The U.S. government is writing checks. Big ones.

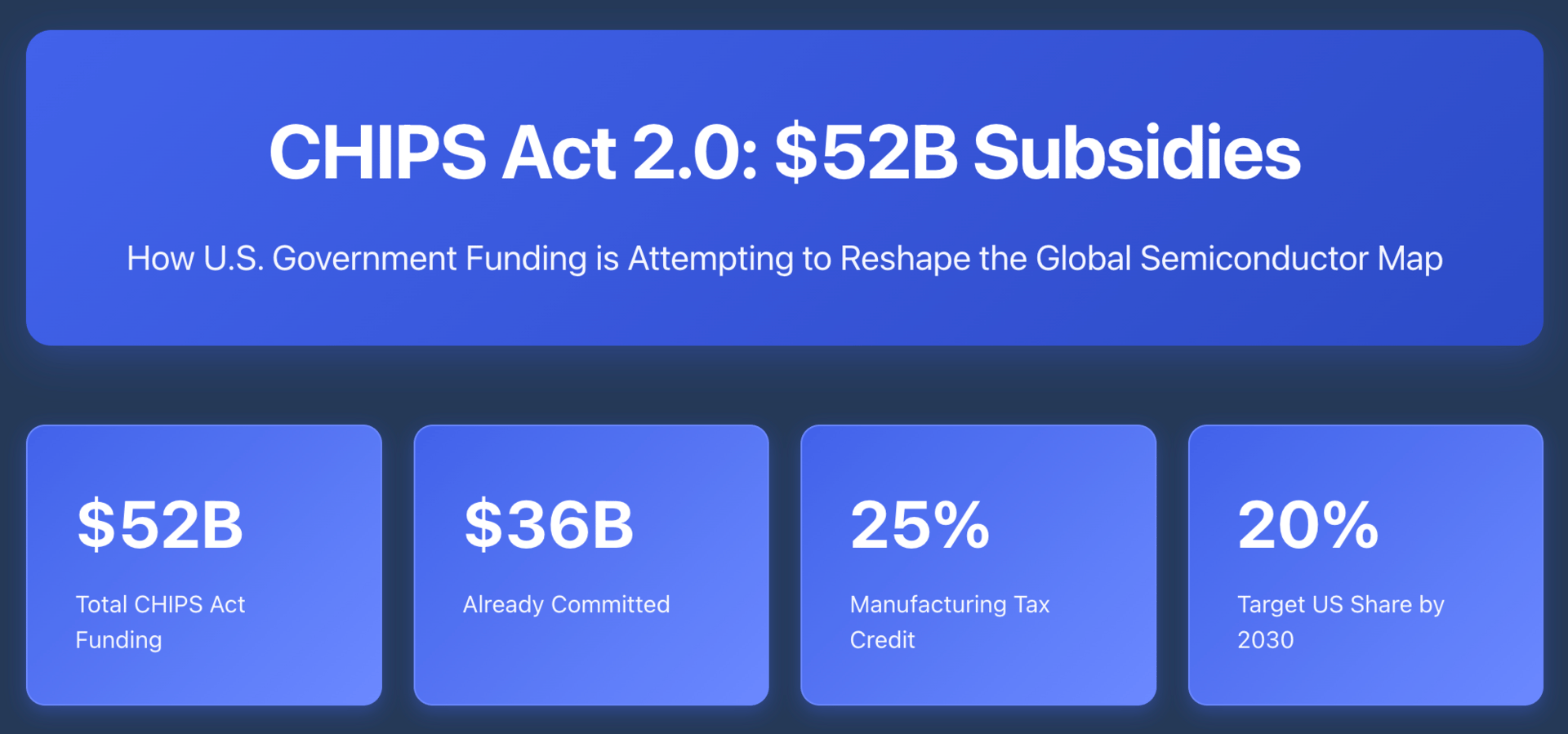

Since 2022, over $36 billion in CHIPS Act funding has been committed to companies like Intel, TSMC, and Samsung. Another $16 billion sits ready to deploy.

The stated goal? Bring semiconductor manufacturing back to American soil and reduce dependence on Taiwan and South Korea.

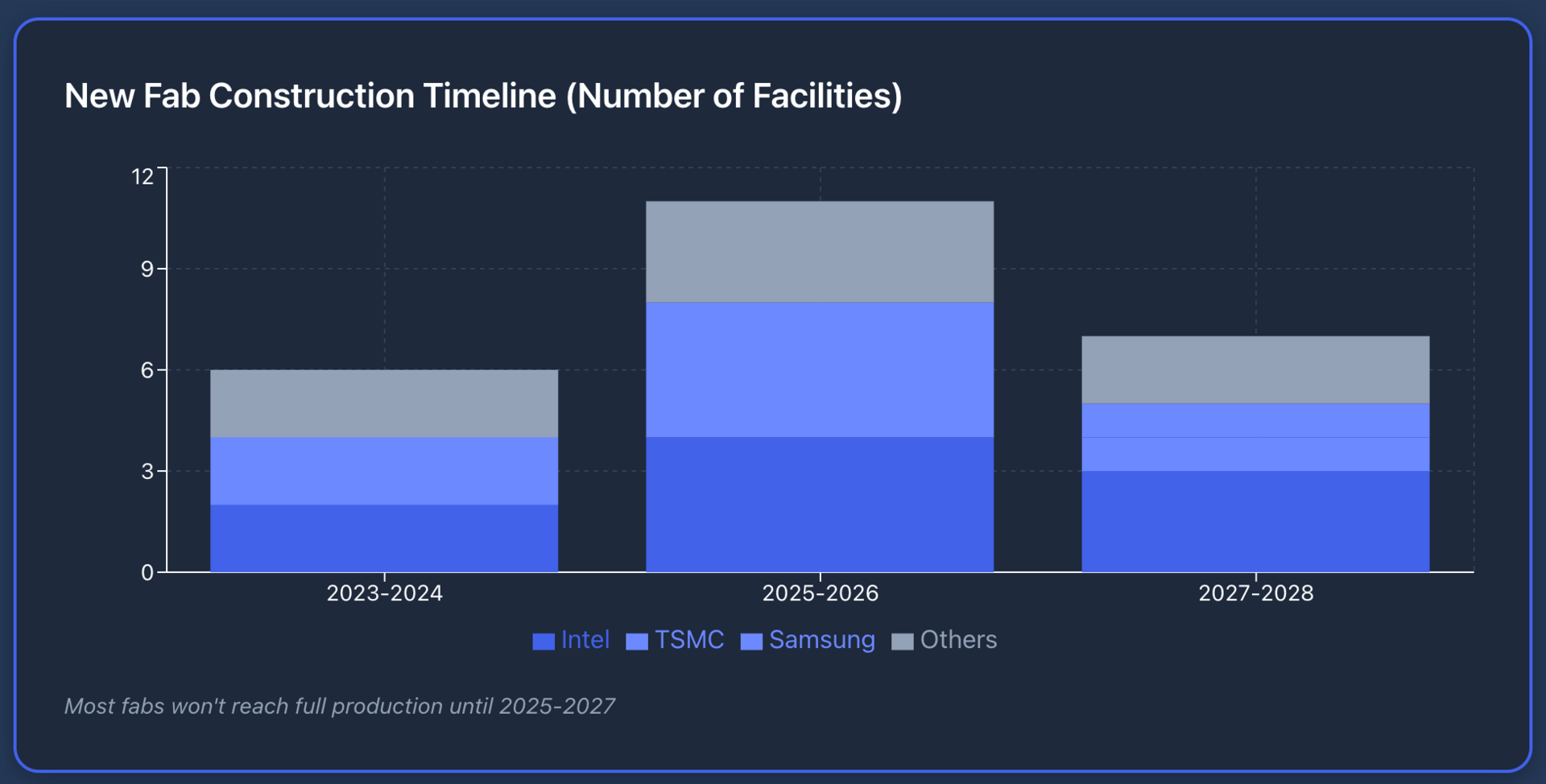

Intel grabbed $8.5 billion in grants and up to $11 billion in loans.

TSMC secured $6.6 billion for its Arizona fabs. Samsung got $6.4 billion for Texas expansion. Micron landed $6.1 billion.

GlobalFoundries, Texas Instruments, and others split the rest.

Who's Actually Winning

The CHIPS Act induced many of the world’s leading semiconductor companies to produce chips in the US by offering a generous advanced manufacturing tax credit of 25% to facilities that make semiconductors or equipment that makes chips.

Intel is the obvious beneficiary.

The company is building or expanding fabs in Arizona, Ohio, New Mexico, and Oregon. The funding helps offset Intel's massive capital expenditure burden, which has been crushing margins for years. Wall Street noticed.

$INTC jumped 8% when the funding was announced, though it's since given back most of those gains as execution concerns linger.

TSMC and Samsung are also collecting checks, but they don't need them the same way Intel does. These companies are already profitable manufacturing leaders.

Nvidia $NVDA ( ▲ 1.41% ) does not manufacture its own chips, but its key manufacturing partners, such as TSMC.

The U.S. subsidies simply lower their cost basis for American operations.

The Competitive Reality

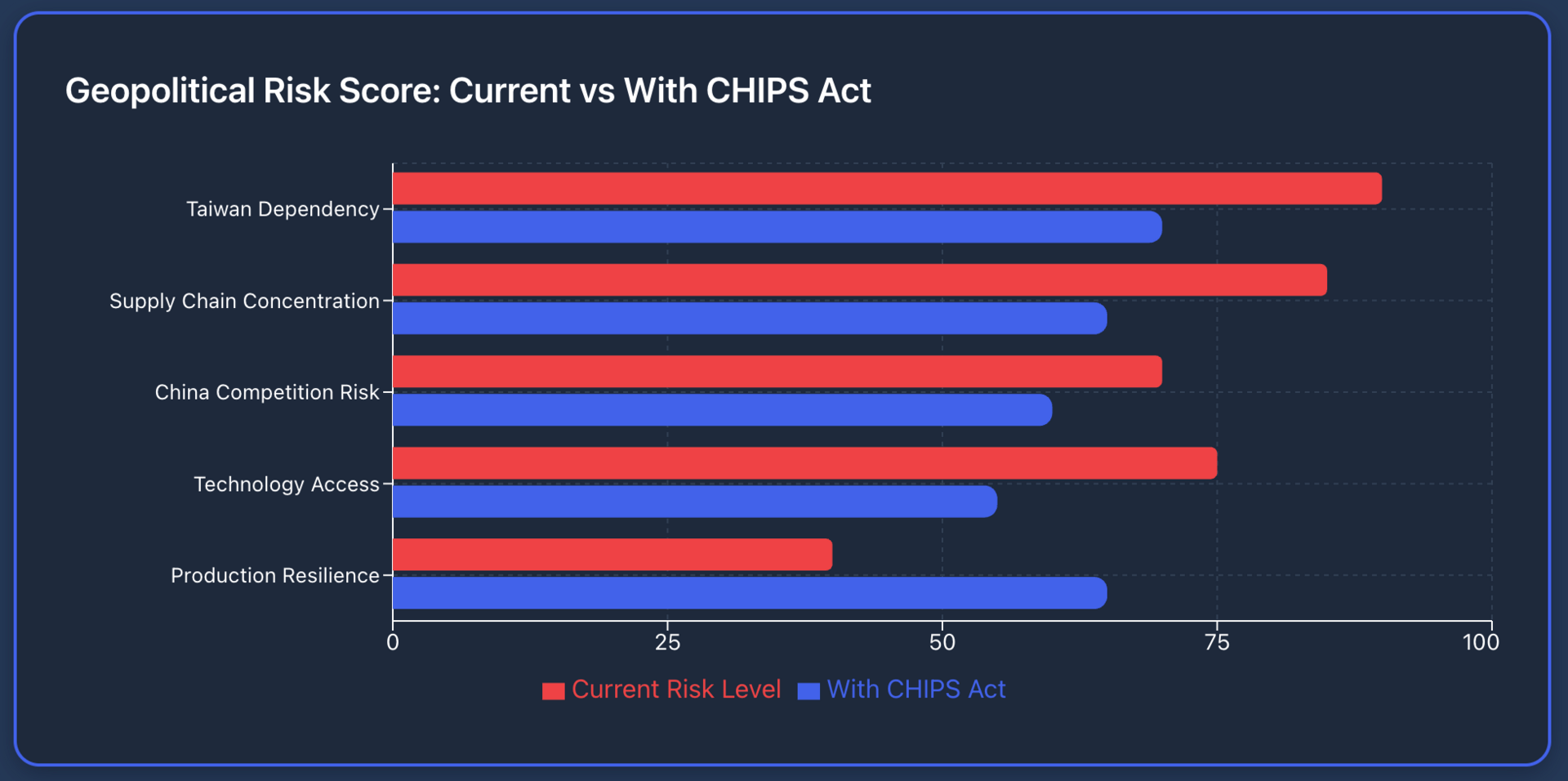

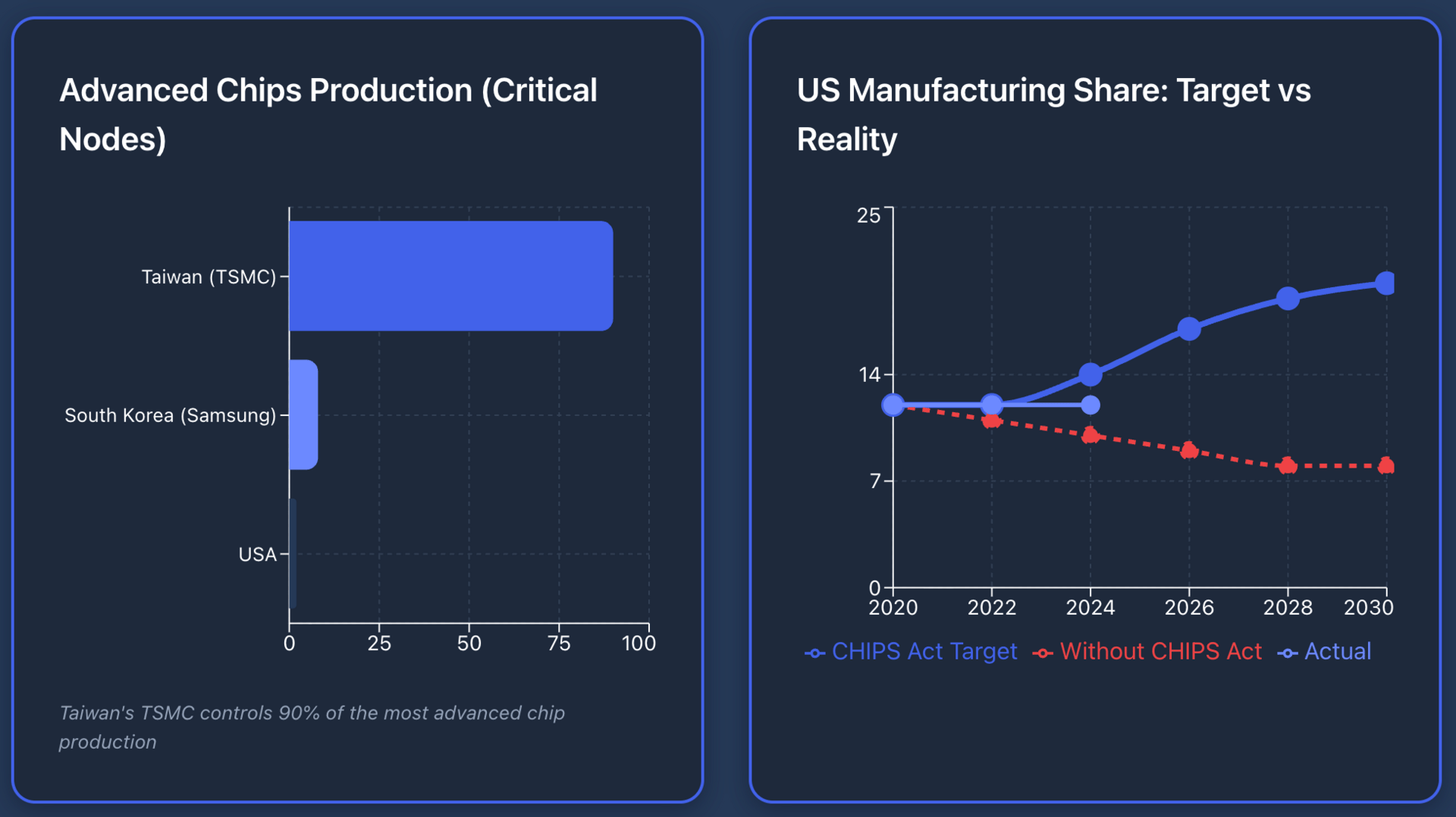

Taiwan still manufactures 60% of the world's semiconductors and 90% of the most advanced chips.

South Korea produces another 18%.

China, despite U.S. restrictions, is pushing up into its own semiconductors.

The U.S. currently makes about 12% of global chips.

The ambitious goal is projected to reach 20% by 2030. Without the CHIPS Act, that share was projected to fall even lower, to around 8%.

Production costs tell the story.

Manufacturing a chip in the U.S. costs 25-50% more than in Taiwan or South Korea. Labor is more expensive. Energy costs are higher. Supply chains are less developed.

And China isn't standing still.

But,U.S. export controls are slowing their access to cutting-edge equipment.

Short-Term vs. Long-Term Impact

In the next 12-24 months, watch Intel's execution.

The company is betting everything on its foundry strategy. If Intel can deliver on its roadmap and actually compete with TSMC on advanced nodes, $INTC could rerate significantly.

If not, that $8.5 billion subsidy just delays the inevitable.

TSMC and Samsung will continue to dominate. Their U.S. fabs are strategic hedges, not core operations.

The subsidies improve their economics but don't change their competitive position.

For fabless designers like Nvidia, AMD, and Broadcom, the impact is indirect. More U.S. manufacturing capacity theoretically reduces supply chain risk.

But in practice, these companies will keep sourcing from whoever offers the best combination of price, performance, and reliability. Right now, that's still TSMC in Taiwan.

What This Means

Three things matter here.

First, capacity is coming online slowly. Most of these new fabs won't reach full production until 2025-2027.

Second, the cost structure gap is real. U.S. manufacturing will remain more expensive unless productivity gains or automation close the difference. That puts long-term pressure on margins for domestic producers.

Third, geopolitical risk is mispriced. The market assumes Taiwan stays stable and supply chains remain intact. If that assumption breaks, the entire semiconductor sector shrinks overnight.

The CHIPS Act is insurance, not a solution.

Intel remains a high-risk, high-reward play. TSMC and Samsung are stable but expensive. Nvidia and AMD trade on AI demand, not manufacturing location.

The subsidies are real.

The manufacturing shift is happening.

But the idea that $52 billion rewrites decades of competitive advantage? That's optimistic.