Buffett's UnitedHealth Bet: Crisis or Buying Opportunity?

The Oracle of Omaha has spoken—and Wall Street is listening. Warren Buffett's Berkshire Hathaway disclosed a $1.6 billion stake in UnitedHealth Group on August 14, 2025, sending the beleaguered healthcare giant's stock soaring 12% in a single day—its largest gain in nearly five years. This classic Buffett move into a beaten-down sector leader signals either contrarian genius or a calculated gamble on America's largest health insurer navigating its most turbulent period in decades.

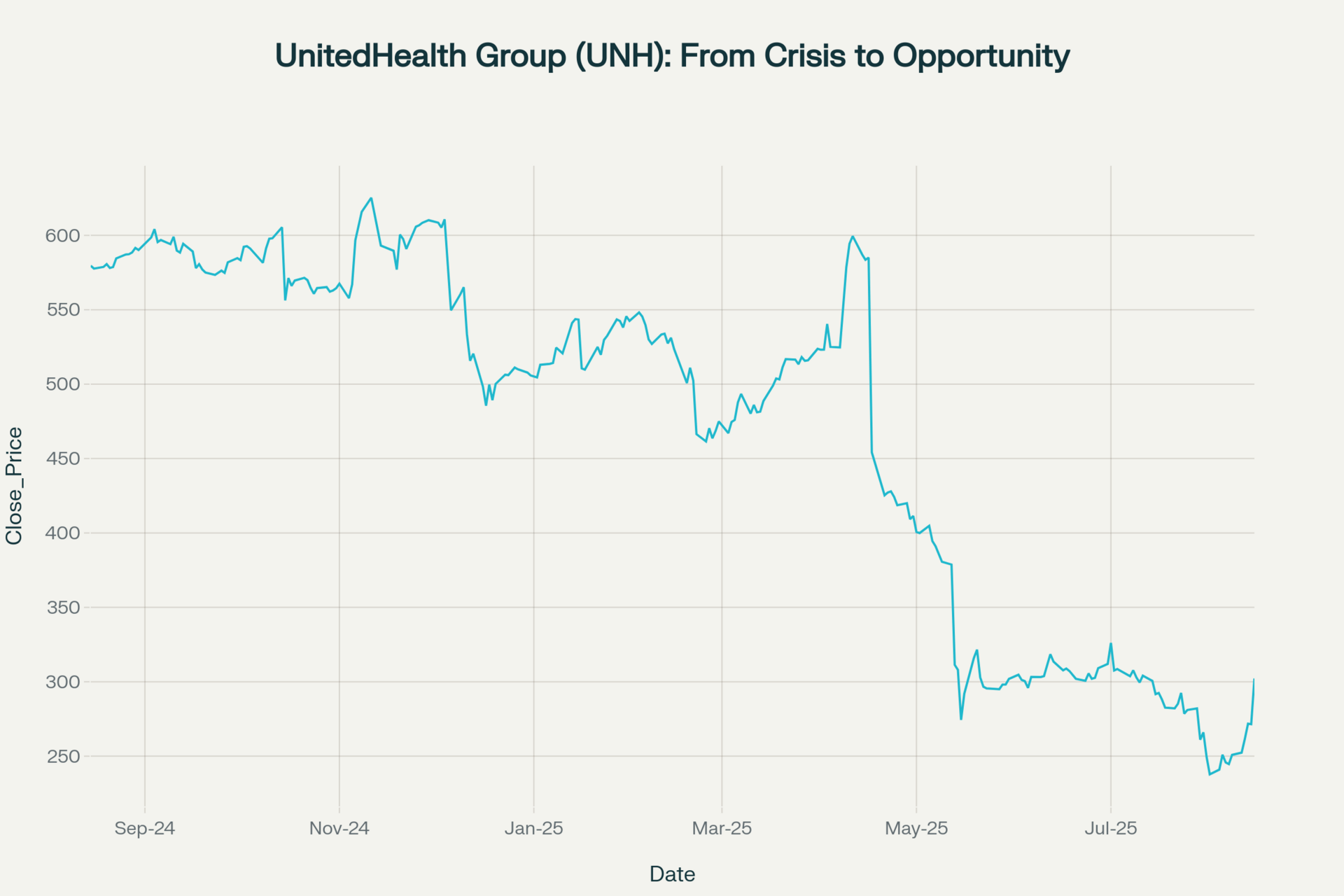

UnitedHealth Group stock experienced a 63% peak-to-trough decline before recovering 29% from its August 2025 lows following Berkshire Hathaway's investment

Berkshire's Strategic Move into UnitedHealth

The fundamentals that likely attracted Buffett remain compelling despite the chaos. UnitedHealth commands a dominant position as America's largest health insurer, serving over 49 million Americans with a market capitalization still exceeding $246 billion. The company's integrated model—combining UnitedHealthcare insurance with Optum's healthcare services—creates substantial competitive moats through economies of scale and vertical integration.

From a valuation perspective, the opportunity was stark. UNH's price-to-earnings ratio collapsed to just 11.3x trailing earnings as of August 2025, representing a 47% discount to its historical average and near decade lows. The stock's 3.25% dividend yield, supported by 36 years of consecutive payments and a conservative 37% payout ratio, provided additional downside protection. With $25.3 billion in trailing twelve-month free cash flow and an 11.1% free cash flow yield, UnitedHealth's cash generation capabilities remained robust despite operational challenges.

This aligns perfectly with Berkshire's historical investment philosophy of acquiring dominant companies at fair prices when market sentiment reaches pessimistic extremes. The $1.6 billion position, representing 5 million shares, ranks as the 18th largest holding in Berkshire's portfolio—significant enough to signal conviction while remaining small enough for testing waters.

UnitedHealth's Perfect Storm

The healthcare giant has weathered an unprecedented convergence of crises. The December 2024 assassination of CEO Brian Thompson sent shockwaves through the organization and broader industry, highlighting growing public animosity toward health insurers. This tragedy compounded already mounting challenges from escalating medical costs, regulatory investigations, and operational missteps.

Federal scrutiny has intensified dramatically. The Department of Justice launched both criminal and civil investigations into UnitedHealth's Medicare Advantage billing practices, focusing on allegations that the company inflated patient diagnoses to secure higher federal reimbursements. These probes examine practices dating back years, with prosecutors interviewing former employees about potential fraud schemes worth billions.

Financial performance deteriorated sharply in 2025. Rising medical utilization, particularly in Medicare Advantage plans, forced the company to slash its full-year earnings guidance from an initial $26-28 per share to just $16 per share—a staggering reduction that reflected fundamental mispricing of member risk. The combination of regulatory pressure and operational challenges drove UNH shares down nearly 50% year-to-date before Buffett's intervention, from peaks above $630 to lows near $235.

Expert Analysis & Market Outlook

Wall Street analysts remain cautiously optimistic despite the headwinds. The consensus rating stands at "Moderate Buy" with an average price target of $363, implying 19.7% upside from current levels. However, target ranges vary wildly from $198 to $440, reflecting genuine uncertainty about the company's trajectory.

Healthcare sector fundamentals support a recovery thesis. S&P Global projects overall revenue and earnings growth for health insurers in 2025, despite elevated risks in Medicare Advantage and Medicaid segments. The sector benefits from an aging population, with Medicare Advantage enrollment reaching 54% of eligible beneficiaries and continuing to grow at 3.8% annually. McKinsey estimates Medicare Advantage EBITDA margins will recover 150-200 basis points by 2028, returning to long-term averages of 3-3.5% as the industry consolidates and optimizes pricing.

The regulatory environment may become more favorable. The incoming Trump administration has signaled potential support for Medicare Advantage, with market speculation that regulatory pressure could ease. This represents a stark contrast to current investigations and could provide meaningful tailwinds for industry leaders like UnitedHealth.

Healthcare ETFs have lagged significantly in 2025, down 5% while the broader S&P 500 gained over 7%. This underperformance has created attractive entry valuations across the sector, with healthcare trading at a 20% discount to the S&P 500 versus a historical 4% premium. The sector's defensive characteristics and long-term growth drivers—including an aging population and healthcare spending projected to grow 5.8% annually through 2033—support eventual outperformance.

What to Expect Next

Key catalysts will determine whether Buffett's bet pays off. UnitedHealth's third-quarter earnings, expected in October, will provide crucial insights into management's progress stabilizing Medicare Advantage margins and medical cost trends. The company has launched third-party reviews of its risk assessment coding and operational practices, with results expected by year-end.

Regulatory developments demand close monitoring. The DOJ investigations could result in substantial fines or operational restrictions, though UnitedHealth's previous legal victory in a related case provides some precedent for defense. Any resolution of these matters would remove a significant overhang on the stock.

Industry consolidation may accelerate. Smaller Medicare Advantage players are exiting unprofitable markets, potentially benefiting dominant players like UnitedHealth through reduced competition and improved pricing power. The company's scale advantages in data analytics, provider networks, and risk management position it well for market share gains.

Technical indicators suggest the stock has found a floor. UNH's 29% recovery from August lows to current levels around $302 has broken above key resistance levels, with potential to challenge the 50-day moving average for the first time since April. Institutional buying beyond Berkshire—including positions from notable value investors like Chris Davis and Michael Burry—suggests smart money views current levels as attractive.

The ultimate question for investors: Has Buffett once again demonstrated his legendary ability to find value in chaos, or is UnitedHealth's crisis deeper than even the Oracle of Omaha anticipated? With healthcare fundamentals intact, regulatory risks potentially moderating, and valuations at compelling levels, Berkshire's move may signal that America's health insurance leader is approaching an inflection point—making this less about crisis management and more about capitalizing on a generational opportunity.