Intro:

European equity markets just hit record highs.

European equity ETFs attracted €10.18 billion in net inflows, a 149% surge from the prior week. Meanwhile, US equity flows stayed flat at $32.68 billion.

But here's the thing. Those European flows didn't go into broad market trackers. They poured into cyclical sectors, Materials, Financials, Industrials, while US money kept chasing the same tech-heavy funds.

The flow pattern tells you where smart money sees opportunity.

Seems, it's rotating into Europe.

Weekly Flow Data

Top European Sector Inflows:

Materials: €394M

Financials: €383M

Industrials: €316M

Energy: €123M

Technology: €67M

European investors are buying cyclicals and value.

Compare that to US portfolios where tech still represents 32% of holdings in S&P 500 ETFs.

US flows remain massive in absolute terms. But December's $224B total represented a record month, which makes January's flat momentum notable.

US investors are still buying growth and tech.

What percentage of your equity portfolio is in non-US markets?

The Active ETF Revolution

Active vs Passive: The Data

US Market:

Active ETF market share: 10%

Active ETF AUM: $1 trillion (crossed in 2025)

Flow growth rate: 5x faster than passive

2025 flows: 30% of all inflows went to active

European Market:

Active ETF market share: 4%

Flow growth: Strong but 5-6 years behind US

Key driver: Competitive fees + liquidity vs traditional funds

Here's what matters: Active management is making a comeback via the ETF wrapper. Tax advantages in the US (lower capital gains treatment) drove the surge. Europe is following the same path.

If you're still 100% in passive index funds, you're missing the tactical opportunities active managers can exploit in volatile markets.

Fixed Income Flows

European fixed income ETFs saw €2.69 billion in Week 2 inflows, a 232% jump from Week 1.

Where it went:

Government investment grade: €735M

Corporate high yield: €570M

Corporate investment grade: €476M

Why it matters: Bond flows often signal economic expectations. The corporate high yield strength suggests investors see opportunity in credit risk—not fear of default.

The Numbers That Matter

What the data says:

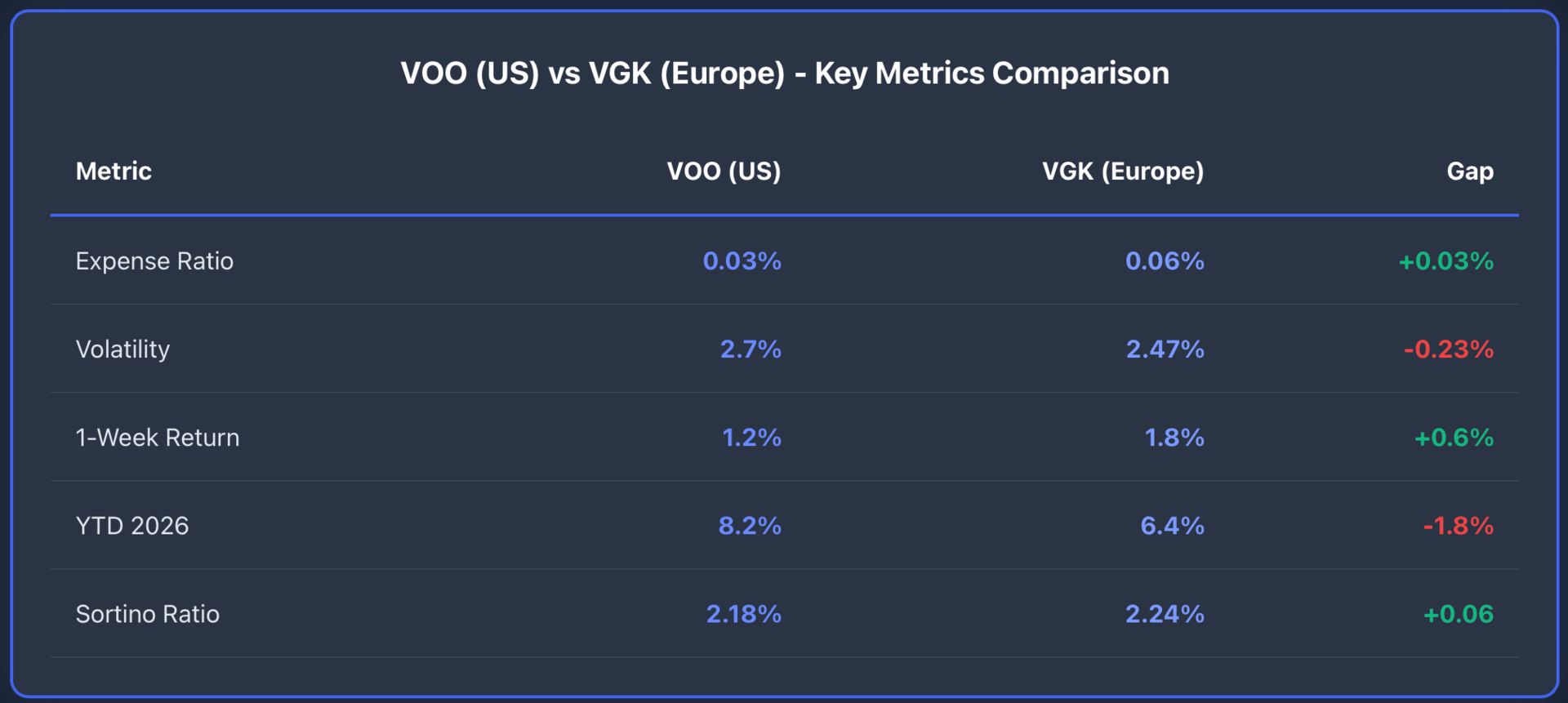

VGK delivered better weekly returns (+1.8% vs +1.2%)

VGK shows lower volatility (2.47% vs 2.70%)

VGK has superior downside protection (Sortino 2.24 vs 2.18)

VOO maintains YTD lead but momentum shifted this week

Real Macro Developments & ETF Flows

Why European Markets Are Moving

Renewable energy infrastructure: RWE and SSE won major offshore wind contracts, triggering the utilities sector surge. European green energy investment cycle is accelerating.

Healthcare pipeline strength: Pharmaceutical stocks hitting multi-year highs on drug approval momentum. European healthcare exposure (16.4% vs US 13.2%) is paying off.

Financials strength: European bank ETFs pulled €882M in flows (Week 1). Interest rate environment favoring financials over tech.

What's Weighing On US Markets

Fed independence concerns: Political pressure on Jerome Powell rattled markets. Dollar weakness followed. Gold hit record highs.

Valuation compression risk: Deutsche Bank flagged potential for US underperformance—it already happened in 2025 when international stocks outpaced domestic.

Tech concentration anxiety: When 32% of your portfolio is one sector, rotation risk matters. First signs showed up in Week 2 flows.

Investment Strategies

Strategy 1: Add Cyclical Europe Exposure

What the flows show: Materials, Financials, Industrials getting capital.

Action: Allocate 15-20% to VGK or sector-specific European ETFs (materials, energy, industrials).

Why: Catch the rotation out of US tech into European value/cyclicals.

Materials pulled €394M last week. What's your materials allocation?

Strategy 2: Blend Active + Passive

What the flows show: Active ETFs growing 5x faster than passive.

Action: Move 10-15% of passive allocation to active ETFs in sectors where stock selection matters (small caps, emerging markets, credit).

Why: Active management adds value when dispersion is high. We're in that environment now.

Strategy 3: Reduce Tech Concentration

What the flows show: European investors avoiding tech overweight. US investors are still piling in.

Action: If tech is over 25% of portfolio, trim to 20-22% and reallocate to industrials, materials, financials.

Why: Concentration risk. When one sector dominates, rotation hurts. Diversify before it happens.

Experts’ Advice

Institutional flow patterns (January 2026):

Rebalancing out of US tech: Large funds taking profits after strong 2025

Adding European cyclicals: Materials and industrials getting fresh capital

Increasing active allocation: Tax advantages driving shift from traditional funds

Building bond exposure: Corporate high yield (€570M weekly) shows confidence, not fear

ESG continues to matter: Europe leads in ESG ETF assets. US investors underweight this structural trend.

EUR/USD Dynamics

Dollar weakness on Fed uncertainty. Euro stability on ECB policy clarity.

For US investors buying VGK:

When dollar falls, your EUR-denominated returns increase

When dollar rises, your returns decrease

Current trend favors European ETF holders

For European investors buying VOO:

Reverse dynamic applies

30% US withholding tax on dividends (unless W-8BEN filed)

Estate tax exposure on US assets

Hedge or not: Depends on your view. Unhedged European exposure gives you currency diversification. Hedged removes FX volatility but costs 0.20-0.40% more in fees.

Potential Risks

Is your portfolio tilted too heavily toward US equities? If over 80%, you're taking single-market risk the data says is unnecessary. Calculate it all.

Are you tracking sector concentration? Add up your tech exposure across all funds. If it's over 30%, you're more concentrated than you think. Review your sector weightings.

Do you know your real downside risk? Standard deviation doesn't show what happens in corrections. Check Sortino ratios and max drawdown history.

Have you considered active ETFs? If you're 100% passive, you're missing tactical opportunities in this volatile environment. Evaluate active vs passive mix.

The Reality Check

US ETFs pulled $224 billion in December 2025. That's massive. But European equity ETFs grew inflows 149% week-over-week in January 2026. That's momentum.

The question isn't whether to own US or European ETFs. The question is whether your allocation matches what the flow data actually shows.

European flows are accelerating. Cyclical sectors are leading. Active management is winning. Fixed income is seeing steady demand.

Your portfolio should reflect these realities—not last decade's performance.

Check your portfolio. Compare to these flows. Make the adjustments.

After seeing €10B weekly flows into Europe, when will you rebalance?

The opportunity is here. The question is whether you'll take it.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Greenland: Trump’s Vision of the New World Order

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.