Introduction: The "ChatGPT Moment" for Robots

For the last three years, the market obsessed over Generative AI. We taught computers to write code and generate images.

But ChatGPT cannot make a sandwich. It cannot weld a car chassis. It cannot load a pallet.

We are entering Phase 2 of the AI Revolution: Embodied AI. According to the International Federation of Robotics (IFR) 2025 report, we are witnessing the "ChatGPT moment" for robotics. Generative AI is now allowing robots to program themselves using natural language, lowering the barrier to entry from weeks of coding to seconds of prompting.

This is not a tech trend. It is a demographic necessity.

The Macro Nightmare: The Humans Are Missing

The narrative that "Robots will steal our jobs" is mathematically wrong. The reality is: There is nobody to take the jobs.

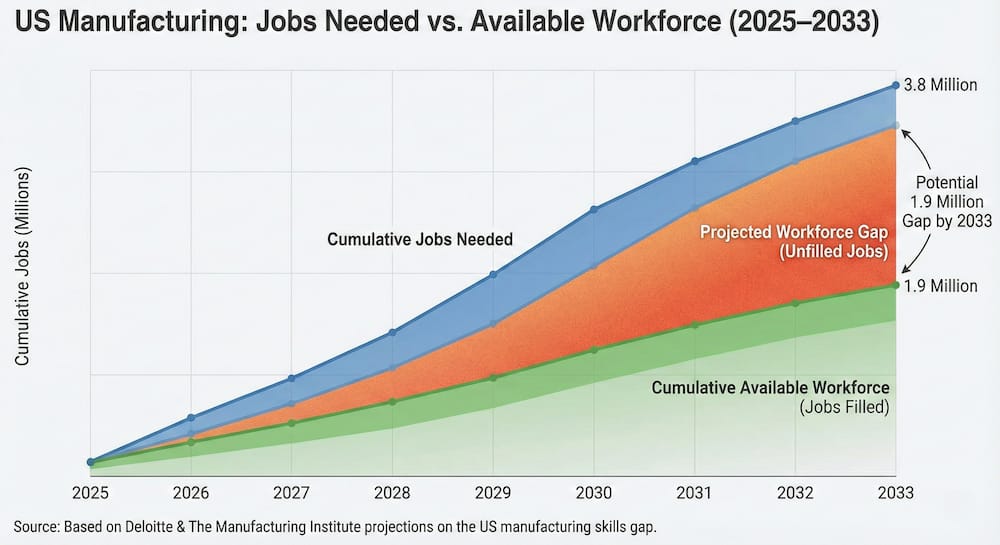

According to the latest study by Deloitte and The Manufacturing Institute:

The Gap: The US manufacturing sector will need to fill 3.8 million jobs by 2033.

The Reality: Without automation, 1.9 million of those jobs will remain unfilled.

The Cost: This labor shortage could cost the US economy $1 trillion in lost output alone.

In Europe (specifically Germany) and Asia (Japan/China), aging populations mean the workforce is shrinking. Companies aren't buying robots to fire people; they are buying robots because the retiring Boomers cannot be replaced.

The $1 Trillion Gap: 1.9 Million Jobs Will Go Unfilled

The "Sci-Fi" Reality: Humanoids Clock In

Until recently, humanoid robots were YouTube stunts. In late 2025, they proved they can handle the grind.

Figure AI at BMW: Proof of Scale The deployment of Figure 02 at BMW’s Spartanburg plant wasn't just a demo—it was production. Over an 11-month deployment (which concluded in Nov 2025), the fleet:

Worked full 10-hour shifts (Mon-Fri).

Clocked 1,250 hours of runtime.

Successfully placed >90,000 sheet metal parts.

Contributed to the assembly of >30,000 BMW X3s.

Update: Figure is now retiring the 02 fleet to deploy the next-gen Figure 03, built on this real-world data.

Tesla’s Optimus: Running Towards 2026 In December, Elon Musk released the "Running Robot" update. Optimus is no longer stumbling; it is demonstrating improved balance and coordination in the lab. With pilot production already underway in Fremont, Tesla is on track for external sales in 2026.

Why this matters: We have moved from "Scripted Automation" (robots in cages) to "Physical AI" (robots that work alongside humans).

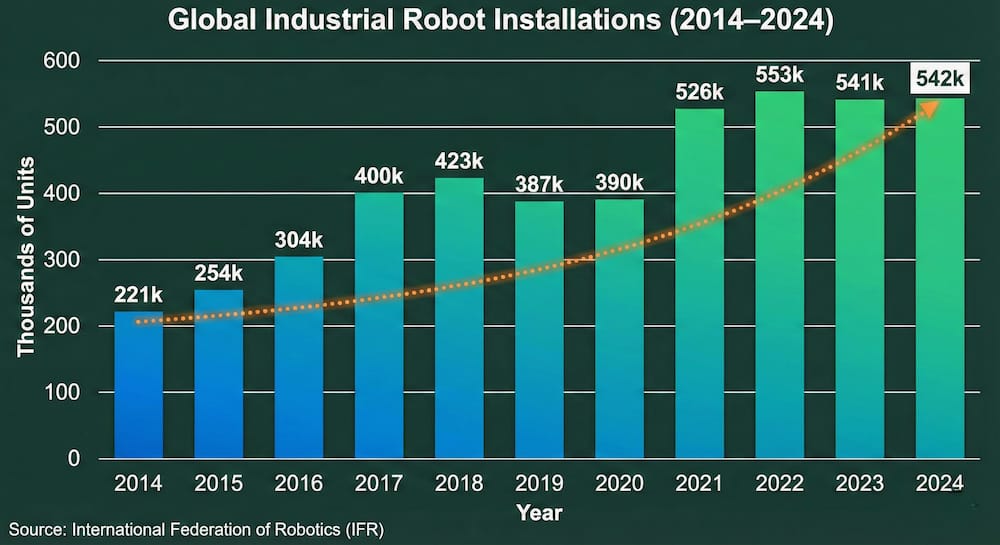

The Hard Data: 542,000 New Robots

This isn't a forecast; the CapEx is already being spent. The IFR World Robotics 2025 report confirms a secular bull market:

Record Volume: 542,000 new industrial robots were installed in 2024. That is a doubling of annual installations in just 10 years.

China’s Dominance: China is the undisputed king, consuming 54% of global supply.

The Service Boom: The Service Robots segment (logistics AMRs, medical bots) grew 9% to 200,000 units.

The Robot Army: Global Installations Double in a Decade

The ETF Shootout: ROBO vs. BOTZ

How do you play this? Don't pick a single winner. Use ETFs, but understand the difference.

Option A: ROBO Global Robotics & Automation ETF ($ROBO)

The Strategy: The "Pick and Shovel" play.

Structure: Equal-weighted (prevents concentration risk).

Holdings: Highly diversified. You get the arms (Fanuc), the brains (NVIDIA), the eyes (Cognex), and surgery bots (Intuitive Surgical).

Verdict: The Safe Core. Buy this for broad exposure to the entire tech stack.

Option B: Global X Robotics & Artificial Intelligence ETF ($BOTZ)

The Strategy: The "Heavy Industry" play.

Structure: Market-cap weighted (Concentrated).

Holdings: Top 10 holdings dominate. Heavily exposed to Japan (Fanuc, Yaskawa) and industrial automation.

Verdict: The Aggressive Beta. Buy this if you believe specifically in the re-industrialization of the world.

Choose Your Weapon: Broad Tech ($ROBO) vs. Heavy Industry ($BOTZ)

The Risks: A Reality Check

Geopolitics: With China buying 54% of robots, trade wars or new tariffs on high-tech servos/chips could disrupt the supply chain for Japanese and European manufacturers.

CapEx Cycles: Robotics is a capital expenditure. If we hit a deep recession in 2026, companies will freeze spending on new machines.

The Bottom Line

We are witnessing the convergence of LLMs and motors. Software changed the world of bits. Physical AI is about to change the world of atoms.

As the workforce ages, the companies that build the "new workforce" will become the most valuable industrials on earth.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.