President Trump just unleashed a bombshell: $200 billion in mortgage bond purchases by Fannie Mae and Freddie Mac to slash rates and supercharge housing affordability. Markets lit up instantly – REITs +1-2%, 30-year mortgages dipping 0.2% in hours.

Trump's Bold Play: The Announcement Breakdown

Fresh off Truth Social this morning: "Fannie/Freddie to buy $200 BILLION in bonds IMMEDIATELY. Mortgage rates CRASH, Americans buy homes AGAIN. NO MORE Wall Street hoarding single-family houses – BlackRock-style banned!" This "progressive pivot" from Trump targets institutional investors snapping up suburbs, forcing rates down via GSE firepower. White House signals rollout next week; Treasury yields softened 5bps.

Immediate impact:

Rates: 30-year fixed to 6.1% (from 6.3%) – biggest intraday drop since December.

Pre-market: VNQ +1.8%, REM +2.3%, SCHH +1.2%.

Context: Follows defense budget ($1.5T) and Venezuela win – Trump's "America First" economy trifecta.

Market Reaction & Catalysts

Housing was starved: inventory low, rates high, institutions own 20%+ rentals. $200B injects liquidity straight to MBS:

REITs rally on rental demand surge.

MBS spreads tighten – REM leads.

Broader: Dow futures +0.3%, Nasdaq flat (tech rotation).

Volatility ahead:

NFP (1:30 PM ET): Consensus +180k jobs; >200k = Fed pause.

UoM Inflation (3 PM ET): Core +0.1% expected.

Defense tie-in: Trump pauses new contracts until delivery ramps – ITA holds steady.

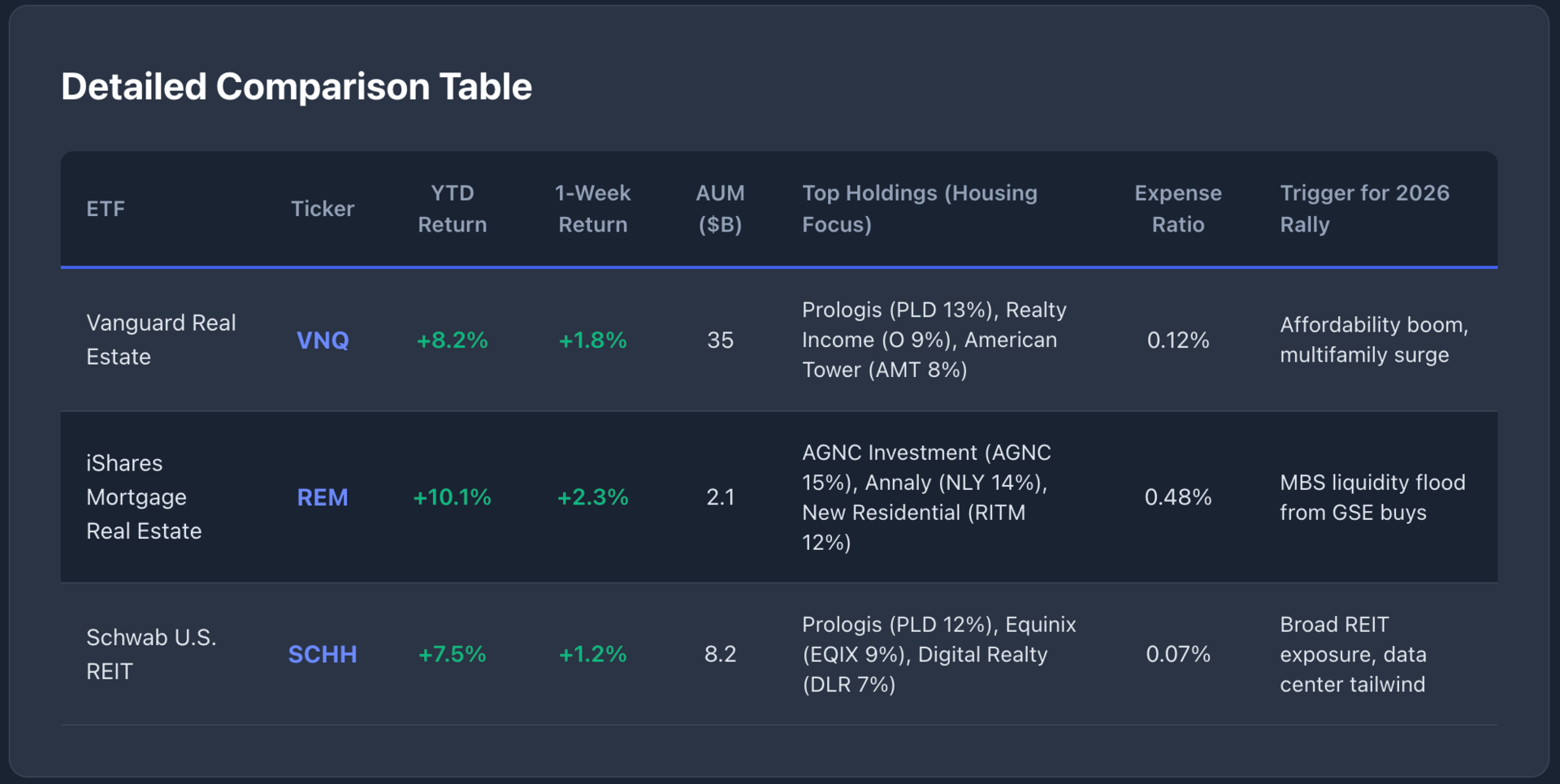

Top ETFs to Watch – Full Comparison

Data: Yahoo Finance, TradingView as of Jan 9, 2026 12:30 CET. VNQ broadest play; REM high-yield (9% avg); SCHH cheapest.

Investment Thesis: Why Now?

Bull Case: $200B = rocket fuel. Historical parallel: QE3 (2012) sent VNQ +35% YTD. Affordability crisis solved → home sales +15% (NAR est.), rents +5-7%. Trump veto-proof? Congress loves housing wins.

Risks: Fed hikes if NFP hot; institutions pivot to commercial. Hedge: 50% VNQ/REM, 30% ITA (geopolitics), 20% cash.

Targets: VNQ $102 (from $95), REM $24 (from $22) by Feb.

Action: Alerts: VNQ >$96, REM >$22.5. NFP watch: strong data = REIT dip-buy.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.