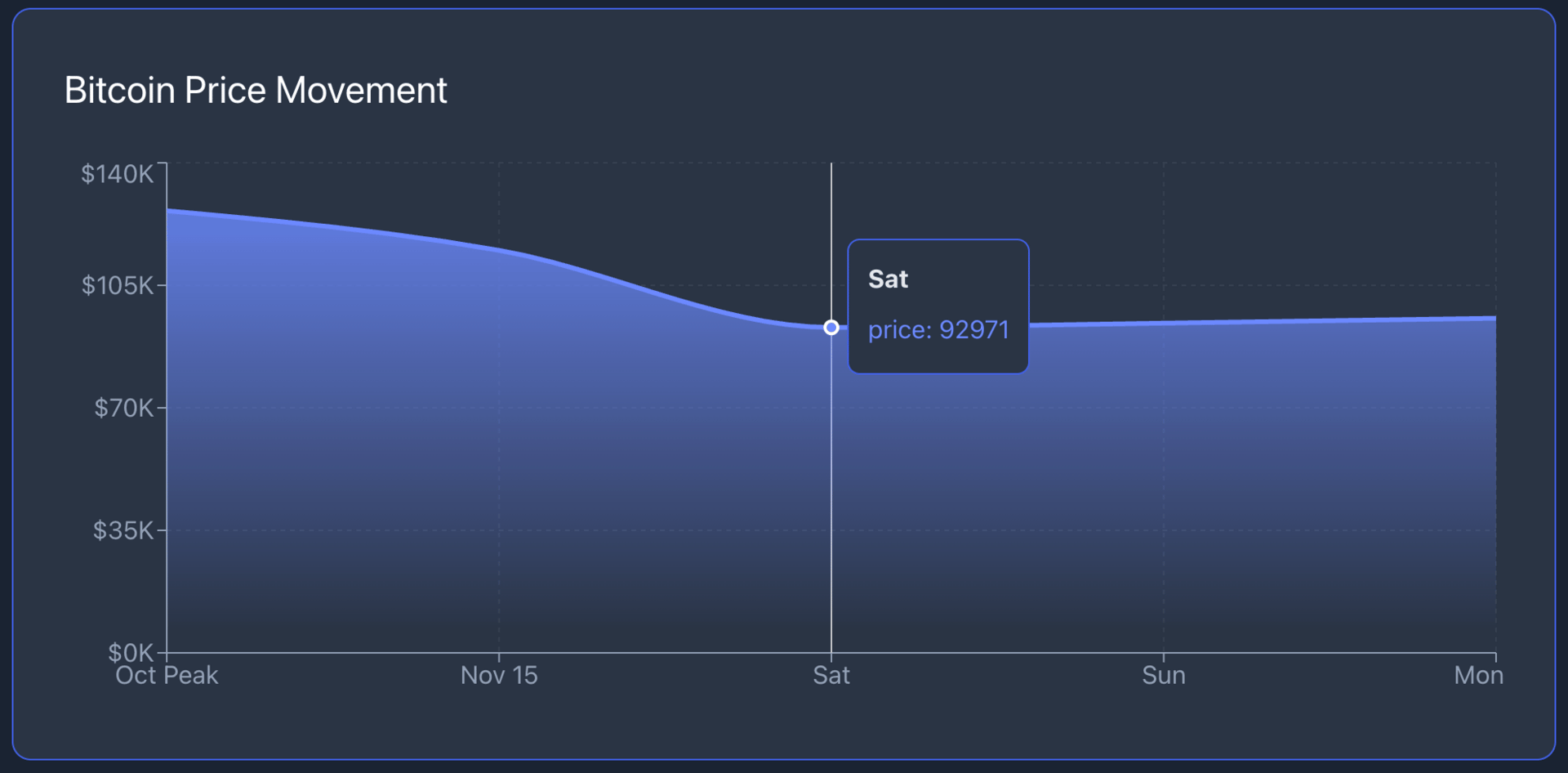

Bitcoin fell to $92,971 last week. By Monday, it recovered to around $95,600.

That's a ~24% nosedive from October's peak of $126,296.

And the Fear and Greed Index? It cratered to 10, the worst reading since February.

So the real question is: Are we watching crypto fall apart, or is this the chance investors have been waiting for?

What Caused the Freefall

This wasn't just one thing. It was everything hitting at once.

The Fed basically pulled the rug out. Back in October, everyone was betting on a December rate cut — odds were at 97%.

Now? They've dropped to around 52%. Inflation is still stuck at 3%, and the Fed wants it at 2%. That matters because when interest rates stay high, risky assets like Bitcoin get hammered.

Then came the liquidations. Over $1.3 billion worth of forced selling as leveraged traders got wiped out.

When prices fall fast, these traders have to sell. And when they sell, prices fall faster. It's a brutal cycle.

Add in new fears about crypto regulations under the Trump administration, a stronger dollar, and global tension, and you've got a perfect storm.

Some technical analysts are warning Bitcoin could slide another 30% to $70,000. That's not guaranteed, but it's on the table.

Which ETFs Are Taking the Biggest Hit

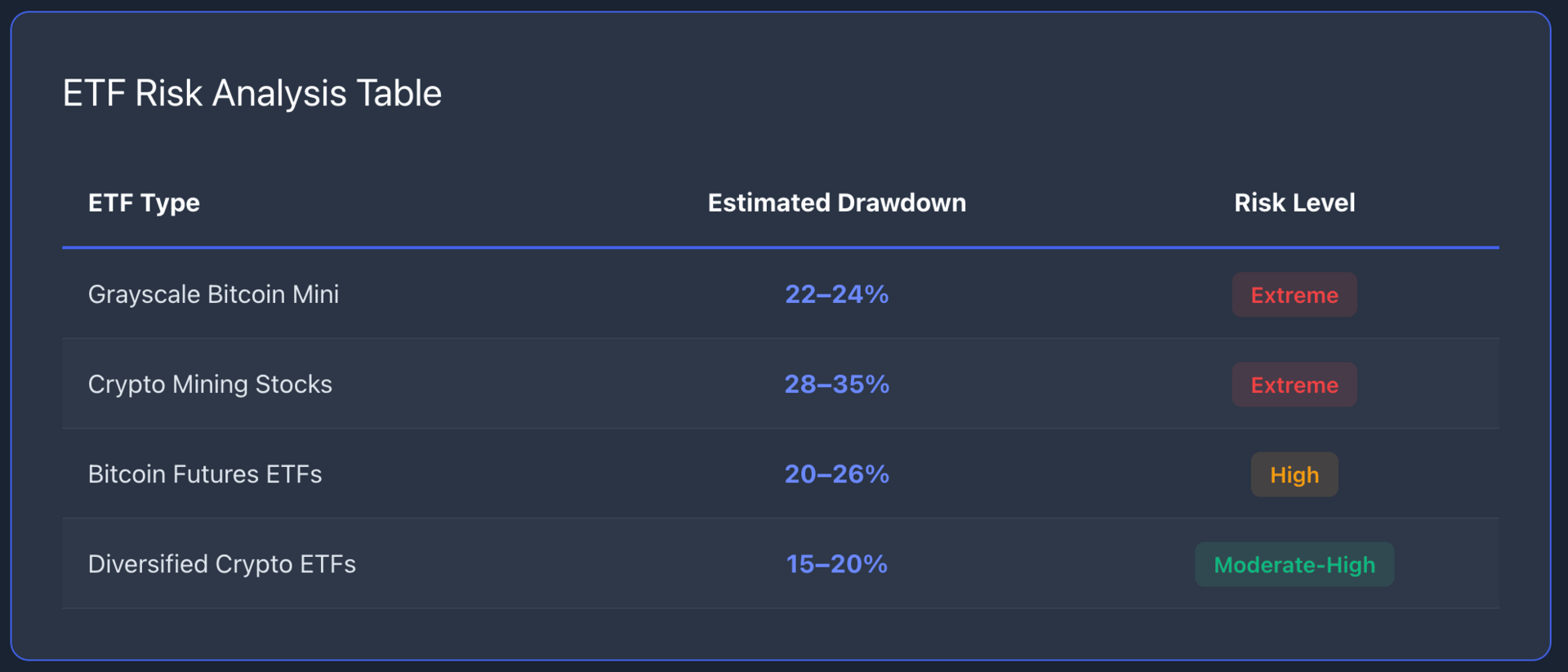

Not all ETFs feel this pain equally. Some are getting destroyed. Others are just bruised.

The Grayscale Bitcoin Mini Trust $BTC is feeling it the most. Direct Bitcoin exposure means direct volatility. When Bitcoin drops 24%, these funds drop with it — no cushion, no diversification.

Then you've got the indirect plays. MicroStrategy $MSTR, Marathon Digital, Riot Platforms — these are the mining stocks and companies that live and die by crypto prices. They're down hard too. Bitcoin futures-based ETFs are also spinning. They track volatility, which means they amplify the chaos.

Crypto-focused ETFs that hold a basket of digital assets are somewhere in the middle. They're down, but spreading risk across multiple coins softens the blow a bit.

After this 24% drop, my confidence in crypto is:

The Bottom or Just a Pause

Nobody knows. But here's what both sides are saying.

The bull case: Extreme fear has historically marked the bottom. When the Fear and Greed Index drops below 15, it often signals capitulation — the point where everyone who's going to sell has already sold. And despite the price crash, institutional adoption is still climbing. Big money hasn't left the building.

The bear case: If Treasury yields keep rising — they're sitting around 4.3% right now — Bitcoin could fall further. Why? Because bonds start looking attractive again. Safe returns without the rollercoaster. That pulls capital away from risky assets like crypto.

Both scenarios are real. Both could happen.

What’s your take on the current Bitcoin price?

What You Should Do

First, don't panic buy. And don't panic sell. Take a breath.

If you want exposure, consider dollar-cost averaging. Spread your buys over the next 4 to 6 weeks. Buy a little now, a little next week, a little the week after. It smooths out the volatility.

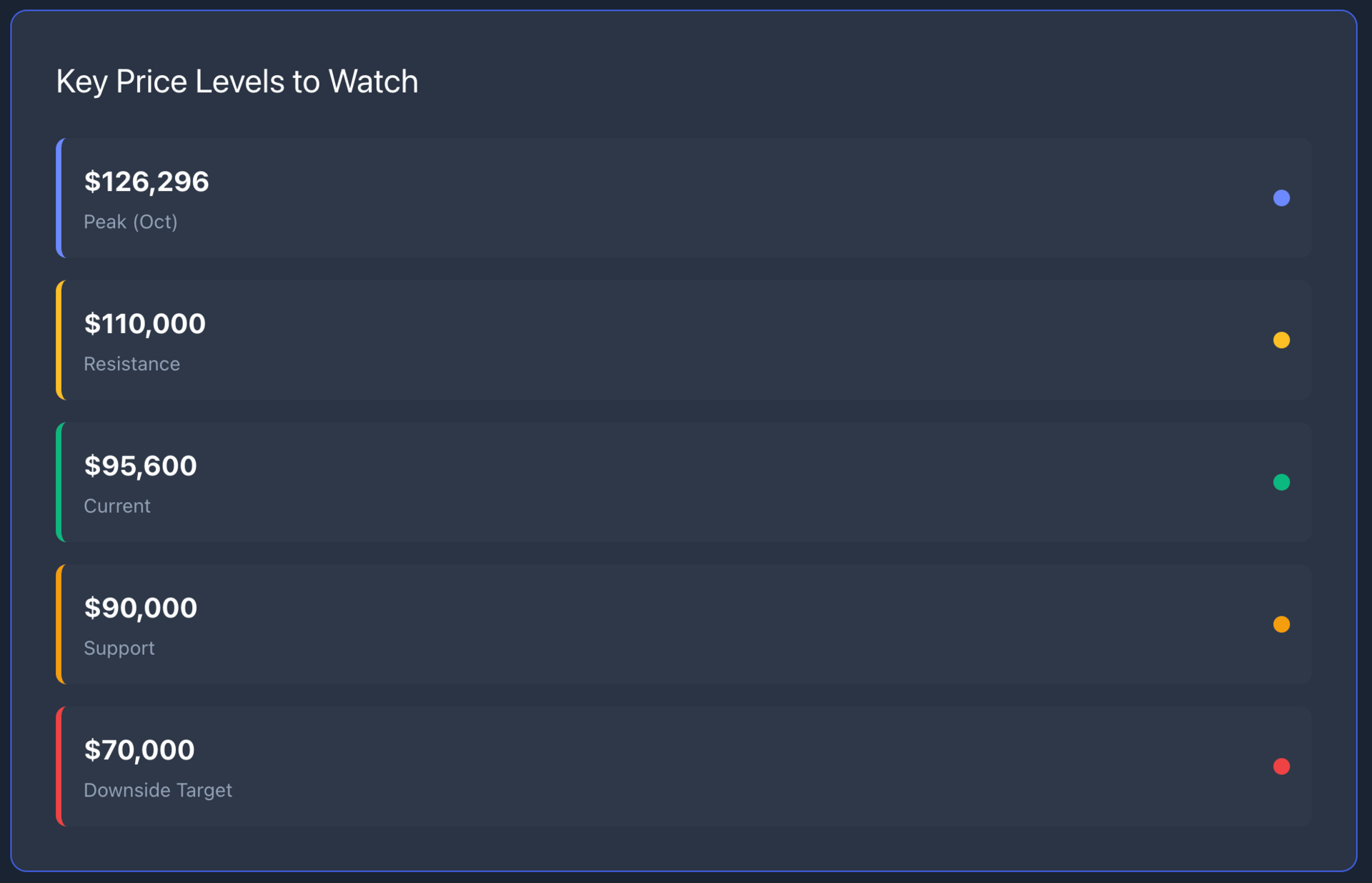

Set price alerts at key levels:

$90,000 support: If Bitcoin holds above this, it might stabilize

$100,000 resistance: Breaking above this could signal genuine recovery

$70,000 downside target: If we break $90K support, this is the next major level

Think about diversification beyond pure Bitcoin. Ethereum and other altcoins offer different risk profiles. Diversified crypto ETFs can spread that risk even further.

Set price alerts. Watch for $90,000 as a support level — if Bitcoin holds above that, it might stabilize. And keep an eye on $110,000 as resistance. Breaking above that could signal the worst is over.

But here's the most important thing: Only invest what you can afford to lose. Crypto is volatile. It always has been. This crash is brutal, but it's not surprising. If you can't stomach a 30% drop, maybe crypto ETFs aren't for you right now.

The opportunity is real. But so is the risk.