's a problem for the entire AI supply chain.

Nvidia, Amazon, Microsoft—everyone is counting on OpenAI to keep spending at a massive scale. If that assumption breaks, the whole AI infrastructure thesis needs to be repriced.

What to Watch Next

The next 60 days will tell you everything you need to know.

If Nvidia and OpenAI announce a signed agreement in January or February, this was just standard corporate negotiation. The deal moves forward, and Nvidia bulls can relax.

If we hit March without a signature, start reducing exposure to Nvidia on any strength. The deal is likely delayed, and the market will eventually price that in.

For Amazon, watch for any official announcement of the $10 billion investment. AWS confirms they're in talks for supplying Trainium chips to OpenAI at scale, that's a buy signal for $AMZN.

The strategic value of that relationship is worth more than the revenue itself.

For Microsoft $MSFT, they're protected by ownership and long-term contracts. But watch their Azure capex guidance.

If Microsoft starts building more compute capacity specifically for OpenAI workloads, that tells you they're preparing to fill any gaps Nvidia or Amazon leave behind.

The narrative around AI infrastructure is shifting. Seems Nvidia's dominance isn't guaranteed anymore. OpenAI has options.

So, the company that moves fastest to actually deliver compute capacity, not just announce plans, will win the biggest customer in AI.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.