Geologists just discovered one of the world's largest lithium deposits in McDermitt Caldera, a supervolcano straddling Nevada and Oregon.

We're talking 20 to 40 million tons of lithium trapped in volcanic clay, worth roughly $1.5 trillion at current prices.

That's enough to power EVs and consumer electronics for decades.

The discovery of the McDermitt Caldera lithium deposit is a bigger deal for:

The Numbers Behind the Discovery

McDermitt Caldera, Nevada (GettyImages/gchapel)

McDermitt Caldera formed 16 million years ago when a massive magma chamber collapsed. The lithium sits in volcanic lake deposits, with concentrations reaching 2.4%—double the global average.

Jindalee Lithium and Lithium Americas are drilling now. “Drill, Baby, Drill”

Production at Thacker Pass, the southern section of the caldera, could start between 2027 and 2028.

The US government already committed $435 million to Lithium Americas, taking a 5% stake. The goal is clear: reduce dependence on Chinese supply chains. MIT developed extraction methods that work with clay deposits without the traditional evaporation ponds. And the Trump administration's push to streamline permits for critical minerals should accelerate timelines.

This deposit sits about 100 kilometers from Winnemucca. Access is straightforward. Infrastructure exists.

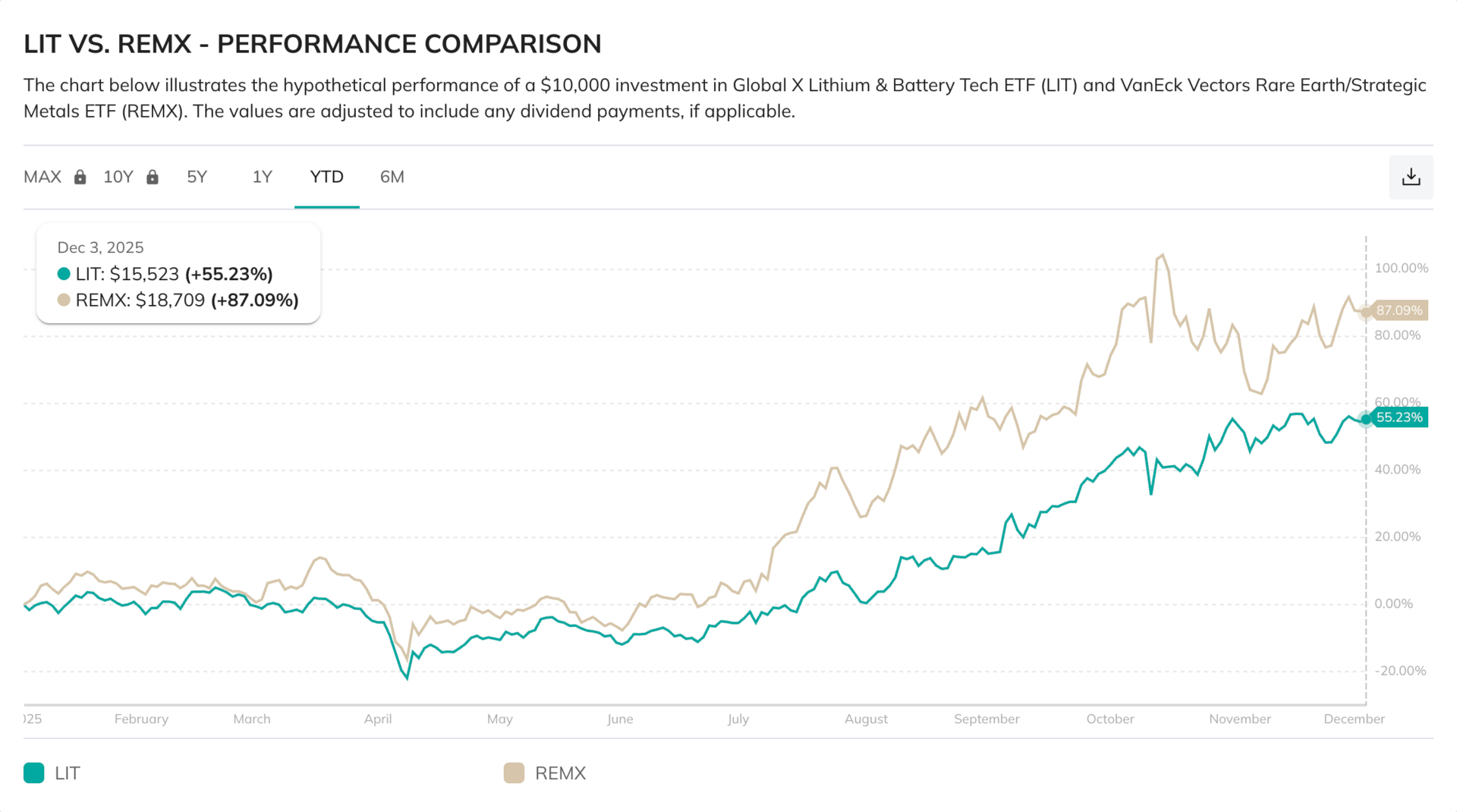

ETF Performance

Lithium prices have been falling—currently trading around $10,000 to $15,000 per ton.

Global X Lithium & Battery Tech ETF $LIT ( ▲ 1.98% ) is down 9.69% YTD.

VanEck Rare Earth/Strategic Metals ETF $REMX ( ▲ 3.71% ) barely moved, up just 0.08%.

Both funds show similar risk-adjusted returns with Sharpe ratios near 0.97.

But here's the thing: LIT focuses on miners like Albemarle and SQM, plus battery manufacturers.

REMX spreads across rare earth producers with lithium exposure. The divergence in performance tells you the market hasn't fully priced in what a domestic supply surge means.

Inflows to $LIT picked up after the DoE announcement. Fund managers see what's coming. Stable domestic supply reduces price volatility.

That matters more than current spot prices when you're modeling long-term demand from AI infrastructure and EV adoption.

The volatility profile changes when you remove geopolitical supply risk from the equation. McDermitt de-risks the entire sector for US-based funds.

Based on the current market, what is the best investment strategy for lithium?

Portfolio Positioning

You want exposure before production starts, not after.

$LIT ( ▲ 1.98% ) trades well below its 52-week high. A target of $70+ makes sense once extraction begins.

$REMX ( ▲ 3.71% ) offers broader commodity exposure if you're hedging against single-metal risk.

Allocate 5% to 10% of your portfolio to lithium ETFs. Pair it with solar exposure through TAN if you're building a clean energy position. If you're concerned about Chinese oversupply hitting prices, consider short positions in FXI to hedge.

Watch the Fed's December 9-10 meeting and the ISM PMI report on December 4. Those data points will move the energy and materials sectors.

The Risks You Can't Ignore

Thacker Pass faced delays from environmental opposition. Local tribes and conservation groups filed lawsuits. Permitting remains unpredictable despite federal support. Australia and Chile still dominate global lithium production—they won't surrender market share without a fight.

Lithium prices are in a bear market through 2024 and into 2025. Oversupply from existing operations continues to pressure margins.

New supply from McDermitt won't help prices in the near term. But long-term demand fundamentals from electrification haven't changed.

Competition matters. Technology matters more.

What You Should Do Now

McDermitt changes the strategic calculus for US energy independence. It's the largest known lithium deposit in North America. The valuation gap between current ETF prices and the sector's long-term position looks exploitable.

Buy lithium ETFs on weakness. Dollar-cost average if you're building a position. This isn't a momentum trade. It's a three-to-five-year structural shift in domestic mineral production.

The market undervalues what secure domestic supply means for battery manufacturers and automakers. That gap won't last once production timelines get confirmed.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.